Bond markets again dominated proceedings overnight across the risk complex with all eyes on US Treasuries as Wall Street can’t make its mind up on direction with continued wobbles going into the end of year session. The USD was unchanged against the majors with the Australian dollar holding somewhat steady at the mid 65 level after absorbing yesterday’s GDP print while Euro continued its selloff with another new weekly low below the 1.08 level.

US Treasury yields saw no movement on the short end of the curve but 10 year yields continue to fall with another 5 point drop to just below the 4.1% level while oil prices remain volatile with Brent crude pushed towards the $75USD per barrel level. Gold’s blowout on the Monday morning open continues to moderate with further consolidation around the $2020USD per ounce level.

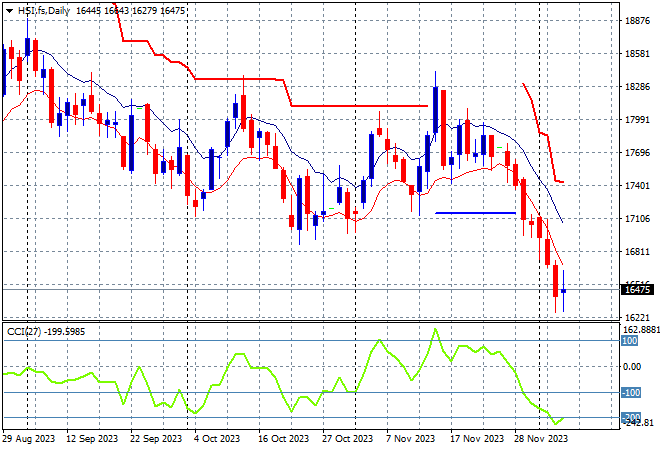

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets were trying to move slightly higher into the close but failed with the Shanghai Composite down 0.1% to 2968 points while in Hong Kong the Hang Seng Index is finally rebounding, up 0.8% to 16463 points.

The daily chart was showing a significant downtrend that had gone below the May/June lows with the 19000 point support level a distant memory as medium term price action remained stuck in the 17000 point range before this new losing streak. Daily momentum readings are solidly back to oversold settings with price action now below the October lows:

Japanese stock markets were the best performers in the region with the Nikkei 225 up 2% to 33445 points.

Trailing ATR daily support is starting to come up to price action after this bounce went beyond the September highs at the 33000 point level with daily momentum now fully retracing from the overbought zone. Correlations with Wall Street and Yen are in play again as I remain wary of a selloff back to ATR support at 32000 points:

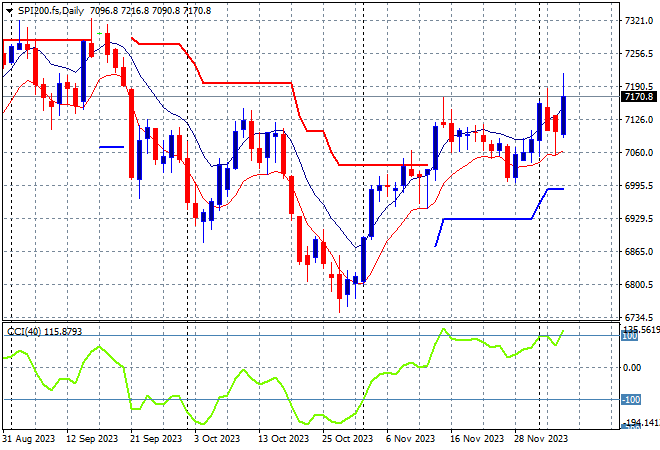

Australian stocks were very solid achievers in yesterday’s session with the ASX200 closing 1.7% higher to push back above the 7100 point level.

SPI futures however are indicating at least a 0.4% drop on the open, due to the falls on Wall Street overnight. The daily chart is again looking more optimistic here in the medium term with short term price action filling a hole against the tide and firming somewhat here with a possible reverse head and shoulders pattern forming, but resistance at 7200 points is looming overhead:

European markets were able to follow through on their recent good sessions with more steady results across the continent, as the Eurostoxx 50 Index eventually finished 0.7% higher at 4483 points.

The daily chart shows weekly resistance at the 4300 point resistance level taken out with this large bounce setting up for further gains as momentum remains quite firm. Support is now upgraded to at least the 4300 point level with the lower Euro overnight again definitely helping here:

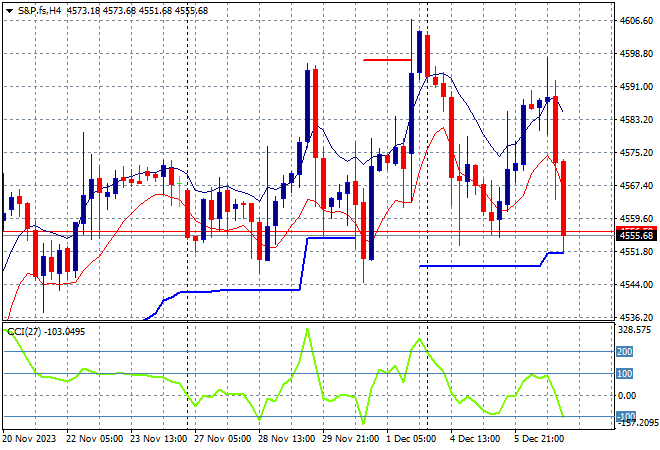

Wall Street however can’t find any positive momentum from European bourses or elsewhere and pulled back again with the NASDAQ down nearly 0.6% while the S&P500 slipped 0.4% to close at 4549 points.

