Asian share markets are generally in a positive mood despite the absence of a strong lead from Wall Street overnight as reduced volatility in bond and currency markets helps settle nerves and paper over real macro problems. The USD has given up a small amount of ground but remains strong following the upside surprise in the jobs print on Friday night while the Australian dollar continues its modest bounce following the RBA’s recent hold decision but still looks decidedly weak just above the 65 cent level.

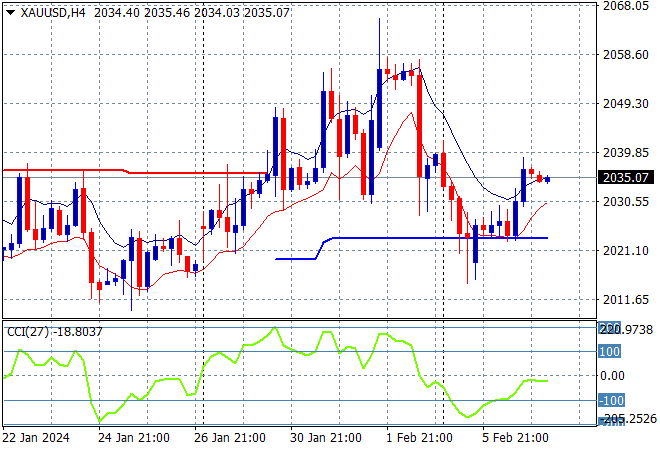

Oil prices are reducing in volatility which means expect more volatility soon as tensions in the Middle East reman high with Brent crude barely holding below the $79USD per barrel level while gold is trying to push higher as one of best performing undollars, firming at the $2030USD per ounce level:

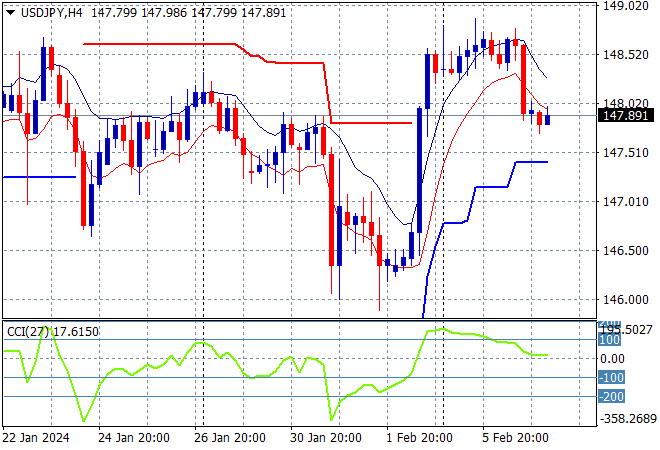

Mainland Chinese share markets are still bouncing back with the Shanghai Composite moving nearly 0.8% higher to 2812 points while in Hong Kong the Hang Seng Index is steady in afternoon trade at 16096 points. Japanese stock markets however couldn’t find any confidence with the Nikkei 225 closing 0.2% lower at 36087 points while the USDJPY pair is just holding on to its big reversal from Friday night, currently just below the 148 level:

Australian stocks pushed back a two day decline with a positive session as the ASX200 closed nearly 0.5% higher at 7615points while the Australian dollar managed a bounce at first but is still struggling just above the 65 cent level following yesterday’s RBA meeting:

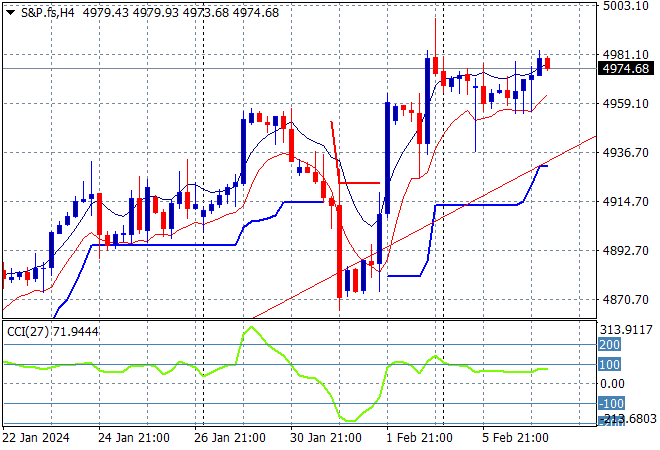

S&P and Eurostoxx futures are holding on to their overnight positions going into the London session as the S&P500 four hourly chart shows price action trying to get back on trend as it reaches for the 5000 point level:

The economic calendar is relatively quiet tonight with US balance of trade and a plethora of Fed speeches.