Asian share markets are generally lower across the region without a positive lead from Wall Street which was closed overnight. Risk markets have pivoted on the latest UK election landslide by the Labour Party while PBOC bond machinations are dominating Chinese markets. The USD remains weak against the majors in the wake of the election with Euro advancing above the 1.08 level while the Australian dollar is firming above the 67 cent level as well.

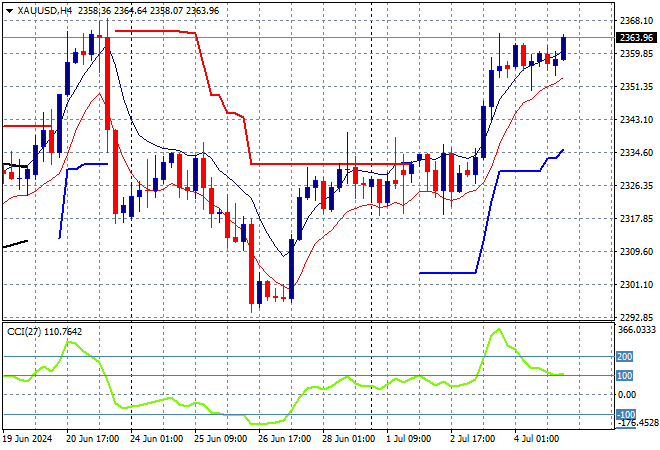

Oil prices are holding at their recent highs with Brent crude still slightly above the $87USD per barrel level while gold wants to push higher above the $2360USD per ounce level:

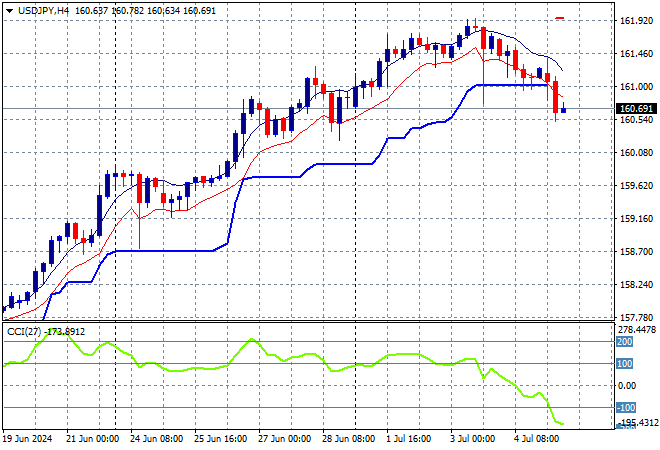

Mainland Chinese share markets are falling sharply again with the Shanghai Composite rejecting the 3000 point barrier, currently down 0.8% while the Hang Seng Index is off by more than 1% to 17828 points. Meanwhile Japanese stock markets are retracing slightly on Yen concerns with the Nikkei 225 down 0.2% or so to 40833 points as the USDJPY pair breaks below the 161 level to give up all its gains for this week:

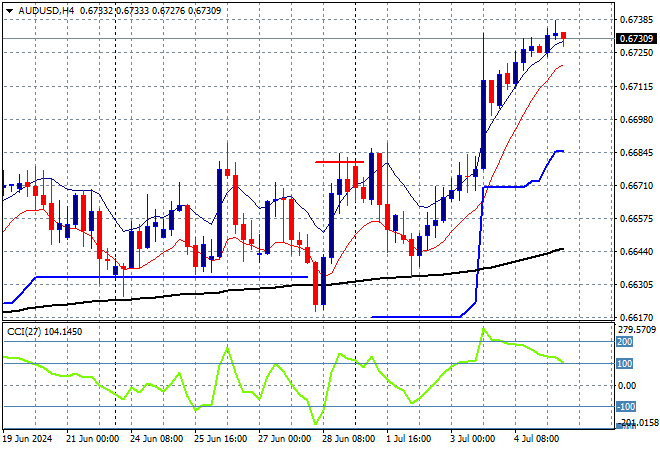

Australian stocks have slid back slightly with the ASX200 losing just over 0.2% to 7812 points while the Australian dollar is holding steady above the 67 cent level, wanting to hold on to its recent breakout:

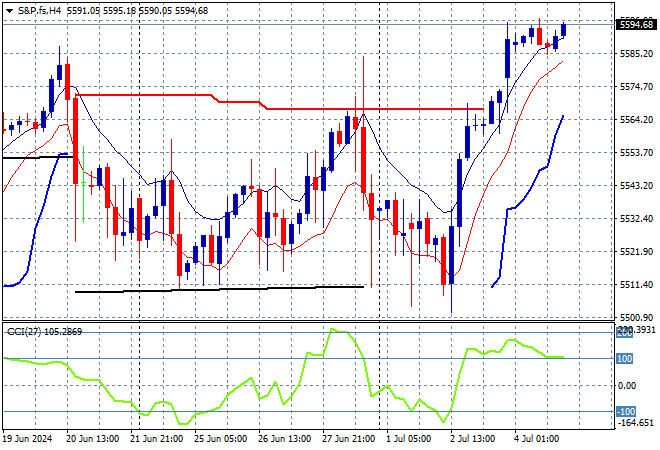

S&P and Eurostoxx futures are heading higher as we head into the London session with the S&P500 four hourly chart showing price action wanting to advance above the 5500 point level which continues to act as support:

The economic calendar finishes the trading week with the big one – US non farm payroll aka unemployment figures for June.