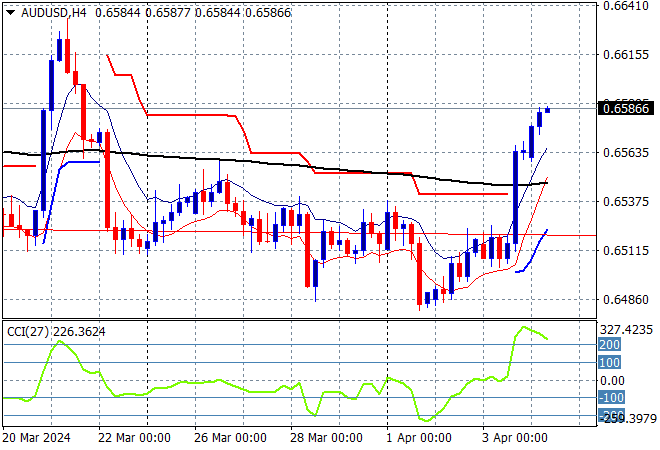

Asian share markets are bouncing back despite closed Chinese markets and relatively low rebound overnight on Wall Street. The shakeout from Fed Chair Powell’s speech and the falling of USD is helping buoy risk spirits but this maybe temporary as bond markets have not yet fully reacted. The Australian dollar has benefited from the reversal in USD as it pushes through the mid 65 handle.

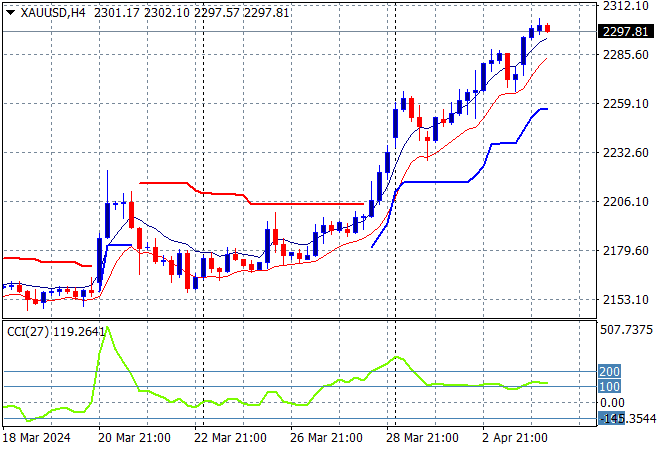

Oil prices are holding on to their gains with Brent crude still well above previous weekly resistance, about to exceed the $90USD per barrel level while gold continues to regain strength as it tries to push through the $2300USD per ounce level:

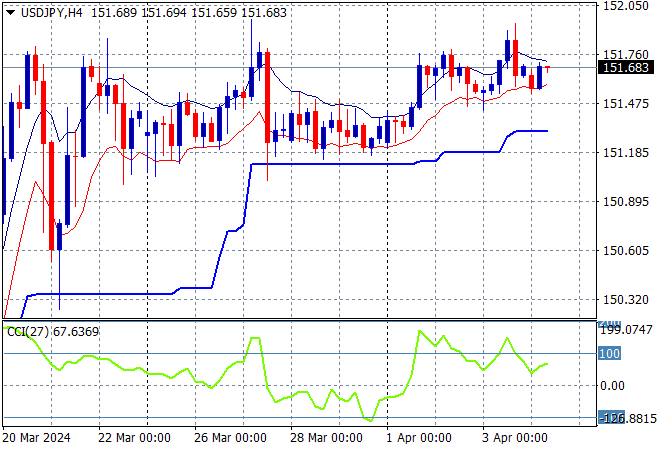

Mainland and offshore Chinese share markets were closed for a holiday today while Japanese stock markets put in a very strong rebound, with the Nikkei 225 closing nearly 1.4% higher at 39965 points. Meanwhile the USDJPY pair is fairly steady at just above the 151 mid level, nearly matching the previous weekly highs:

Australian stocks were able to rebound with the ASX200 closing over 0.4% higher to 7817 points while the Australian dollar is just holding on above the 65 cent level after last night’s upside volatility:

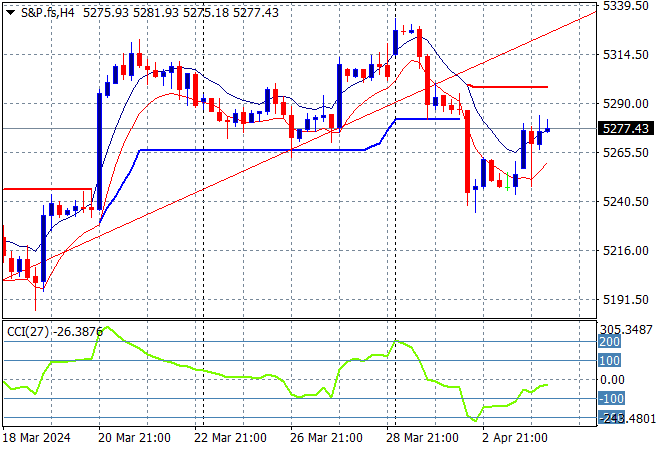

S&P and Eurostoxx futures are trying to get back on track after a slightly disappointing session overnight as we head into the London session with the S&P500 four hourly chart showing price action stuck above the 5200 point level:

The economic calendar tonight includes the latest ECB meeting minutes, US weekly initial jobless claims and a few more Fed official speeches.