Asian share markets are somewhat positive in the wake of the tech lead rally on Wall Street from Friday night following the latest US non farm payroll print, but also had to absorb the weekend attacks throughout the Middle East. The USD is still strong following the upside surprise in the jobs print with the Australian dollar still struggling above the 65 cent level.

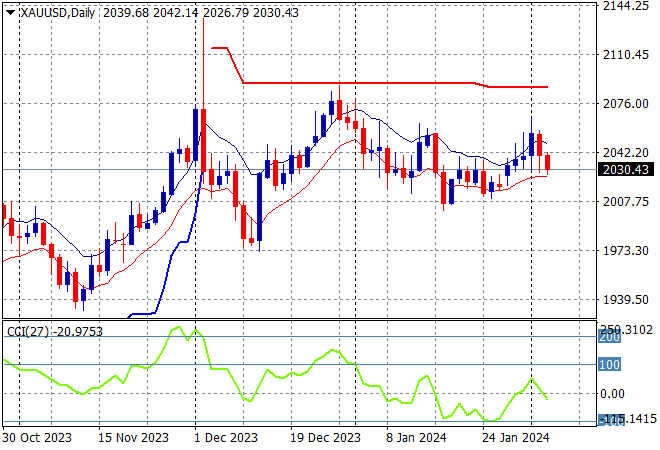

Oil prices remain volatile in the wake of Middle East tensions with Brent crude barely holding above the $77USD per barrel level while gold is just holding on as the best undollar of the bunch, retracing to the $2030USD per ounce level:

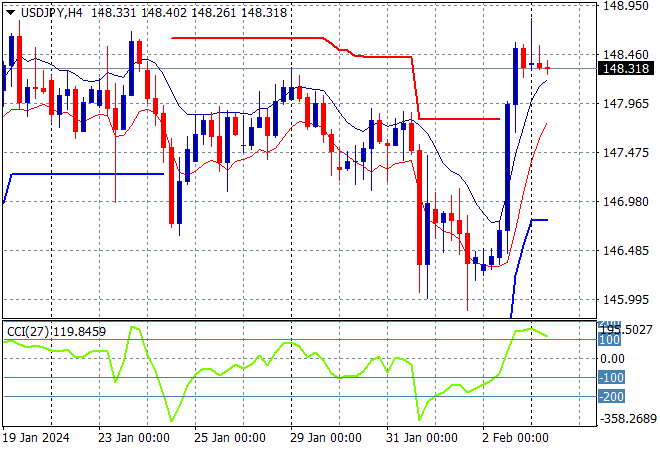

Mainland Chinese share markets are falling again in afternoon trade as the Shanghai Composite moves nearly 1% lower to 2702 points while in Hong Kong the Hang Seng Index is up just 0.1% to 15556 points. Japanese stock markets performed much better, with the Nikkei 225 closing 0.5% higher at 36354 points while the USDJPY pair has managed to hold on to its big reversal from Friday night, currently just above the 148 level:

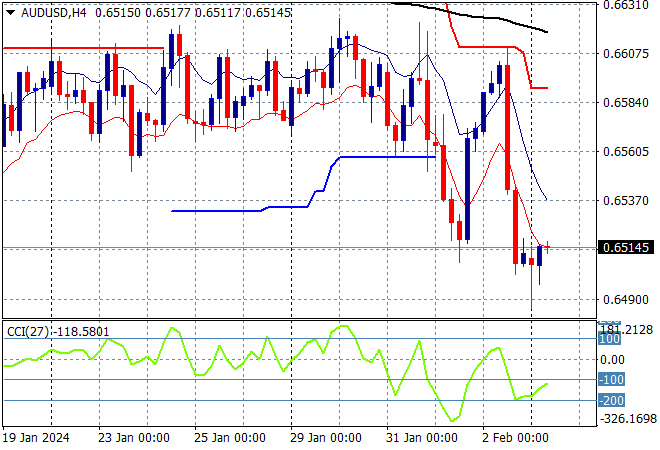

Australian stocks have retraced heavily despite the rise on Wall Street as the ASX200 closed nearly 1% lower at 7625 points while the Australian dollar also failed to get off the floor, barely covering the 65 cent level as it struggles to find short term support:

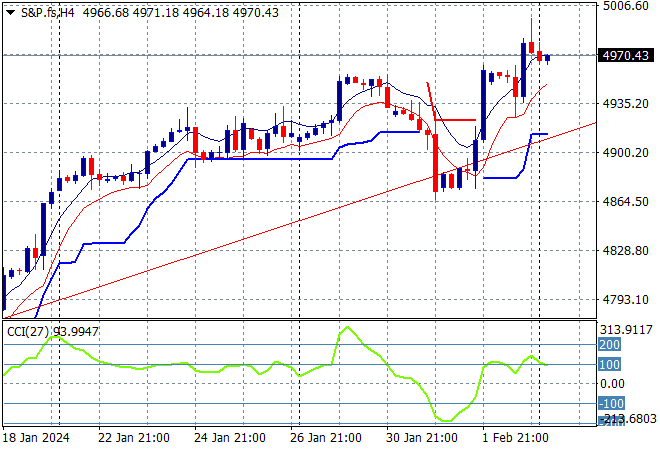

S&P and Eurostoxx futures are holding on to their Friday gains going into the London session with the latter looking to play catchup as the S&P500 four hourly chart shows price action remaining well on trend as it reaches for the 5000 point level:

The economic calendar starts the new trading week relatively slow as usual following the US jobs report on Friday.