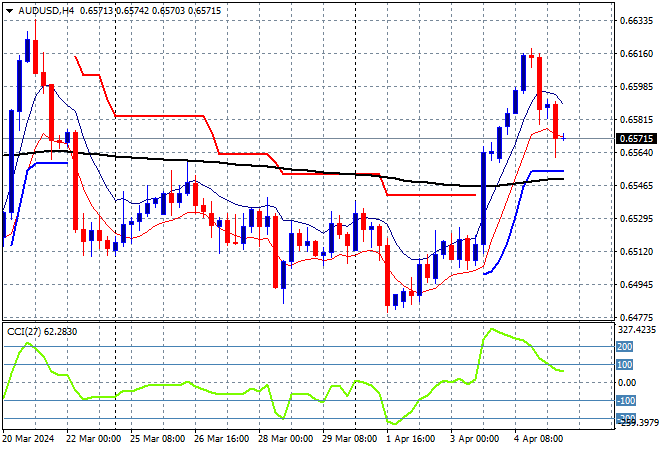

A sea of red across Asian share markets today due to the sharp reversal on Wall Street overnight as markets rebalancing their risks around the Federal Reserve rate cut agenda, which seems to keep getting pushed back. Not a good position to be in coming into tonight’s US jobs report with the USD still looking weak but other risk proxies like the Australian dollar unable to take advantage due to the poor sentiment, currently sitting above the mid 65 handle.

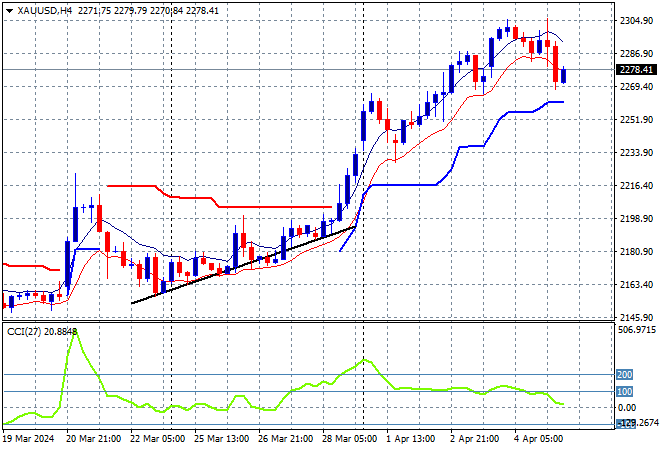

Oil prices are holding on to their gains with Brent crude still well above previous weekly resistance, currently just above the $90USD per barrel level while gold is retracing as it fails to push through the $2300USD per ounce level:

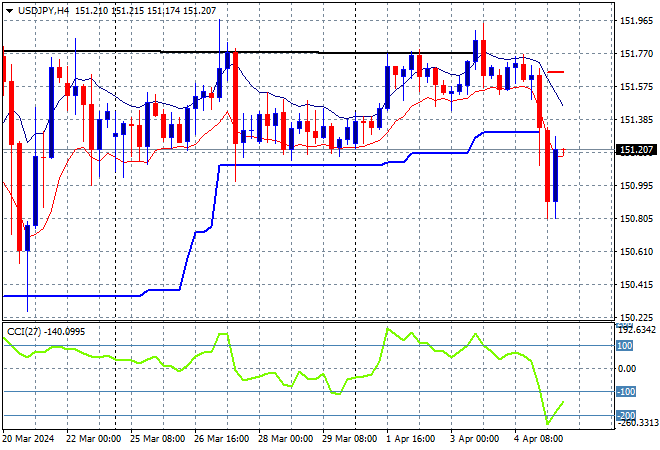

Mainland and offshore Chinese share markets reopened from their mid week holiday with the Shanghai Composite down slightly while the Hang Seng Index is off more than 0.7% for another weekly low. Japanese stock markets suffered with a big one day fall as the Nikkei 225 closed 2% lower at 38969 points while the USDJPY pair is trying to get back on track after breaking below the 151 level overnight on USD weakness:

Australian stocks fell sharply but were able to recover slightly with the ASX200 closing 0.7% lower to 7773 points while the Australian dollar is giving back almost half of its recent gains to retrace to just above the mid 65 cent level:

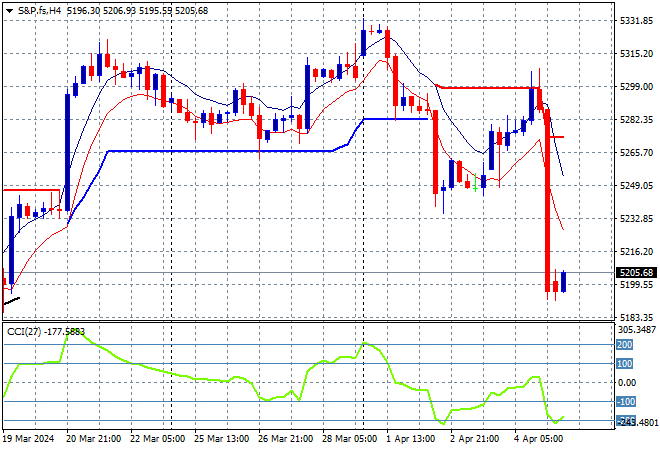

S&P and Eurostoxx futures are trying to get back on track after a very disappointing session on Wall Street overnight as we head into the London session with European shares likely to slump on the open while the S&P500 four hourly chart shows price action back down at the 5200 point level:

The economic calendar tonight will focus exclusively on the latest US unemployment print that sets direction for the following trading month.