Asian share markets are trying to reduce in volatility today as some semblance of calm returns to all the risk markets, particularly bonds. Yen is weakening again to alleviate some pressure on Japanese equities which are seeing the best reduction in volatility while local issues were benign after an uptick in unemployment. The Australian dollar actually lifted on the numberwang print to push further above the 65 cent level.

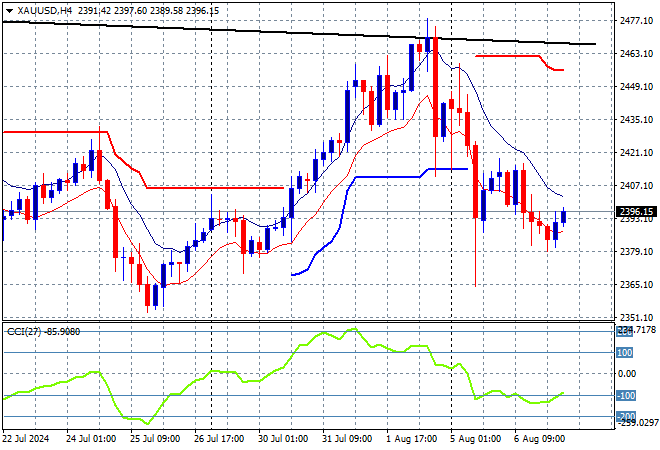

Oil prices are still depressed amid the risk off mood with Brent crude remaining well below the $77USD per barrel level while gold is trying in vain to get back above the $2400USD per ounce level as momentum remains oversold:

Mainland Chinese share markets are putting in modest bumps higher as the Shanghai Composite moves 0.2% higher while the Hang Seng Index is up nearly 1.5% to 16895 points. Meanwhile Japanese stock markets are reducing in volatility but continue to lift higher with the Nikkei 225 closing some 1% higher back to 35089 points while the USDJPY pair has broken out above trailing resistance at the 146 handle:

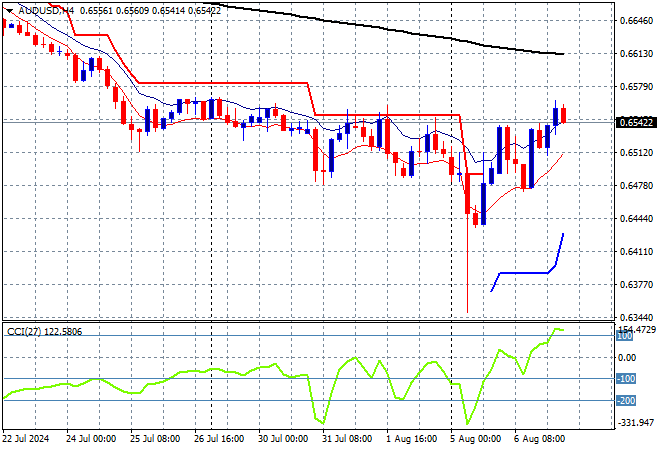

Australian stocks only lifted slightly with the ASX200 closing just 0.25% higher to 7699 points while the Australian dollar made a small breakout this afternoon following the latest unemployment print as traders know the RBA will do what it does best – sit on its hands and do 3/5ths of nothing:

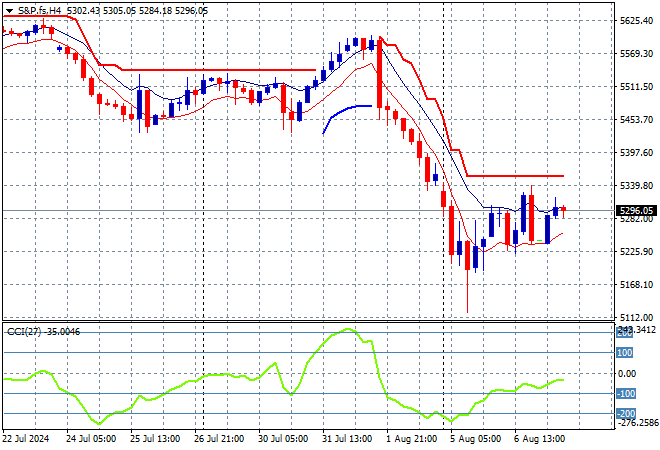

S&P and Eurostoxx futures are rebounding sharply going into the London session with the S&P500 four hourly chart showing some stability returning to the major index as a dead cat bounce pattern is not yet completed:

The economic calendar is relatively quiet tonight with German trade balance figures and then some private US oil data.