Asian stocks are having a minor pause after the not quite so convincing rally on Wall Street overnight in the wake of the ISM manufacturing print which saw the USD sharply down. The Australian dollar has slipped as economic markers before tomorrow’s GDP print see confidence disappear.

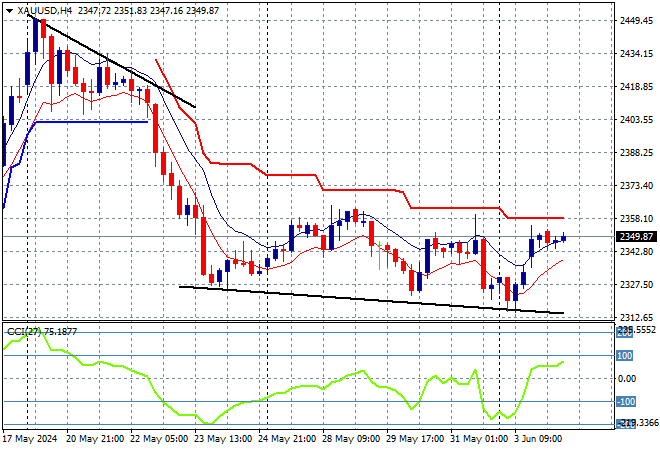

Oil prices are slipping again as Brent crude falls below the $78USD per barrel level while gold is trying to steady itself as it sits at the $2350USD per ounce level this afternoon:

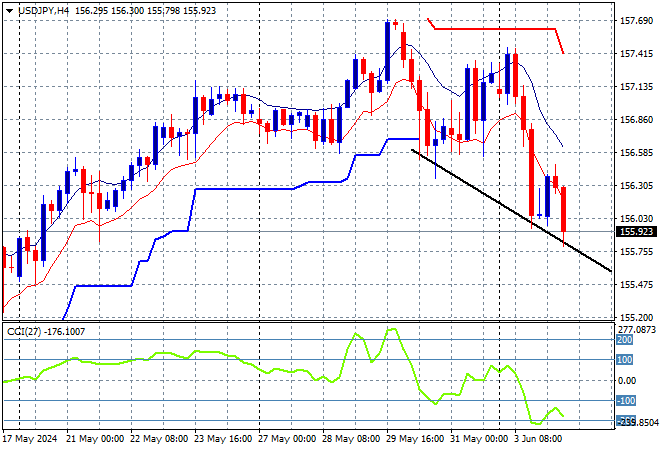

Mainland Chinese share markets are holding on to their positive gains going into the close with the Shanghai Composite up 0.3% while the Hang Seng Index is doing slightly better, 0.4% higher at 18493 points. Meanwhile Japanese stock markets are pausing their rebound due to the higher Yen with the Nikkei 225 down 0.2% to 38837 points as the USDJPY pair continues its overnight falls below the 156 level:

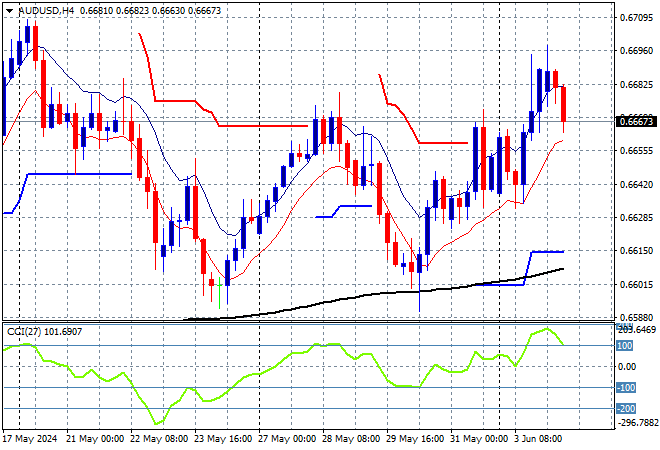

Australian stocks were the worst in the region with the ASX200 down over 0.3% to 7737 points while the Australian dollar has flopped after almost breaking through the 67 cent level with momentum from Friday’s session starting to drop off:

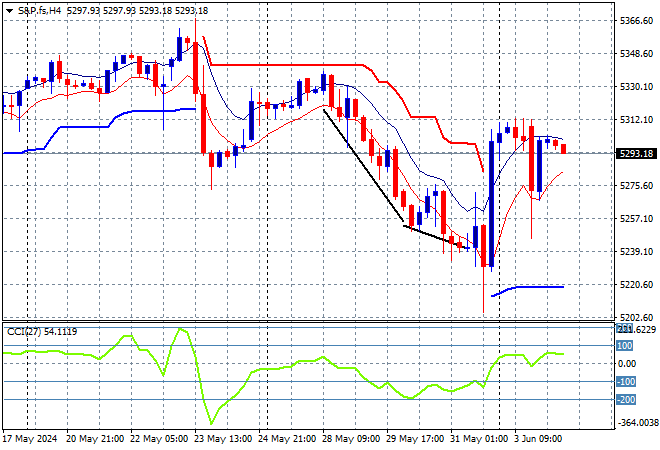

S&P and Eurostoxx futures are both down marginally as we head into the London session with the S&P500 four hourly chart showing price action now retracing back below the 5300 point level after a near breakout on Friday night as short term momentum starts to rollover:

The economic calendar includes German unemployment then US factory orders.