Last night saw some interesting volatiltiy around risk markets with softer US jobs data before tomorrow night’s official US NFP print saw big drops in Treasury yields while stocks vacillated between losses and gains, with Wall Street eventually finishing unsettled and slightly lower. Commodity markets remain on a downer while the USD saw a slight reversal, especially against a strengthening Yen while Euro bounced off short term support. The Australian dollar was able to get back above the 67 cent level but remains in a weak position.

10 year Treasury yields were down a further 8 points to the 3.7% with even more action on the shorter end of the curve while oil prices continued to move sharply lower on demand concerns as Brent crude fell below the $73USD per barrel level. Gold is still struggling to make headway despite the weaker USD overnight and remains slightly below the $2500USD per ounce zone.

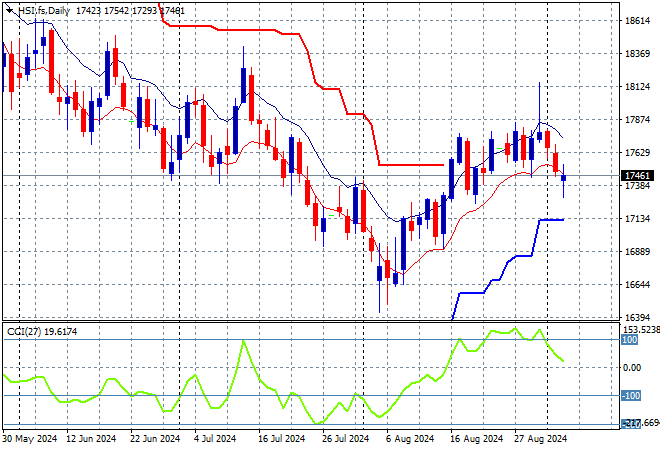

Looking at markets from yesterday’s session in Asia, where mainland Chinese share markets are pulling back with the Shanghai Composite down 0.5% while the Hang Seng Index closed more than 1% lower at 17426 points.

The Hang Seng Index daily chart was starting to look more optimistic a few months back but price action has slid down from the 19000 point level and continues to deflate in a series of steps as the Chinese economy slows. A few false breakouts have all reversed course and another downside move is again looming here as price action won’t clear short term resistance:

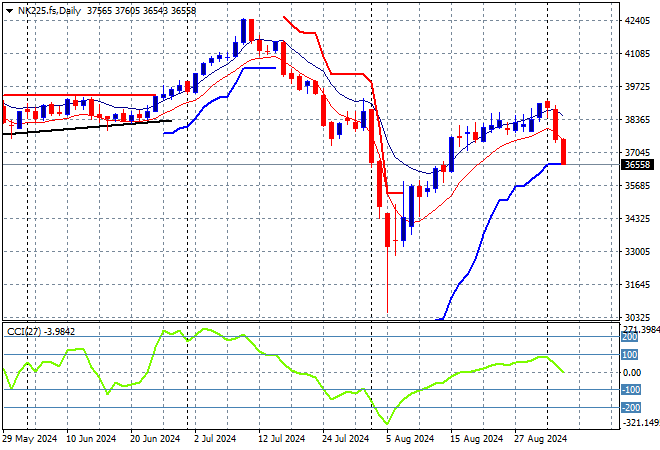

Meanwhile Japanese stock markets were taking the biggest hits with the Nikkei 225 losing more than 4% to 37047 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Yen volatility is coming back so a sustained return above the 38000 point level from May/June with futures indicating another poor opening today:

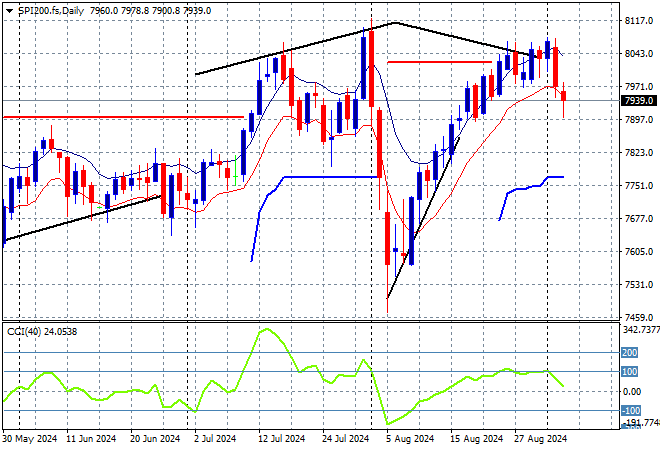

Australian stocks had one of the better sessions in the region, relatively speaking with the ASX200 closing more than 1.8% lower at 7950 points.

SPI futures are flat reflecting the unease on Wall Street overnight. Short term momentum and the daily chart pattern was potentially signalling a top here and this combination could still eventuate, as support at or just below the 8000 point level is still very much under threat:

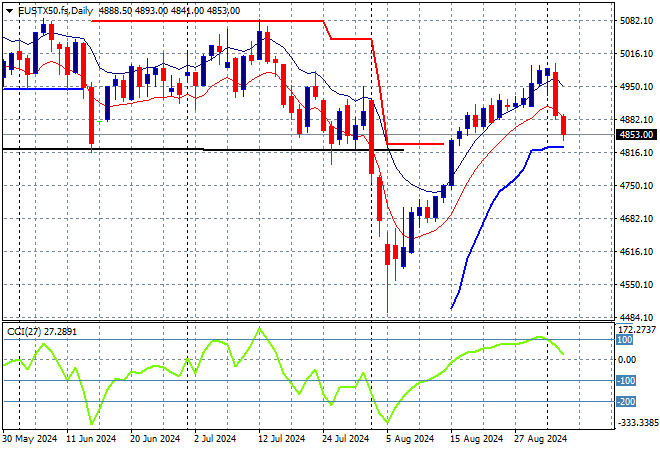

European markets remained in negative mode with losses across the continent as the Eurostoxx 50 Index closed 1.2% lower to 4848 points.

The daily chart shows price action off trend after breaching the early December 4600 point highs with daily momentum retracing well into an oversold phase. This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance just unable to breach the 5000 point barrier. Price has cleared the 4700 local resistance level as it seeks to return to the previous highs but momentum was slowing before this pullback:

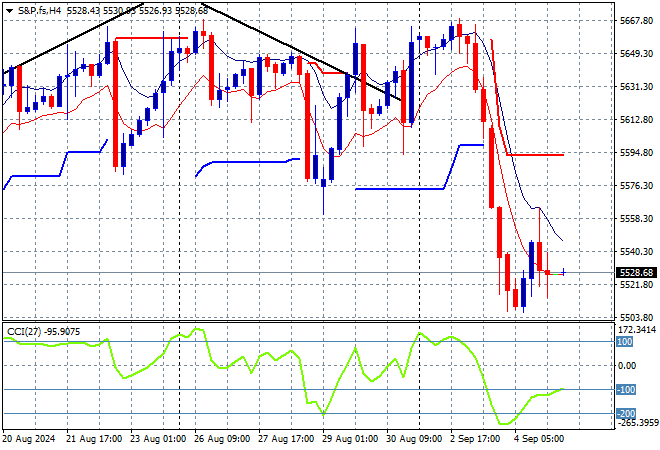

Wall Street was all over the place with the NASDAQ eventually finishing some 0.3% lower while the S&P500 managed a near scratch session to finish at 5520 points.

The four hourly chart illustrates how this bounceback had cleared the mid 5300 point level with momentum retracing fully from oversold to very positive these past two weeks. The potential for a positive breakout was building for a swift return to the early August highs as price has respected short term support, but that has now evaporated:

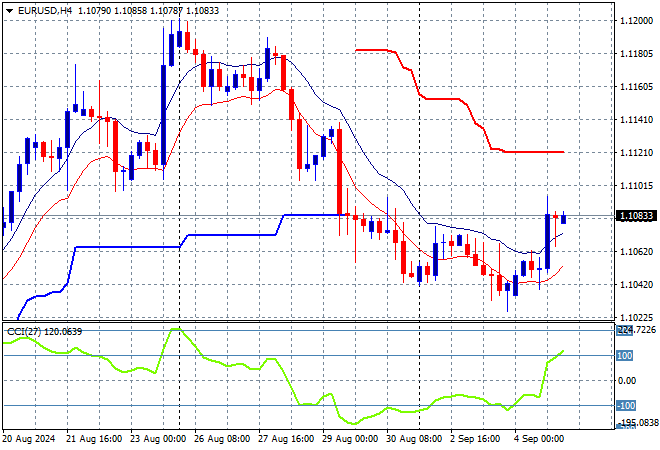

Currency markets saw a slight reversal in USD strength overnight, particularly against Yen while Euro was able to bounce bounce after deflating all week, finishing just below the 1.11 level on the back of the softer US jobs data.

