Asian stock markets are looking very unsteady in the final session of the trading week as inflationary concerns weigh down risk sentiment. ECB President Lagarde is on the inflation train again which will put further pressure on beleagured European stocks while the USD is easing off slightly just before the London open as the Australian dollar keeps above the 66 cent level.

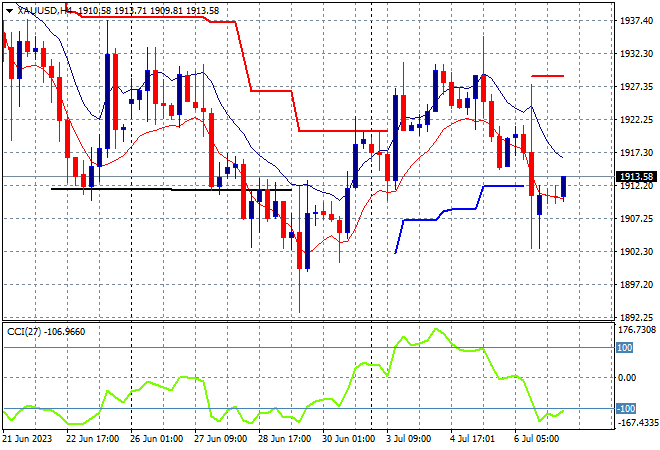

Oil prices are inching higher, with Brent crude hovering just below the $77USD per barrel level while gold is looking only slightly better after its recent selloff, currently just above the $1910USD per ounce level:

Mainland Chinese share markets are trying to rally going into the close with the Shanghai Composite steady at 3202 points while the Hang Seng Index is down nearly 0.5% to 18477 points.

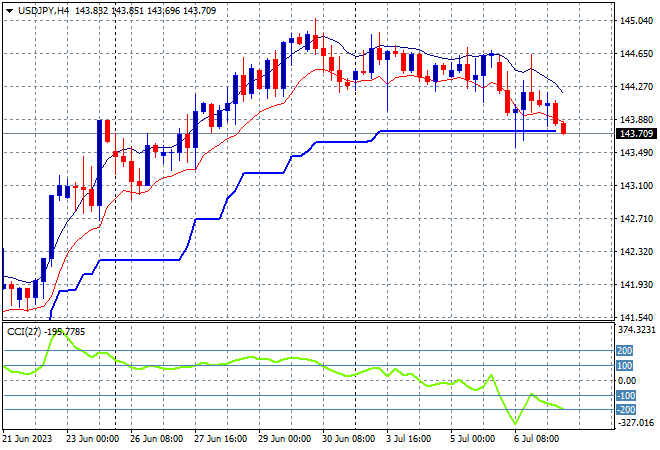

Japanese stock markets are also selling off, with the Nikkei 225 currently losing more than 0.5% at 32601 points with the USDJPY pair also continuing its roll over after being almost unchanged most of the week, cracking right through the 144 level:

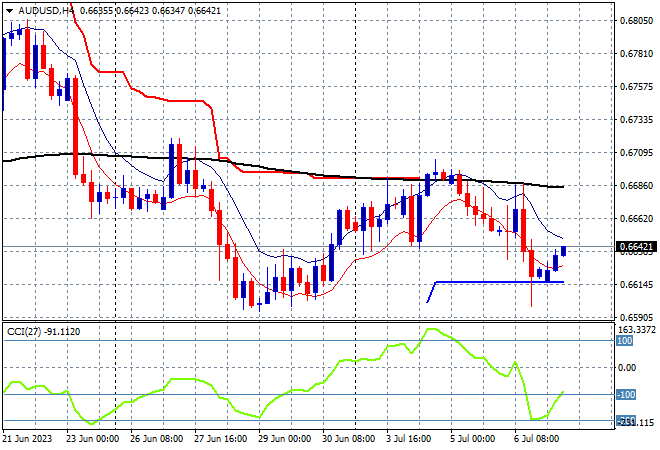

Australian stocks couldn’t escape the selling either with the ASX200 looking to close more than 1.5% lower at 7051 points. The Australian dollar was looking to continue its overnight deflation but has lifted slightly in afternoon trade to almost get to the mid 66 cent level on USD uncertainty going into tonight’s job report:

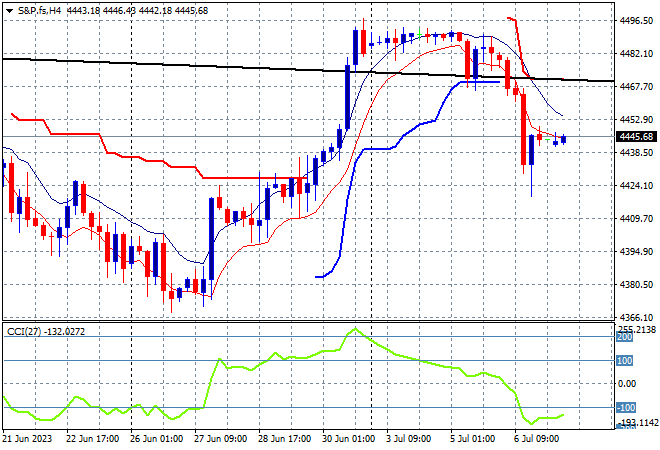

Eurostoxx and S&P futures are flat with the S&P500 four hourly chart showing price action rolling over after hitting resistance at the 4500 point level:

The economic calendar concludes the trading week with the big one – US non farm payrolls aka unemployment for June.