Confidence returned to equity markets overnights following a non-surprise testimony from US Fed Chair Powell, combined with solid private jobs data. Wall Street rallied while bond yields fell back on the expectation that interest rate cuts are still on the agenda, while the USD fell back against all the majors. The Australian dollar was able to bounceback after its recent poor performance to head back above the 65 cent level as Euro firmed almost finished above the 1.09 level.

10 year Treasury yields pulled back again to fall below the 4.1% level, while commodities saw some life across the complex, with Brent crude almost above the $83USD per barrel level while gold can’t be stopped above the $2100USD per ounce level.

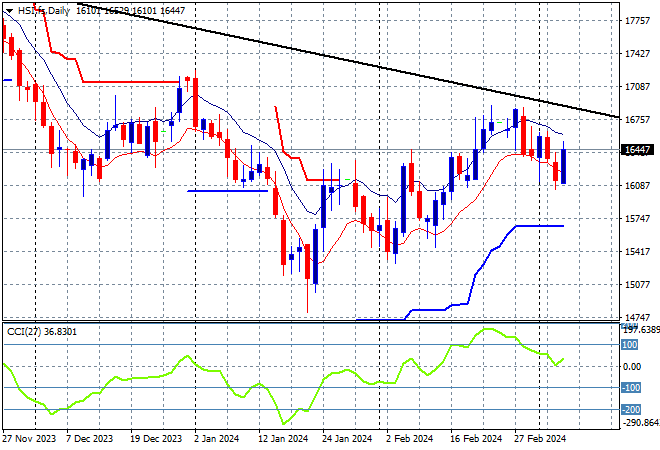

Looking at markets from yesterday’s session here in Asia, where mainland and offshore Chinese share markets are again bifurcating in risk with the Shanghai Composite down 0.2% while the Hang Seng has rebounded more than 1% higher to 16446 points.

The daily chart was starting to look more optimistic with price action bunching up at the 16000 point level, ready to possibly make a run for the end of 2023 highs at 17000 but as I warned previously, watch for any retracement down to the low moving average that could presage a full breakdown to the long term trend:

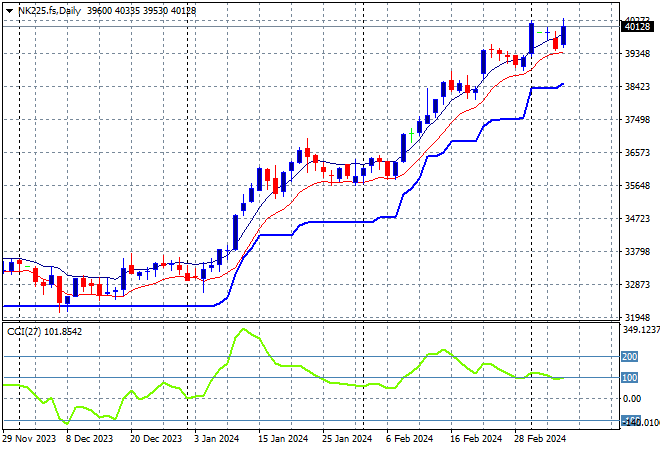

Japanese stock markets were relatively stable after their big run up with the Nikkei 225 closing flat at 40090 points.

Trailing ATR daily support was never threatened by price action after this bounce went beyond the September highs at the 33000 point level with daily momentum getting back to overbought readings with a significant breakout. A selloff back to ATR support at 38000 points remains unlikely as the November highs are wiped out in this breakout but I’m cautious of a strong pullback here on any volatility, although futures look promising this morning:

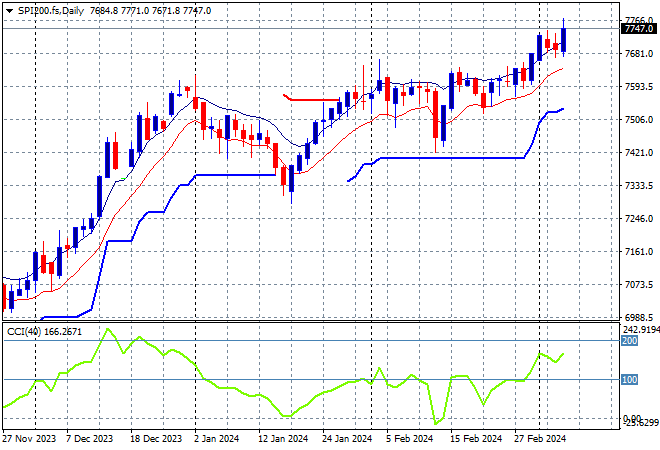

Australian stocks were unable to move substantially higher again with the ASX200 up 0.1% or so closing at 7733 points.

