Asian share markets are trying to fight back today, with Japanese equities returning with a near 10% gain in a single session while overnight markets were down between 2 and 3% with futures indicating some recovery underway. This may be shortlived as markets remain highly volatile and cautious around the trajectory of the Fed, with currency traders navigating today’s RBA meeting and getting no result as a hold decision was made. The Australian dollar remains relatively steady at the 65 cent level but the storm has not yet passed.

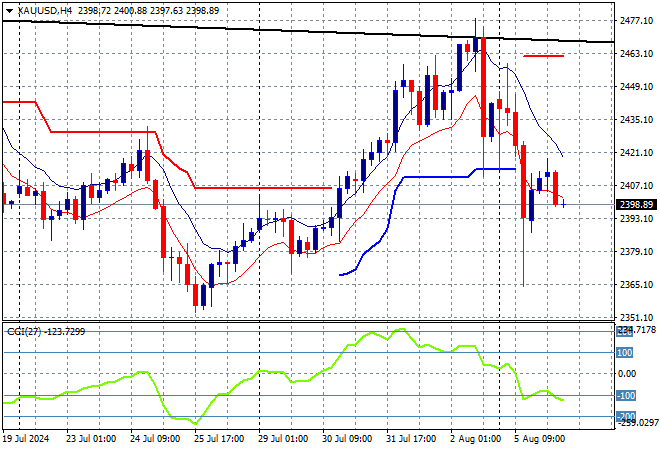

Oil prices are still depressed amid the risk off mood with Brent crude remaining at the $77USD per barrel level while gold is trying in vain to get back above the $2400USD per ounce level as momentum remains oversold:

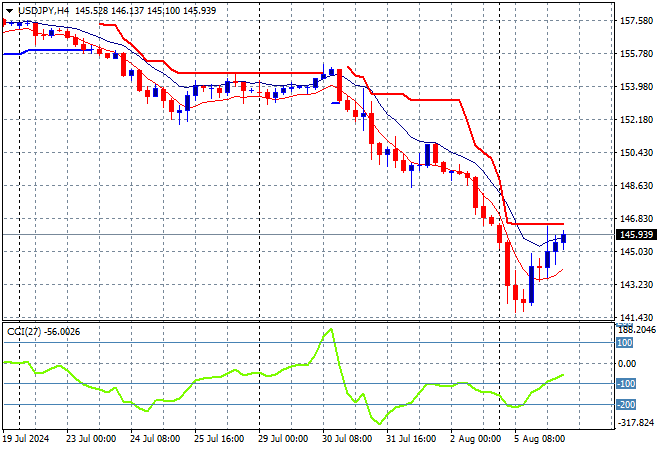

Mainland Chinese share markets are the worst in the region relatively speaking with minor losses as the Shanghai Composite is down 0.4% or so while the Hang Seng Index is barely moving at 16675 points. Meanwhile Japanese stock markets are seeing huge upside volatility now with the Nikkei 225 closing nearly 10% higher back to 34517 points while the USDJPY pair has bounced back some 400 pips in the last 24 hours to almost get above the 146 handle:

Australian stocks had the modest of bounces with the ASX200 closing just 0.5% higher to 7692 points while the Australian dollar absorbed the RBA hold without any change, remaining at the 65 cent level after the overnight bounce:

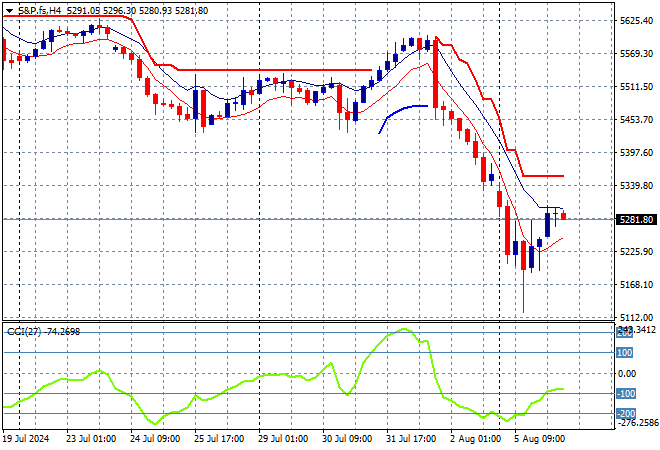

S&P and Eurostoxx futures are rebounding somewhat going into the London session with the S&P500 four hourly chart showing how far the major index fell overnight and what looks like a dead cat bounce underway:

The economic calendar includes US trade numbers for July.