The union currency was looking overbought in the short term as I mentioned before, but had also been structurally supportive so this extended dip was threatening to turn into a wider rout if it couldn’t get back above former support at the 1.11 handle. Not out of the woods yet:

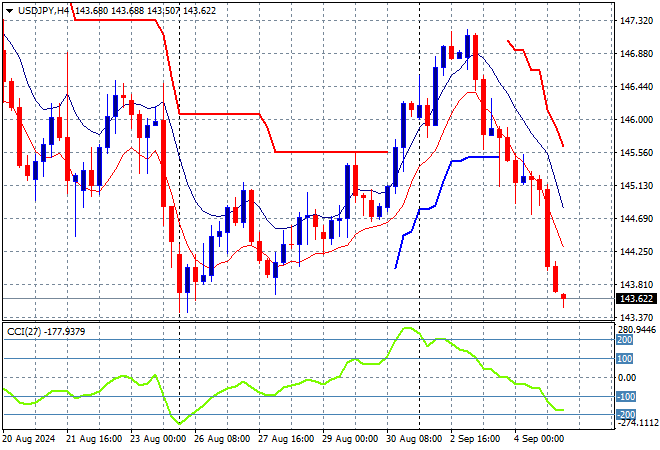

The USDJPY was doing well to get out of its downwards medium term pattern with a follow through after the weekend gap to return well above the 146 handle, but has continued to fail with further downside overnight to match the August lows just above the 143 level.

The overall volatility leading up to the recent rout spoke volumes as it pushed aside the 158 level as longer term resistance in the weeks leading up to the BOJ rate hike. Momentum was suggesting a possible bottom was brewing as the BOJ wants to get this under control with this breakout building, but this retracement is coming faster than expected:

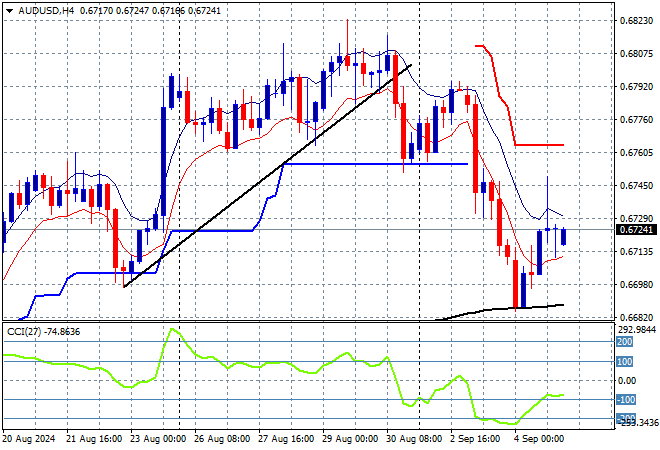

The Australian dollar had been pushing higher on the weaker USD but it finally broke its short term uptrend on Friday night, retreating below the 68 cent level but not short term support, which was defended last night to finishing just above the 67 handle.

During June the Pacific Peso hadn’t been able to take advantage of any USD weakness with momentum barely in the positive zone but that has changed in recent weeks with price action finally getting out of the mid 66 cent level that acted as a point of control. This positivity has disappeared with a full retracement of the last two weeks of weak price action, sending it back to the 67 cent level:

Oil markets are in full sell mode now as they couldn’t get out of their previously weak position with Brent crude again moving lower overnight, breaking through the $73USD per barrel level making another new monthly low in the process.

After breaking out above the $83 level last month, price action had stalled above the $90 level awaiting new breakouts as daily momentum waned and then retraced back to neutral settings. Daily ATR support had been broken with short term momentum still in negative territory, setting up for this sharp retracement – watch out below:

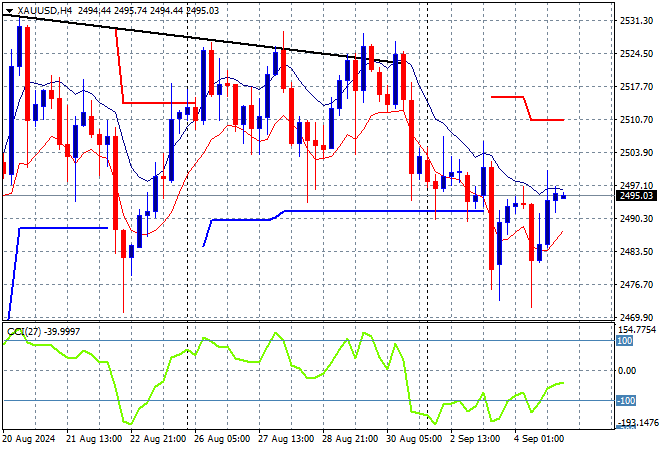

Gold has been unable to get back above the $2500USD per ounce level since the start of the week slump, with only a brief look above before finishing this morning at the $2495 level in a wide ranging session.

The longer term support at the $2300 level remains firm while short term resistance at the $2470 level was the target to get through last week as I indicated. This is still too dependent on USD weakness and I expect further falls if the $2475 level is breached: