Overnight saw the release of the latest US ISM services PMI, which came in much softer than expected and led to a drop in the USD and bond yields. Wall Street still lacks confidence to move higher amid some tech wobbles, combined with the softer print sending it down more than 1% across the board, while European stocks had a small pause. The weaker USD saved the sharp drop in the Australian dollar from yesterday’s poor session but it still remains shaky below the 65 cent level as Euro firmed above the 1.08 level.

10 year Treasury yields pulled back sharply to the 4.1% level, while commodities also dropped across the complex, with Brent crude back to the $82USD per barrel level as gold remains the outsider at a very bullish $2130USD per ounce.

Looking at markets from yesterday’s session here in Asia, where mainland and offshore Chinese share markets are again bifurcating in risk with the Shanghai Composite up just 0.3% while the Hang Seng has plunged more than 2% lower to 16176 points.

The daily chart was starting to look more optimistic with price action bunching up at the 16000 point level, ready to possibly make a run for the end of 2023 highs at 17000 but as I warned previously, watch for any retracement down to the low moving average that could presage a full breakdown to the long term trend:

Japanese stock markets are relatively stable after their big run up with the Nikkei 225 closing flat at 40097 points.

Trailing ATR daily support was never threatened by price action after this bounce went beyond the September highs at the 33000 point level with daily momentum getting back to overbought readings with a significant breakout. A selloff back to ATR support at 38000 points remains unlikely as the November highs are wiped out in this breakout but I’m cautious of a strong pullback here on any volatility:

Australian stocks were unable to move higher again with the ASX200 down 0.1% or so closing at 7724 points.

SPI futures are down given the bad result on Wall Street overnight. The daily chart was looking firmer with the medium term uptrend and short term price action coming together to take out the previous December highs. As I said previously, watching for any continued dip below the low moving average could see a significant pullback but watch ATR support which has been defended so far:

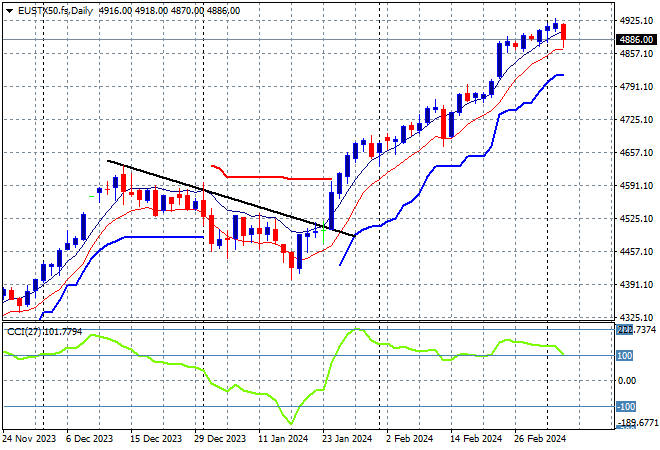

European markets were unsteady across the continent with the Eurostoxx 50 Index finishing 0.4% lower to 4893 points.

The daily chart shows price action still on trend after breaching the early December 4600 point highs but daily momentum has now retraced from being well overbought with futures indicating a further pullback this evening. This is looking to turn into a larger breakout but watch for any falls below the low moving average or ATR support proper:

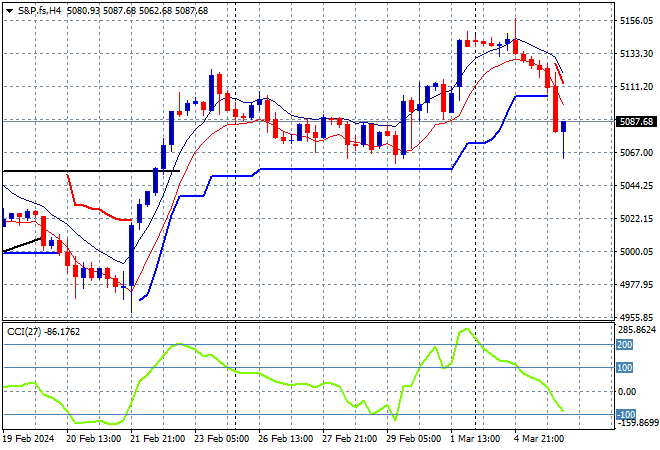

Wall Street couldn’t handle the soft PMI print nor some tech wobbles with the NASDAQ leading the way, down more than 1.5% while the S&P500 finished over 1% lower at 5071 points.