SPI futures are up nearly 0.5% given the solid result on Wall Street overnight. The daily chart was looking firmer with the medium term uptrend and short term price action coming together to take out the previous December highs. As I said previously, watching for any continued dip below the low moving average could see a significant pullback but watch ATR support which has been defended so far:

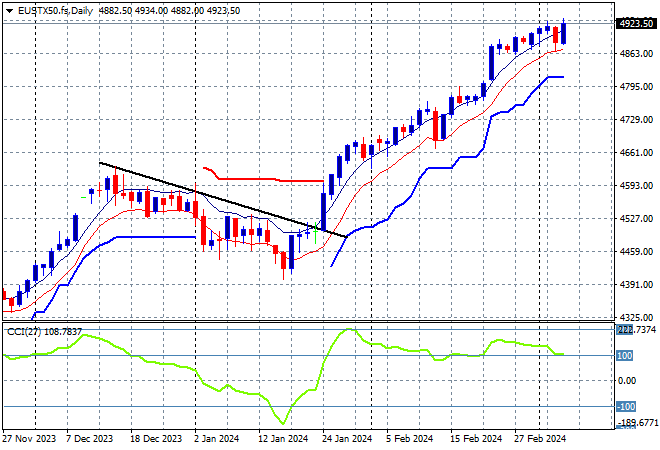

European markets were fairly steady and positive across the continent with the Eurostoxx 50 Index finishing nearly 0.5% higher to 4915 points.

The daily chart shows price action still on trend after breaching the early December 4600 point highs but daily momentum is almost out of overbought phase. This is looking to turn into a larger breakout but watch for any falls below the low moving average or ATR support proper:

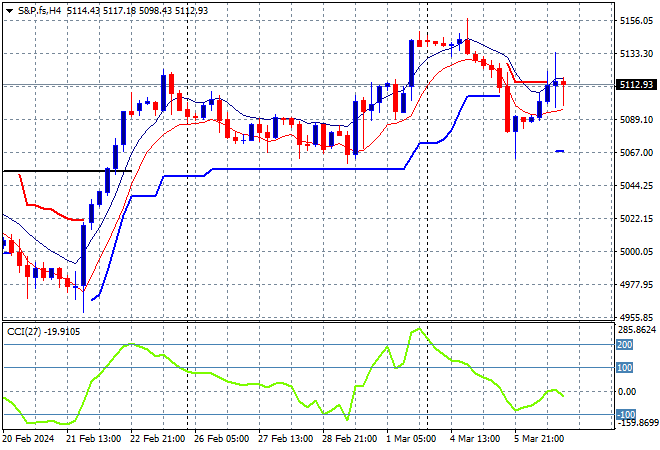

Wall Street got back on track after the Powell comments with the NASDAQ and S&P500 both finishing over 0.5% higher, the latter closing at 5104 points.

The four hourly chart shows this inversion taking it back to last week’s lows just above the 5050 point level with short term momentum floundering, but price has been supported at the corresponding daily ATR support level with a swift return above 5100 points. I’m a bit wary that four hourly momentum is still neutral and price action hasn’t surpassed the high moving average yet:

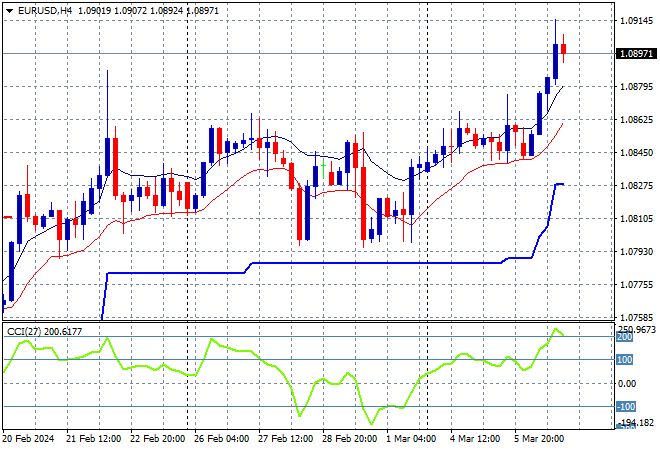

Currency markets went straight into anti USD mode after hearing Fed Chair Powell last night with the DXY Index pushed down at least 0.5%, giving Euro new life and a breakout that saw it briefly pushed through the 1.09 level.

The union currency has made another new monthly high with a view to getting back to the 1.09 handle as momentum remains overbought in the short term and price action breaking out nicely. Watch for any pullback to the 1.0820 level and any test of the 1.08 handle itself however on a reversion:

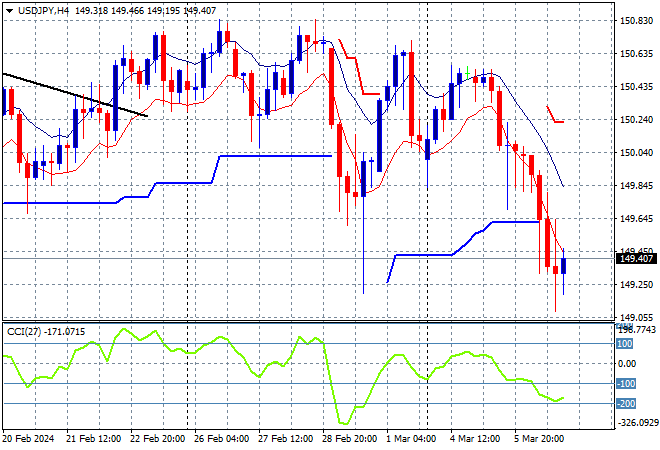

The USDJPY pair remains the most volatile after being the most stable for several weeks with another breakdown overnight that saw it sharply cross below the 149 level before a later comeback that is still seeing some volatility this morning.

The medium term picture was looking very optimistic as Yen sold off due to BOJ meanderings but momentum is still considerably volatile and setting up for another potential swing through the 150 level proper:

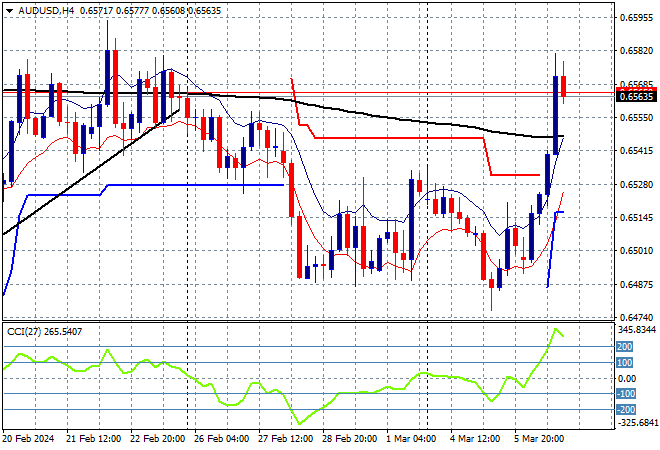

The Australian dollar was able to make a strong bounce back to get well above the 65 handle overnight as it matched the early February highs but not yet exceeded.

The Aussie has been under medium and long term pressure for sometime with the short term moves above the 65 level unable to set up for another breakout with short term momentum really painting the picture of internal weakness here. Watch for any signs of a break below the four hourly low moving average presaging a return to last week’s low:

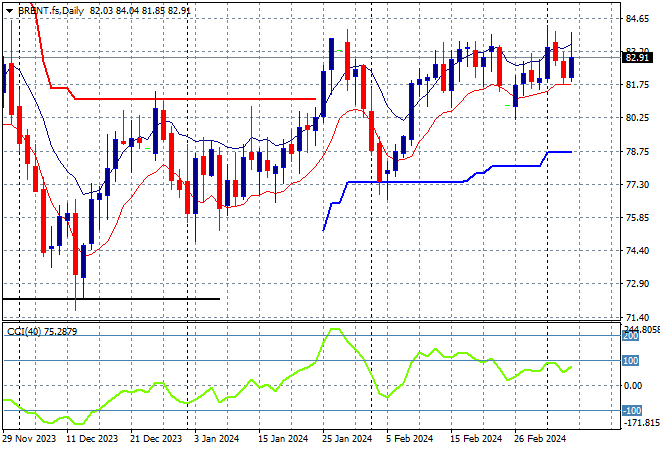

Oil markets are still failing to regain their December highs with Brent crude unable to exceed the Friday night highs at the $83USD per barrel level as it continues to come up against weekly resistance, closing just below that level.

After retracing down to trailing ATR daily support at the $77 level, price is still above the weekly resistance levels that so far have held from the January false breakout with the short term target the late January highs above $84 still the next target:

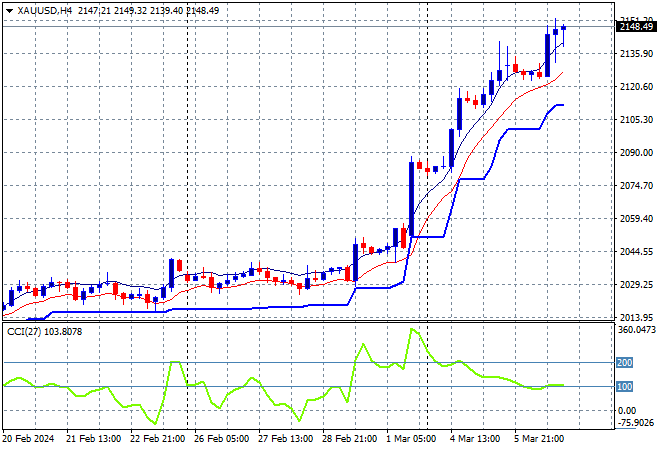

Gold is still moving higher after some recent deceleration but really wants to keep punching through the $2100USD per ounce level, closing just below the $2150 level overnight.

Daily momentum was nearly off the charts – never a good sign – with short term support at the $2000 level turning to what could be rock solid medium term support but still the critical area to watch ahead on a likely pullback due to excessive volatility: