Complete carnage on Asian share markets today, with Japanese equities having some of their worst days ever, with the Nikkei 225 off by more than 12% in a single session. Friday’s much softer than expected US jobs report has exacerbated the risk off mood that had developed post the BOJ rate hike with bond markets rallying hard in the anticipation of an upcoming US recession. Currency markets are volatile too with Yen soaring in appreciation against USD while the Australian dollar is getting hit hard as commodity markets invert with the Pacific Peso now dancing with the 63 cent level.

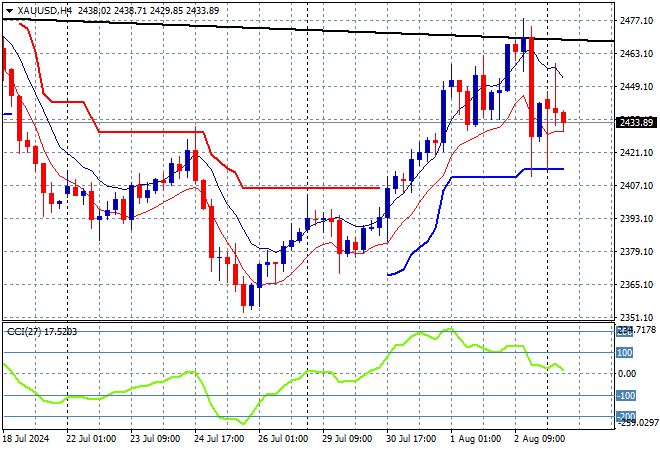

Oil prices are falling sharply amid the risk off mood and the growing Middle East conflicts with Brent crude now below the $77USD per barrel level while gold has been the steady port in a storm, currently holding well above the $2400USD per ounce level:

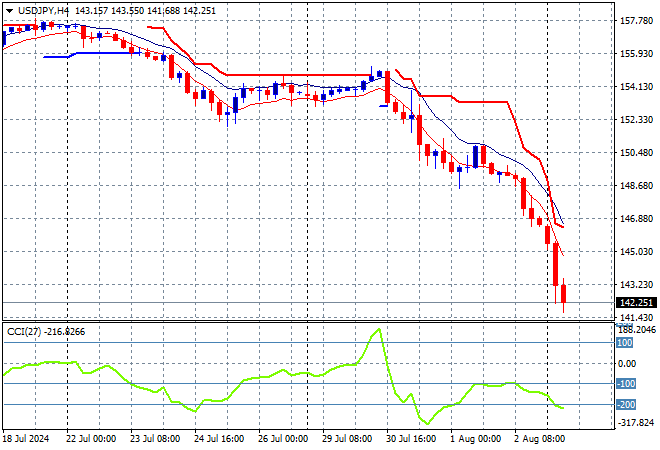

Mainland Chinese share markets are the best in the region relatively speaking with the Shanghai Composite only off by 1% or so while the Hang Seng Index is down a full 2.5% at at 16522 points. Meanwhile Japanese stock markets are seeing epic volatility with the Nikkei 225 down more than 12% to close at its November 2023 lows at 31285 points, now off by nearly 25% in a month. The USDJPY pair has dropped like an anchor too, currently bouncing off the 142 handle:

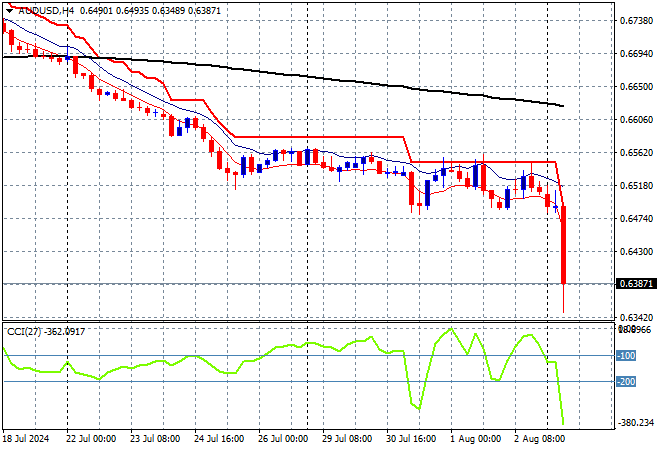

Australian stocks couldn’t escape the carnage with the ASX200 closing more than 3.5% lower to 7658 points while the Australian dollar fell straight through the 64 handle and almost touched the 63 cent level vs USD as the run to safety intensifies:

S&P and Eurostoxx futures are down 3% so far and looking extremely weak going into the London session with the S&P500 four hourly chart showing how the bottom at the 5400 point level has completely fallen out, taking the market back to May closing levels:

The economic calendar is relatively quiet following Friday’s US non farm payrolls print.