Market expectations remain volatile in the wake of the US jobs report on Friday that saw the USD push the major currencies to new weekly lows while bond yields surged. This continued somewhat overnight as the latest ISM services print came in strong, indicating the US domestic economy remains well on track but Wall Street hesitated on the print, with European shares also unable to find positive momentum. The Australian dollar is under the pump as we all await the well holidayed RBA, pushed below the 65 cent level overnight.

10 year Treasury yields lifted higher again, extending past the 4.1% level while oil prices stabilised somewhat as Brent crude remained at the $77USD per barrel level. Meanwhile gold is still under pressure but holding on just above the $2020USD per ounce level.

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets again fell in afternoon trade as the Shanghai Composite moved 1% lower to 2702 points while in Hong Kong the Hang Seng Index was down just 0.1% to 15556 points.

The daily chart still shows the significant downtrend from the start of 2023 with the 19000 point support level a distant memory as medium term price action remains stuck below the 17000 point zone. The recent bounce which saw daily momentum readings almost reach positive settings is just another part of this down phase with a rollover continuing as the inability to reach former support at the 16000 point level is telling:

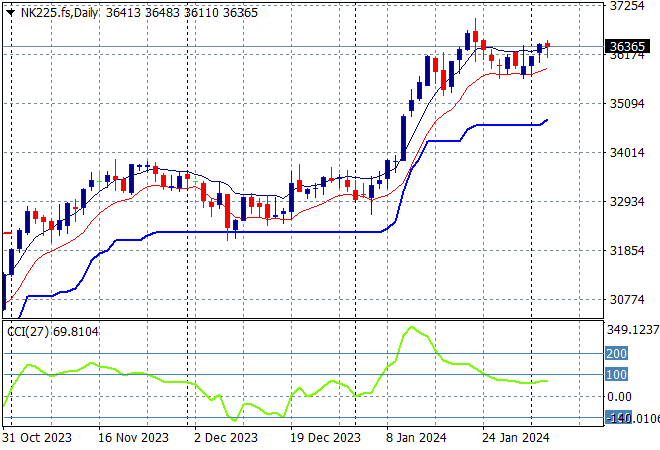

Japanese stock markets performed much better, with the Nikkei 225 closing 0.5% higher at 36354 points.

Trailing ATR daily support was being threatened by price action after this bounce went beyond the September highs at the 33000 point level with daily momentum remaining extremely overbought. A selloff back to ATR support at 32000 points remains unlikely as the November highs are wiped out in this breakout but I’m cautious of a strong pullback here on any volatility:

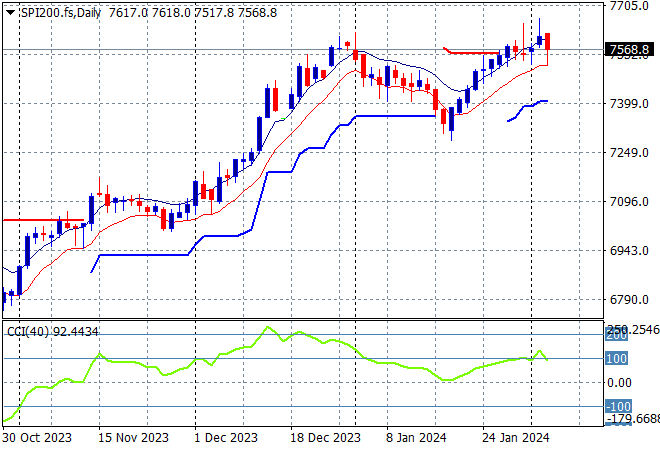

Australian stocks retraced heavily despite the rise on Wall Street as the ASX200 closed nearly 1% lower at 7625 points.

SPI futures are down 0.5% or so given the stumble on Wall Street overnight. The daily chart is looking firmer with the medium term uptrend and short term price action coming together to take out the previous December highs. I would still watch for any continued dip below the low moving average and conversely with a breakout above the 7600 point level:

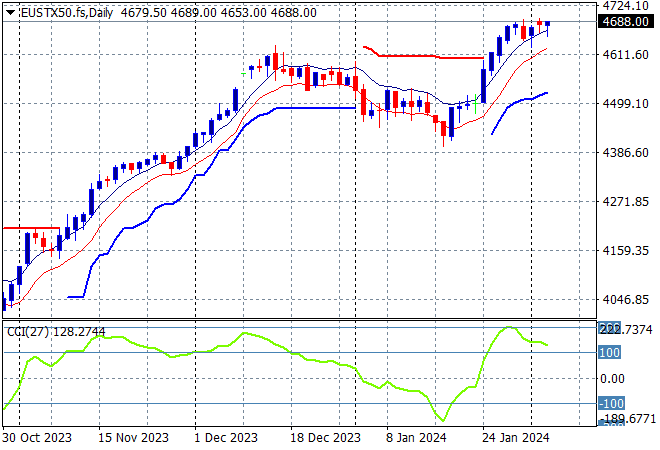

European markets remained somewhat hesitant with minor scratch sessions across the continent as the Eurostoxx 50 Index finished 0.1% higher at 4655 points.

The daily chart was showing price action meandering and not yet making a solid attempt at breaching the early December 4600 point highs before this surge with daily momentum still well overbought and price above the highs from December. There are some signs this slowdown could turn into a further retracement but the risk complex seems to favour more bidding tonight:

Wall Street also had a breather with the NASDAQ down 0.2% while the S&P500 punched in a scratch session, losing 0.2% to close at 4946 points.

