Asian share markets have had a mixed session today despite the falls overnight on Wall Street with volatile commodity prices and US politics overshadowing confidence. The USD remains slightly weak against the majors due to the soft ISM services PMI while the Australian dollar has lifted slightly despite the poor GDP print locally.

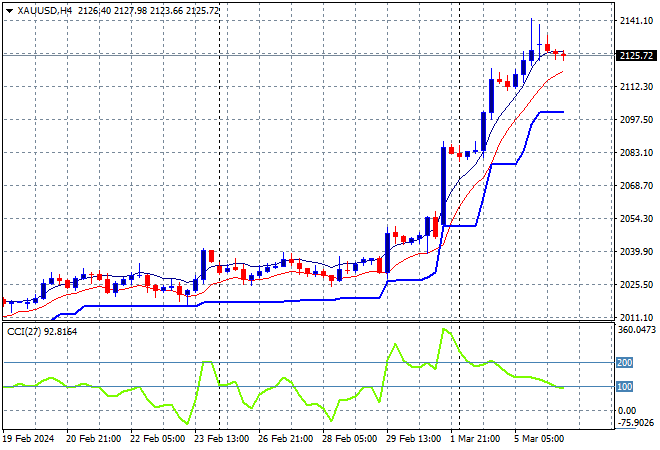

Oil prices are trying to claw back recent losses but Brent crude is stalled just above the $82USD per barrel level while gold is holding on to its recent gains alongside Bitcoin (which slid 20% overnight but is rebounding again), still above the $2100USD per ounce level as it obliterates any resistance:

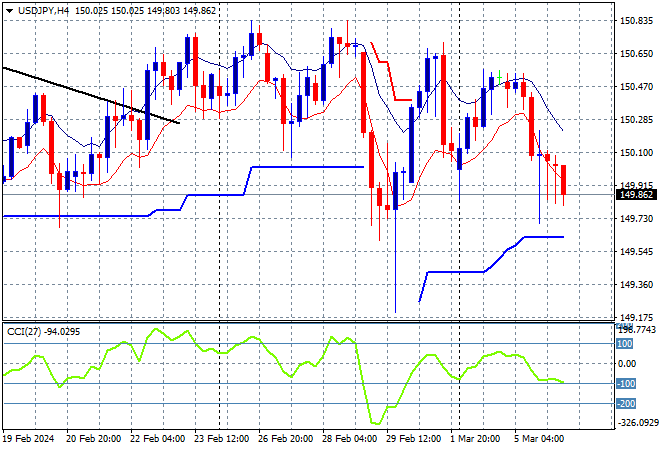

Mainland and offshore Chinese share markets are again bifurcating in risk with the Shanghai Composite down 0.2% while the Hang Seng has rebounded more than 1% higher to 16446 points. Japanese stock markets are relatively stable after their big run up with the Nikkei 225 closing flat at 40090 points while the USDJPY pair has been pushed down below the 150 level again:

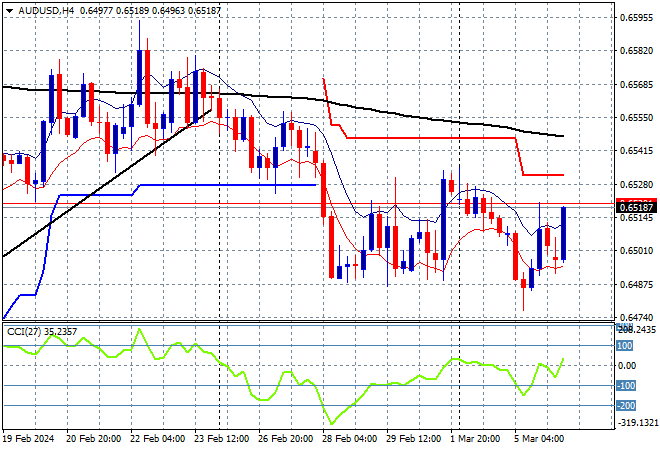

Australian stocks were unable to move substantially higher again with the ASX200 up 0.1% or so closing at 7733 points while the Australian dollar has rebounded sharply this afternoon, getting back above the 65 cent level after recently making a new weekly low:

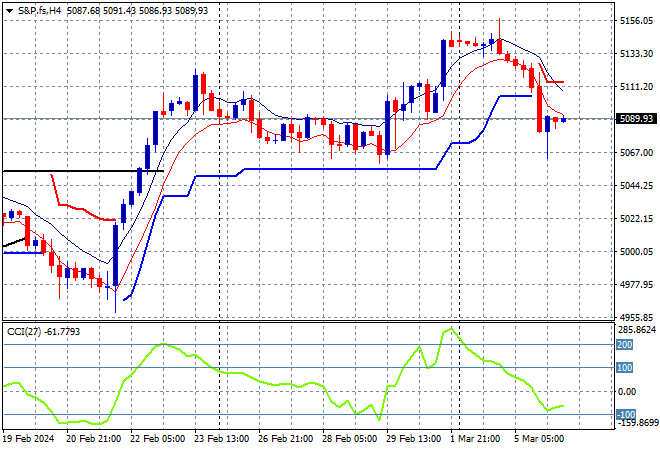

S&P and Eurostoxx futures are steady but lacking confidence as we go into the London session with the S&P500 four hourly chart showing price action still below the 5100 point level:

The economic calendar is light again tonight with some private US jobs data followed by Fed Chair Powell’s testimony.