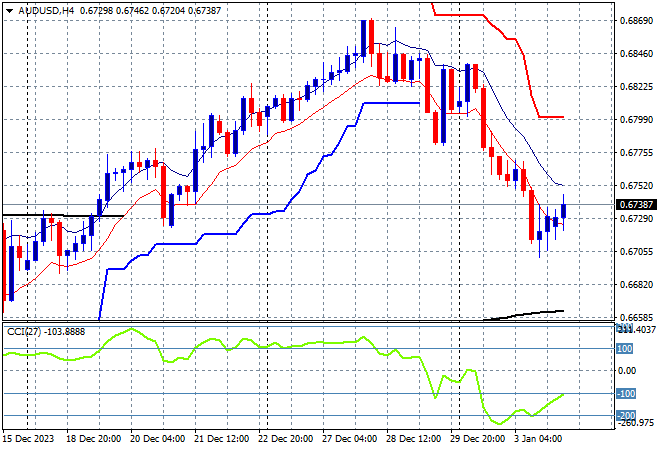

Asian share markets are still behaving in mixed fashion after a poor lead from Wall Street overnight as the new trading year continues to bring some dread most markets, with Japanese bourses finally opening. The Australian dollar is trying to hold back a resurgent USD to get above the 67 cent level.

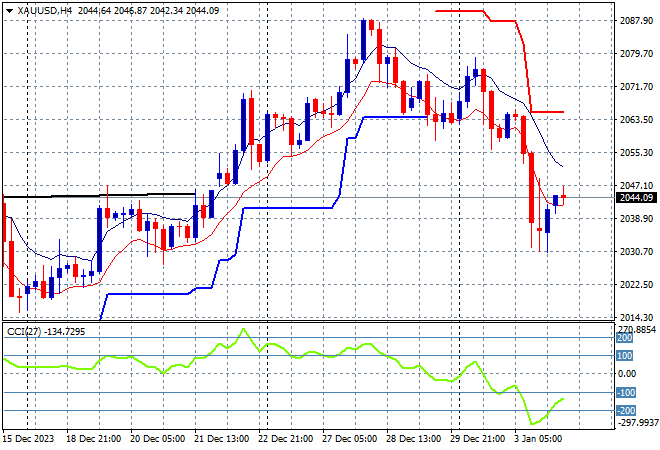

Oil prices are inching higher on Red Sea tensions as Brent crude lifts above the $76USD per barrel level while gold is trying to bounceback from its overnight plunge, lifting just above the $2040USD per ounce level:

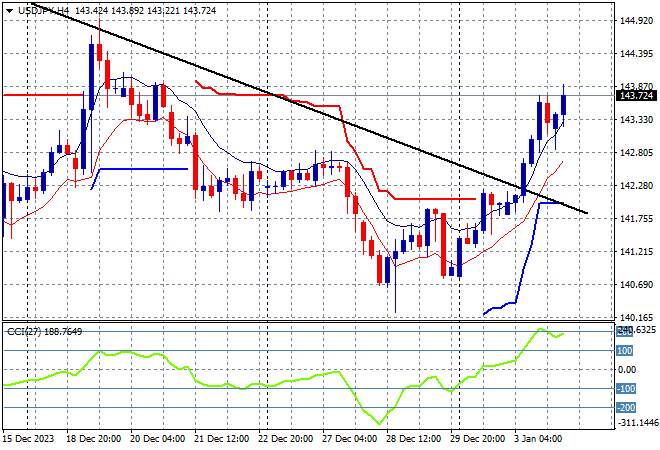

Mainland Chinese share markets are failing to bounceback as the Shanghai Composite remains well below the 3000 point barrier, closing 0.4% lower at 2955 points while in Hong Kong the Hang Seng Index is down 0.2%, closing at 16608 points. Japanese stock markets finally reopened with the Nikkei 225 losing just 0.5% as it played catchup, offset by a declining Yen as the USDJPY pair pushes further above the 143 level:

Australian stocks were able to put in modest losses with the ASX200 closing nearly 0.4% lower to retrace below the 7500 point level, closing at 7494 points while the Australian dollar rebounded to get back above the 67 cent level after its New Year slump:

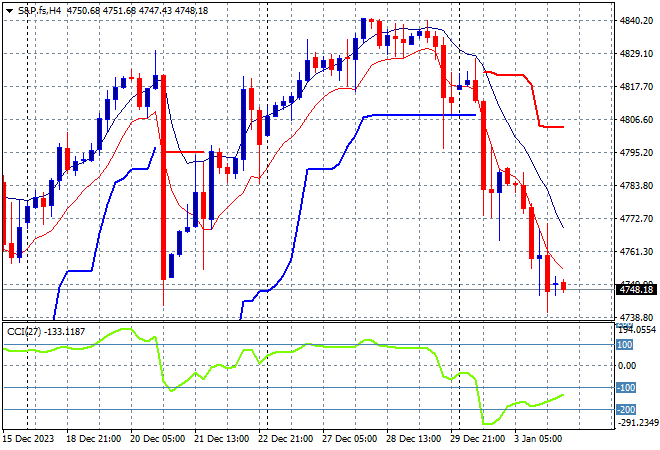

S&P and Eurostoxx futures are pulling back further from their start of year lows going into the London open with the S&P500 four hourly chart showing a continued breakdown below the 4800 point level with short term momentum quite oversold:

The economic calendar will focus mainly on German inflation tonight plus the latest US weekly initial jobless claims.