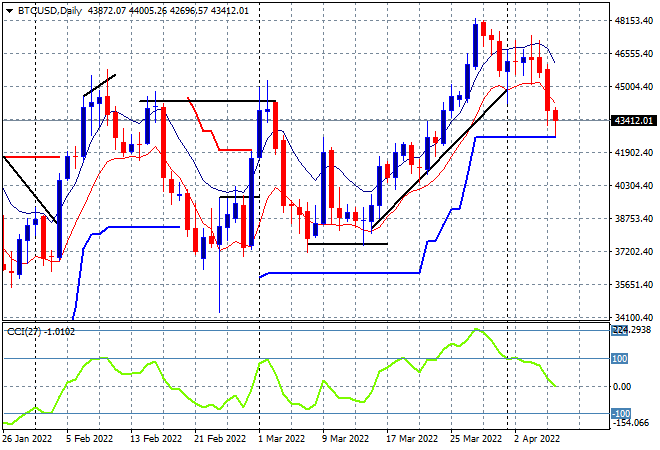

Another sea of read across Asian stock markets today as the risk contagion spreads from overnight markets as central banks go on a hawkish bent. The Australian dollar remains weak, heading below the 75 handle following the post RBA meeting pump and dump while the USD is still strong against the other major currency pairs, although Euro may bounce back on the ECB minutes tonight. Oil prices are trying to claw back their overnight losses on the expectations on more sanctions, while gold is largely unchanged and remaining disappointing here without a new daily high, stuck at the $1920USD per ounce level. Bitcoin is breaking down again, now down to the $43K level and about to break daily support:

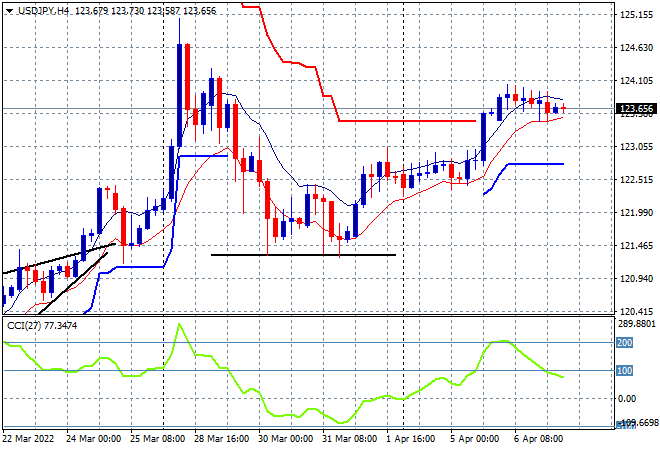

Mainland Chinese share markets are selling off sharply going into the close, the Shanghai Composite falling 1% to 3253 points while the Hang Seng Index has lost nearly 0.8% to 21899 points. Japanese stock markets continued their own selloff with the Nikkei 225 falling over 1.5% to 26888 points while the USDJPY pair is pausing once more, this time consolidating at the mid 123 level after its mid week breakout on USD strength:

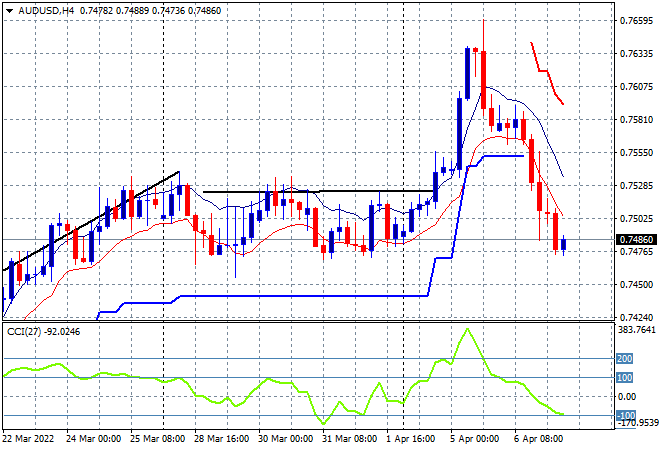

Australian stocks were not able to stave off the selling with the ASX200 closing 0.6% lower, remaining well below the 7500 point level to finish at 7441 points. The Australian dollar is still falling, now back to the weekly lows at just below the 75 handle as commodity prices wobble:

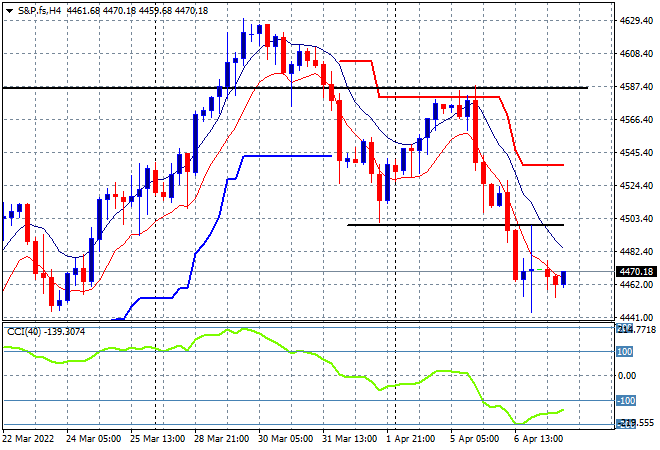

Eurostoxx and Wall Street futures are somewhat sideways as we head into the London session, with the S&P500 four hourly chart holding fast at the 4470 point level, but this looks like going down another set of stairs with weekly support coming up very shortly as momentum remains oversold:

The economic calendar will focus on the latest ECB monetary policy meeting minutes, then US initial weekly jobless claims.