Short term momentum is now back into oversold territory with another swing play down to trailing ATR support on the four hourly chart. Key support at the 4540 point area has not been breached yet despite this volatile shake out in the past few sessions, but watch out:

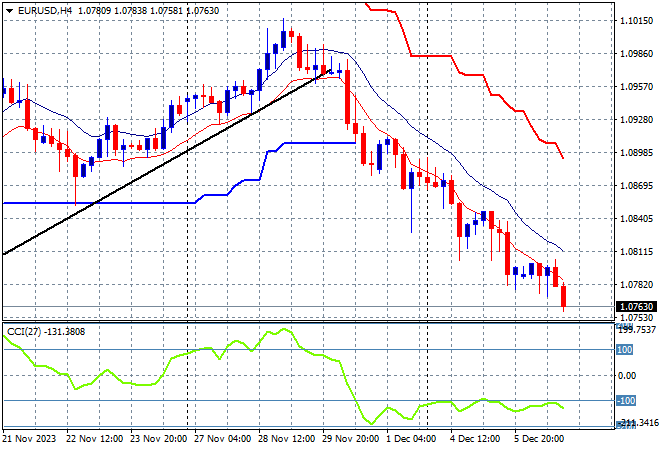

Currency markets saw little change in the US Dollar Index overnight with USD still dominating as Euro continued its fall lower with a new weekly low well below the 1.08 handle.

The union currency is now below its recent weekly lows around the 1.08 level after topping out at the 1.10 level earlier last week, unable to maintain momentum above the daily trendline. Short term momentum is still well oversold but we could see some mild consolidation here:

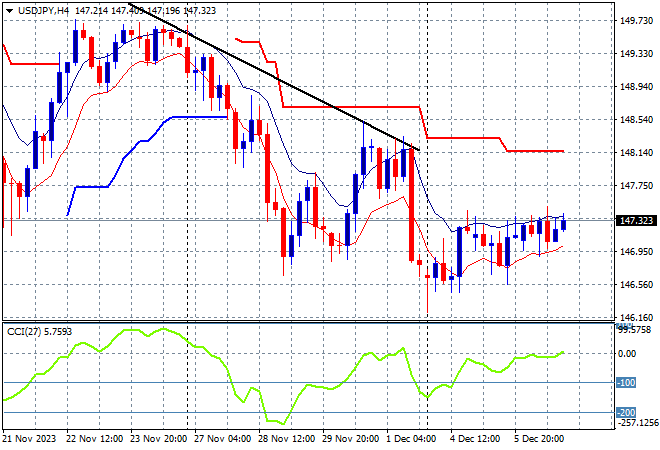

The USDJPY pair managed a very small lift overnight as USD remained strong against most of the majors, but still looks weak here to be just above the 147 level proper and remaining below the weekly downtrend line.

Four hourly momentum showed the way with the inability on the recent bounce to get back into overbought mode with price action rolling over and staying in oversold settings. Watch for a breakdown below the mid week lows next:

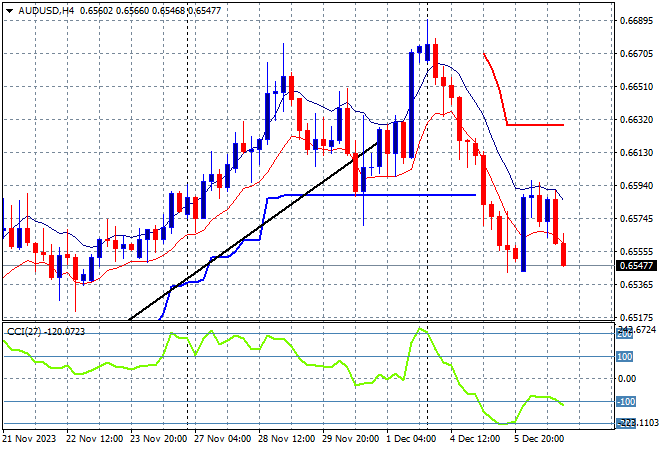

The Australian dollar is continuing to take more heat out of recent price action following the RBA meeting and yesterday’s GDP print with a further retracement from its five month high back down to the 65 cent level to stay below former trailing ATR support on the four hourly chart.

The Pacific Peso remains under medium and long term pressure with short term momentum now oversold as well after a failure to breach the 67 cent level. Watch for a further pullback to the November lows:

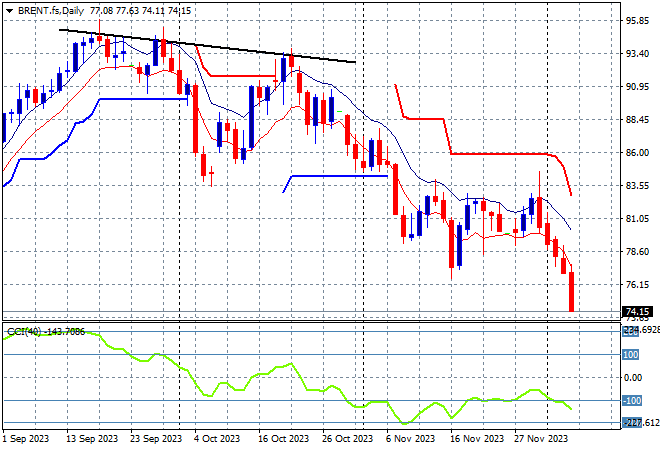

Oil markets remain volatile with the growing conflict in the Middle East and potential OPEC with another down session overnight with Brent crude pushed below the $75USD per barrel level.

After almost reaching $100 in mid September, price was looking to return to the August levels around the $85 area where a point of control had been established before the recent breakout. Daily momentum is still in oversold settings with this failed test of support at the August level setting up for further falls below:

Gold is doing well to calm down its recent wild ride with its previous surge through the $2100USD per ounce level now contained and brought back to last week’s price action area of support just above the $2020 level as of this morning.

Watch out for more profit taking if price action breaks below trailing ATR support and of course, the magical $2000 level: