Street Calls of the Week

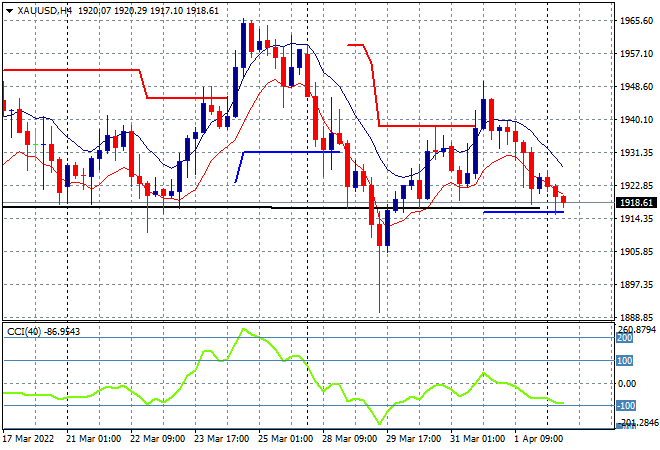

Asian stock markets remain mixed in terms of sentiment and the impact of the USD on domestic currencies, following the latest US unemployment print on Friday night. Oil prices are still pulling back after the US strategic reserve release last week with WTI crude below $100 while Brent crude is drifting down to the $104USD per barrel level. Meanwhile gold has deflated again, almost meeting its previous weekly low prior to that sharp breakdown/bounceback at the $1918USD per ounce level:

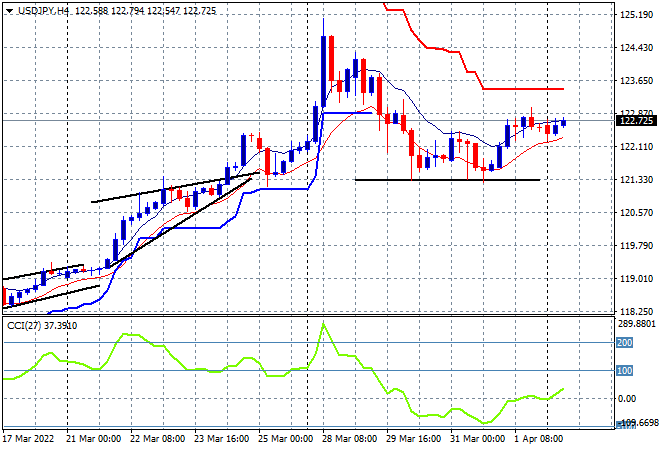

Mainland Chinese share markets are closed for a holiday while the Hang Seng Index has lifted strongly, up 1.8% to 22447 points. Japanese stock markets have moved from retreat to standby mode with the Nikkei 225 putting in a scratch session at 27681 points while the USDJPY pair is maintaining its Friday night close position at just below the 123 handle:

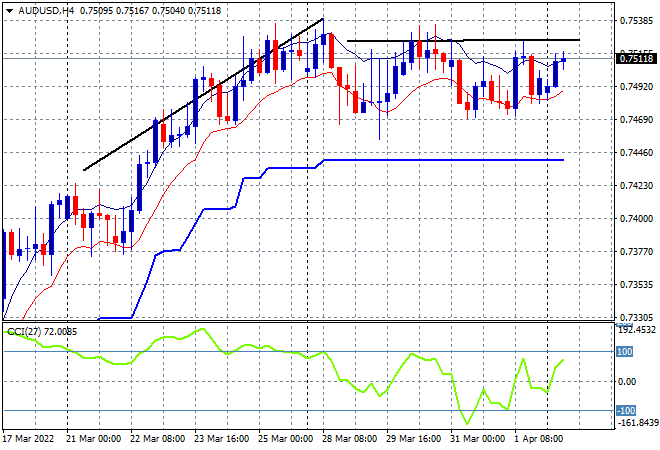

Australian stocks did well, following the modest Wall Street lead on Friday night with the ASX200 closing 0.4% higher to push above the 7500 point level, closing at 7522 points. Meanwhile the Australian dollar has continued its sideways drift but has had a small move back above the 75 level, coming up against clear resistance overhead

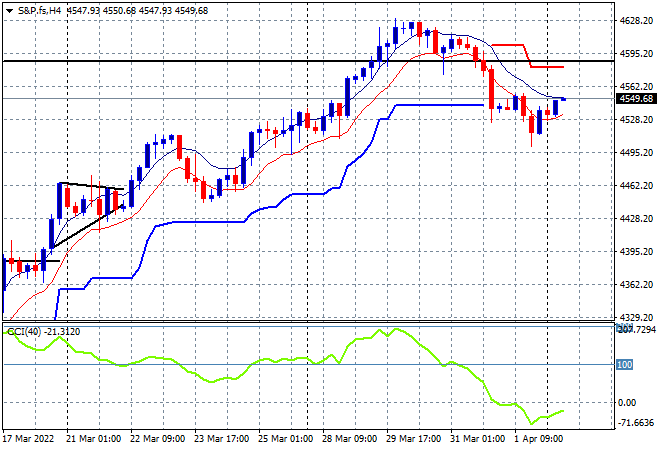

Eurostoxx and Wall Street futures are drifting sideways as we head into the London session, with risk unsure of direction following Friday night’s US unemployment print. The S&P500 four hourly chart shows price still anchored at the trailing ATR support level as resistance overhead at 4600 points is rejected in full:

The economic calendar has its usual quiet spell following the US unemployment print with only a few Bank of England speeches and some tertiary factor orders in the US to look out for.