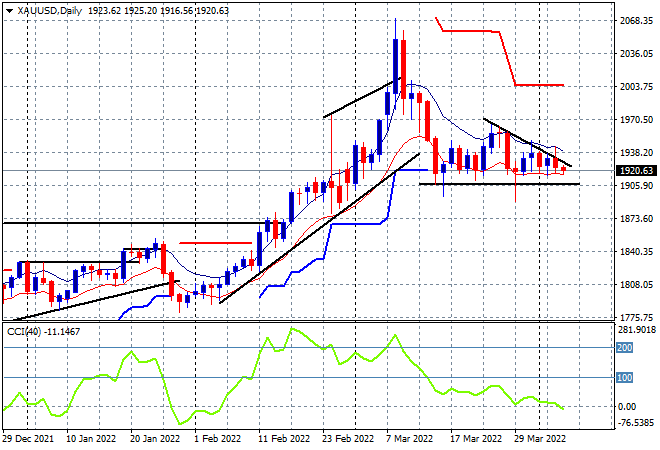

Asian stock markets are all licking their wounds today on the return of traders in China, with sentiment souring due to macro and domestic (read: COVID) reasons, as the more sanctions for Russia are likely to upset risk markets even more. The Australian dollar remains poised below the 76 handle while the USD is still looking pretty strong against the other major currency pairs, especially Euro. Oil prices are trying to claw back their overnight losses on the expectations on more sanctions, although Europe is still not taking the moral stand in banning all Russian energy imports just yet. Gold is setting up for disappointment with the failure to breakfree after failing to make a new daily high and get above its weekly downtrend line at the $1940USD per ounce level:

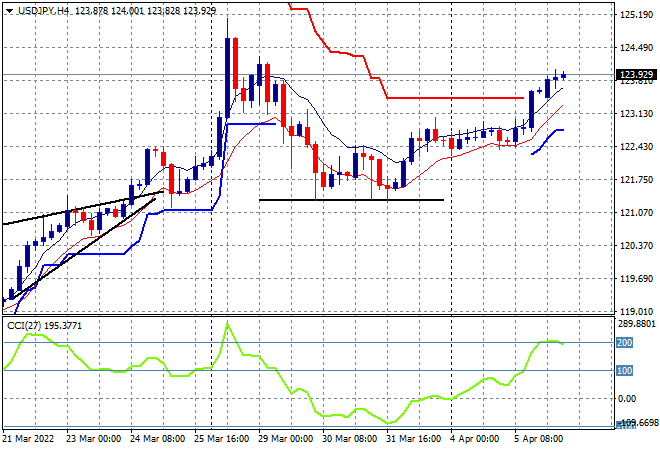

Mainland Chinese share markets reopened after a long weekend holiday with the Shanghai Composite falling 0.2% to 3276 points while the Hang Seng Index lost over 1% to 22180 points. Japanese stock markets switched into reverse mode on the souring of overnight risk sentiment with the Nikkei 225 falling over 1.5 to 27350 points while the USDJPY pair is pushing higher after its overnight breakout on USD strength, about to breach the 124 handle:

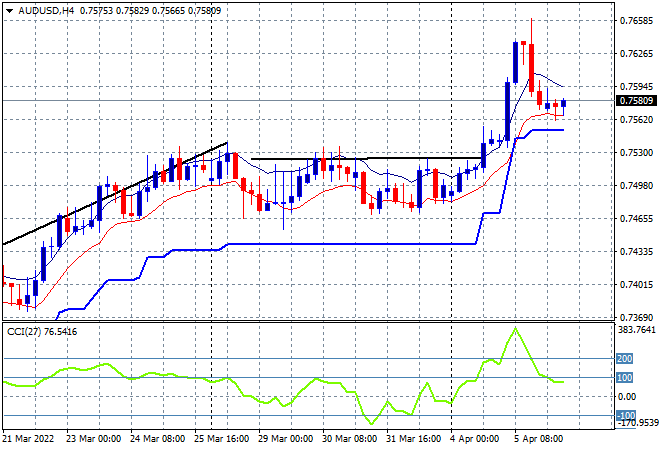

Australian stocks were the best relative performers with the ASX200 closing 0.5% lower, falling below the 7500 point level to close at 7490 points. The Australian dollar is largely unchanged after its post RBA party was pooped overnight, hovering just below the 76 handle but still making new weekly and monthly high as it tosses aside monthly resistance on expectation of faster rate rises:

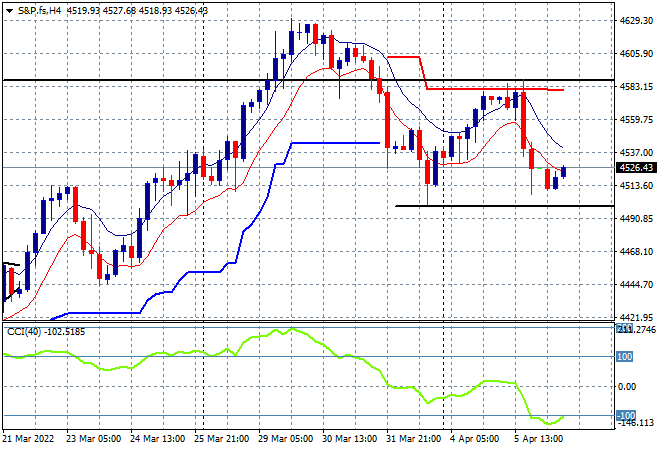

Eurostoxx and Wall Street futures are again drifting sideways as we head into the London session, with the S&P500 four hourly chart showing price anchored at the previous weekly low point just above the 4500 point level as momentum remains oversold:

The economic calendar will be relatively quite until the formal release of the FOMC minutes later in the session.