Short term momentum has retraced fully out of oversold territory on the four hourly and daily chart, now somewhat overbought as the 5000 point level remains the target ahead, despite the “good” economic roadblocks due to the stronger NFP and USD:

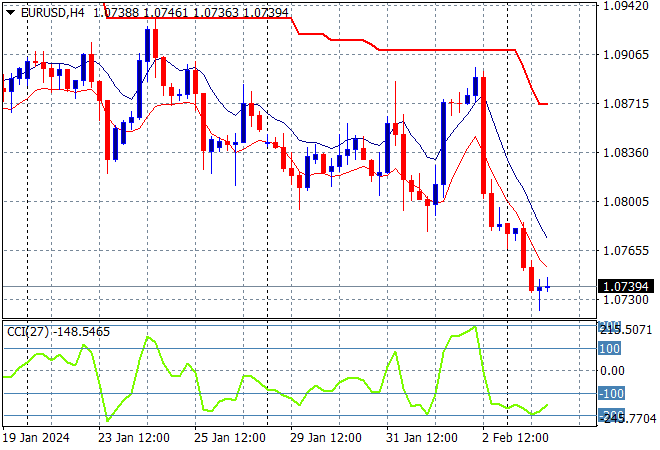

Currency markets were again in the thrall of a strong USD post the NFP print with Euro continuing its decline below the 1.08 handle with yet another new weekly low.

The union currency had been somewhat weak before Friday night, after tracking sideways for nearly three weeks as short term momentum switched to negative as price action remained contained well below trailing ATR resistance. This is not looking good with the 1.07 handle to come under threat next:

The USDJPY pair continued its meltup from Friday night with a push towards the 149 level as short term momentum remains considerably overbought following the jobs print.

Four hourly momentum could retrace here as this meltup pattern runs out of steam so watch the low moving average to come under threat with the 148 level proper remaining as strong short term support:

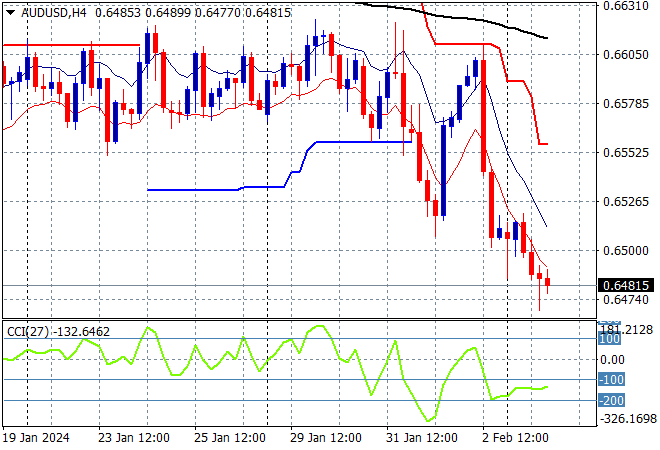

The Australian dollar remains one of the weakest undollars as it continues the post NFP crush, now well below the 65 handle in a one way move as we all await the RBA meeting today.

The Aussie has been under medium and long term pressure for sometime with the latest rally just a relief valve being let off before this realignment back to a strong USD with rate cuts a possibility later today. There are some signs of deceleration here so watch the 65 level for a possible inversion:

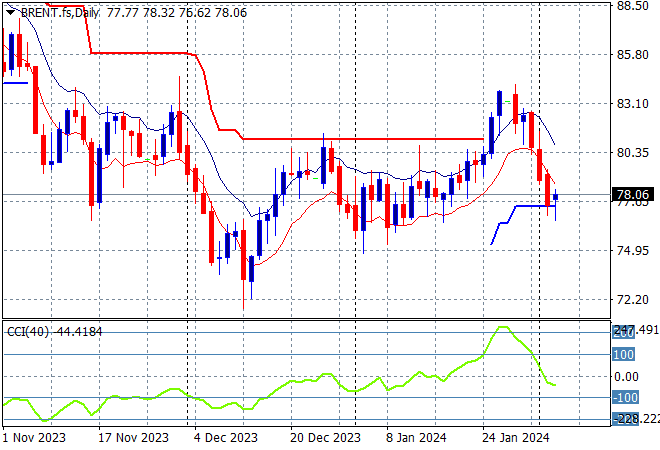

Oil markets failed to stabilise after a solid breakout last week with a continued reversal overnight despite rising tensions in the Middle East as Brent crude retraced down to the $78USD per barrel level.

After clearing the key resistance level at the $80 level, daily momentum had been slightly overbought and ready to engage further to the upside, but the recent stall failed to push through so now saw the key psychological $80 level rejected so watch for the recent lows at $75 to come under threat next:

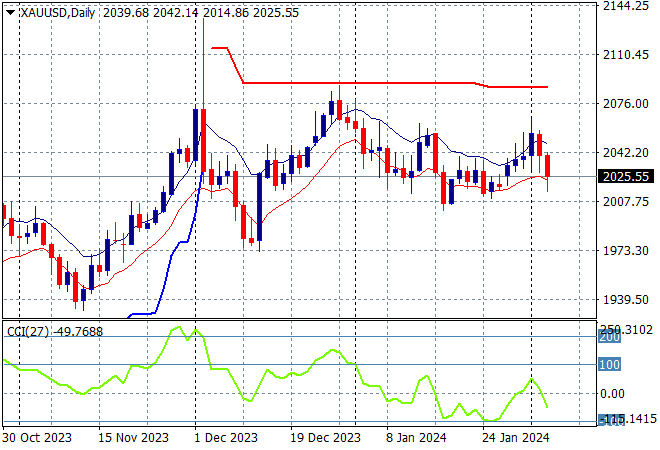

Gold remains somewhat wobbly overnight with another small retracement below the $2030USD per ounce level after failing to hold on to its short term rally following the FOMC and BOE meetings.

Daily momentum is back to negative settings and short term support at just above the $2000 level will likely come under threat next here as the USD gains further strength: