Asian share markets are reeling again, with the red across the board as Yen rallies against USD while risk sentiment in China remains quite negative. Traders are positioning for tomorrow’s US employment print – the non farm payroll report – which could come in a lot softer than expected.

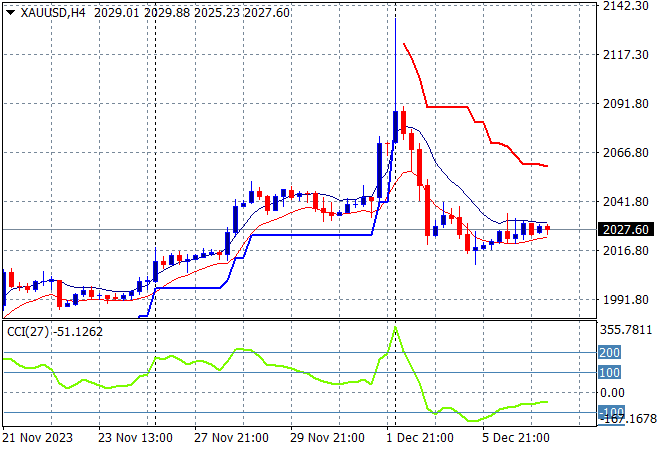

Oil prices are looking to fall further tonight with Brent crude about to break below the $74USD per barrel level while gold is slowly inching higher having exploded in recent sessions to new record high with some heat taken out just below the $2030USD per ounce level:

Mainland Chinese share markets are edging slightly higher near the close with the Shanghai Composite up marginally to 2972 points while in Hong Kong the Hang Seng Index is giving up most of its recent rebound, down 1% to 16313 points. Japanese stock markets are also in a tizzy, with the Nikkei 225 down nearly 1.8% to 32858 points while the USDJPY pair is again rolling over, heading down to the 146 handle:

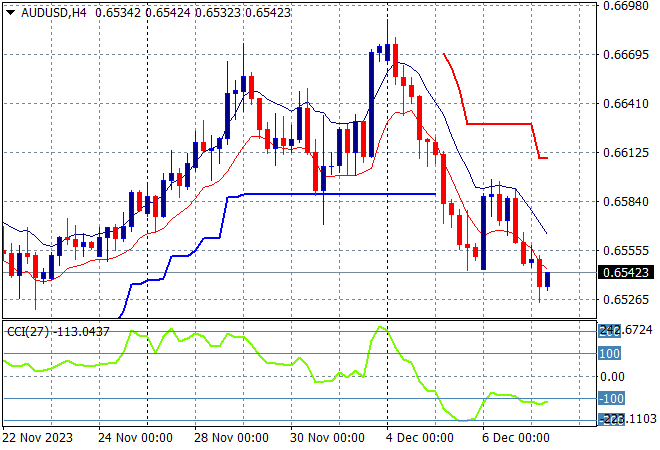

Australian stocks were able to escape the selling but only just with the ASX200 closing 0.1% lower to remain above the 7100 point level at 7173 points while the Australian dollar is still reeling from the GDP print with a fall back towards the 65 cent level and not yet out of strife:

S&P and Eurostoxx futures are down significantly going into the London open as the S&P500 four hourly chart shows support still firm at the 4500 point level where price action is likely to test in tonight’s session as risk sentiment gets back into negative territory:

The economic calendar includes Euro wide GDP and US initial jobless claims.