The four hourly chart shows this inversion taking it back to last week’s lows just above the 5050 point level with short term momentum again floundering, but price must be supported at the corresponding daily ATR support level or a quick reversion back below 5000 points is likely:

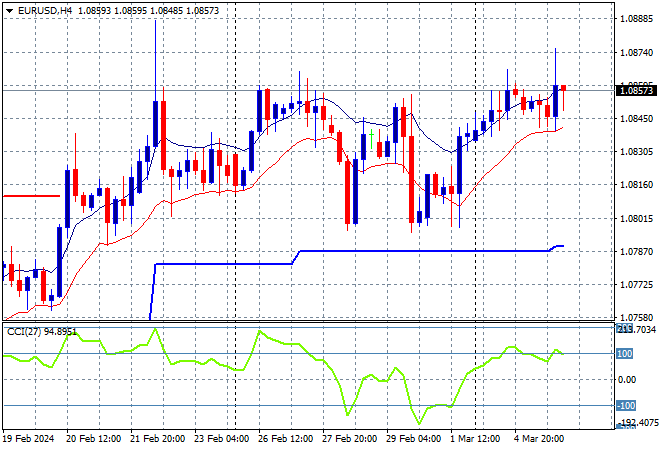

Currency markets remain somewhat anti USD after last night soft US service PMI print with the volatility pushing Euro to a new weekly high above the mid 1.08 level but without a lot of vigor.

The union currency is still at a new monthly high with a view to getting back to the 1.09 handle as momentum was overbought in the short term and price action breaking out as well before last night’s wobbles. Watch for any pullback to the 1.0820 level and any test of the 1.08 handle itself however:

The USDJPY pair remains the most volatile after being the most stable for several weeks with another breakdown overnight that saw it sharply cross below the 150 level before a later comeback that is still seeing some volatility this morning.

The medium term picture was looking very optimistic as Yen sold off due to BOJ meanderings but momentum is still considerably volatile and setting up for another potential swing through the 150 level proper:

The Australian dollar was able to make a small bounce back to get back above the 65 handle overnight but remains in a sideways funk since last week’s US CPI print.

The Aussie has been under medium and long term pressure for sometime with the short term moves above the 65 level unable to set up for another breakout with short term momentum really painting the picture of internal weakness here. Watch for any signs of a break below the four hourly low moving average presaging a return to last week’s low:

Oil markets are still failing to regain their December highs with Brent crude unable able to exceed the Friday night highs at the $83USD per barrel level as it continues to come up against weekly resistance, closing just above $82USD per barrel.

After retracing down to trailing ATR daily support at the $77 level, price is still above the weekly resistance levels that so far have held from the January false breakout with the short term target the late January highs above $84 still the next target:

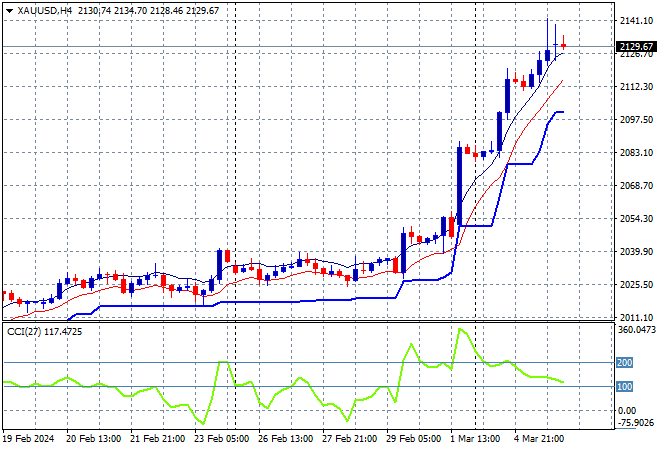

Gold is still moving higher but some deceleration occurred overnight after punching through the $2100USD per ounce level as it became extremely overbought, closing just below the $2130 level.

Daily momentum was nearly off the charts – never a good sign – with short term support at the $2000 level turning to what could be rock solid medium term support but still the critical area to watch ahead on a likely pullback due to excessive volatility: