Asian share markets are putting in mixed sessions today despite the strong response overnight on Wall Street with the USD falling amid lower bond yields. Hawkish comments from the BOJ haven’t helped steady nerves in Japan with Yen soaring higher while the Australian dollar is also on a tear, having recovered the post GDP print reaction.

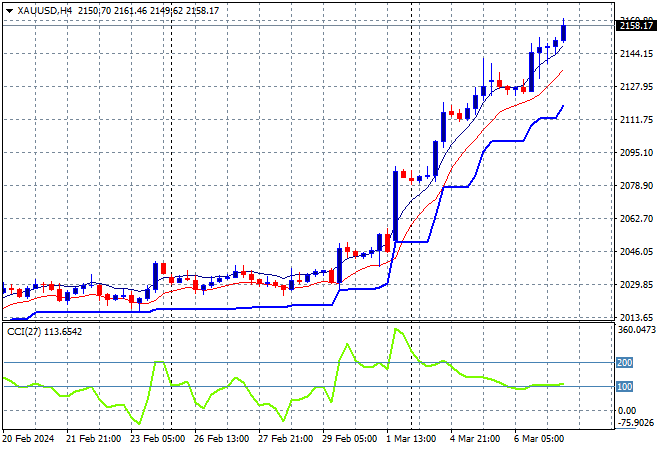

Oil prices are trying to claw back recent losses but Brent crude is stalled just above the $82USD per barrel level while gold is extending its recent gains to almost cross the $2060USD per ounce level as it obliterates any resistance:

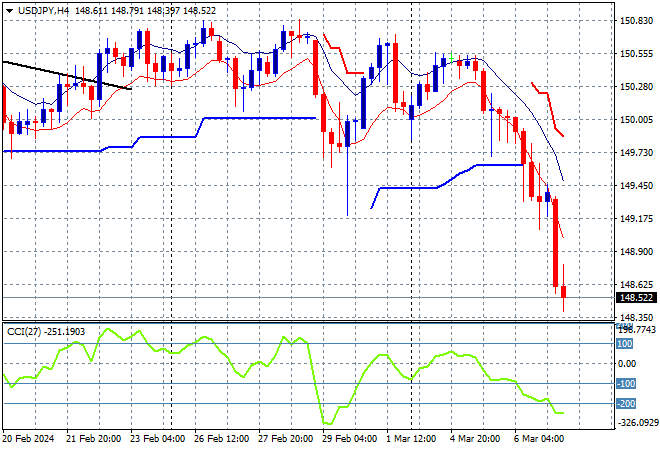

Mainland and offshore Chinese share markets are again bifurcating in risk with the Shanghai Composite down 0.2% while the Hang Seng has dropped than 0.5% lower to 16361 points. Japanese stock markets were the worst off with the Nikkei 225 closing nearly 1% lower at 39720 points while the USDJPY pair has collapsed right through the 149 level:

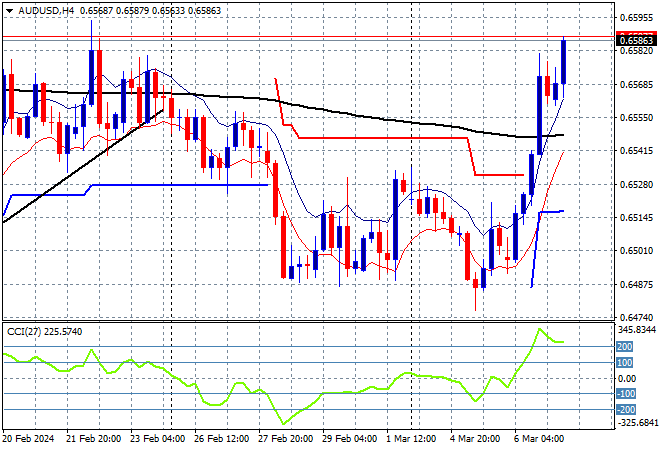

Australian stocks were the odd ones out as the only market to lift higher with the ASX200 gaining some 0.3% closing at 7761 points while the Australian dollar has continued its sharp rebound this afternoon, almost extending up to the 66 cent level:

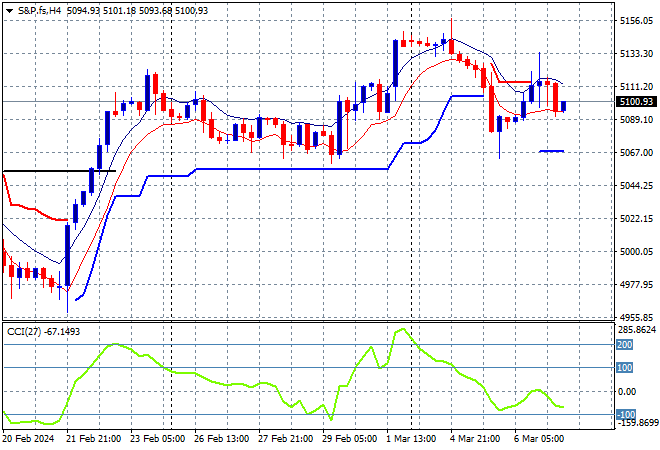

S&P and Eurostoxx futures are steady but lacking confidence again as we go into the London session with the S&P500 four hourly chart showing price action holding at the 5100 point level:

The economic calendar includes the latest ECB interest rate meeting and US initial weekly jobless claims.