The return of risk continues as bond yields and USD continue to fall and equities rose across both sides of the Atlantic. Wall Street rallied nearly 2% across the board with European markets following suit which should again lead to strong gains here in Asia on the open to finish the trading week on an upbeat note.

US bond markets saw a major pullback of 10 year Treasuries which fell to the 4.6% level while oil prices paused their recent selloff, with Brent crude lifting back above the $86USD per barrel level. Despite a falling USD, gold remained steady as it continues its pause just below the $2000USD per ounce level.

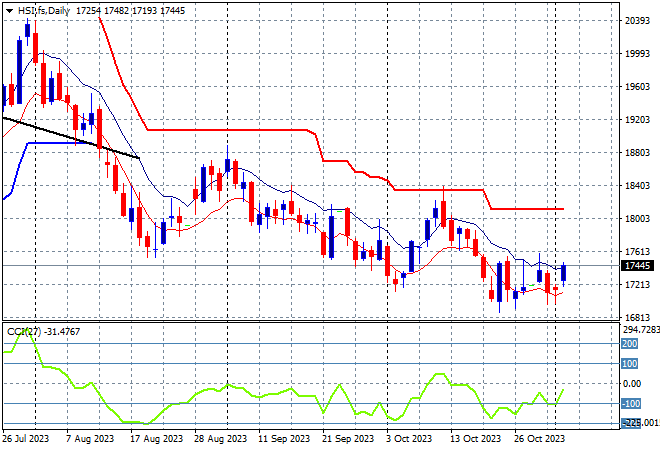

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets lifted higher initially but the Shanghai Composite has closed in the red, down 0.4% at 3009 points while in Hong Kong the Hang Seng Index has bounced back after its previous scratch session to close 0.7% higher at 17230 points.

The daily chart is still showing a significant downtrend that has gone below the May/June lows with the 19000 point support level a distant memory as medium term price action stays well below the dominant downtrend (sloping higher black line) following the previous month long consolidation. Daily momentum readings are trying to get out of oversold mode and price is now well below recent support levels, so watch out below:

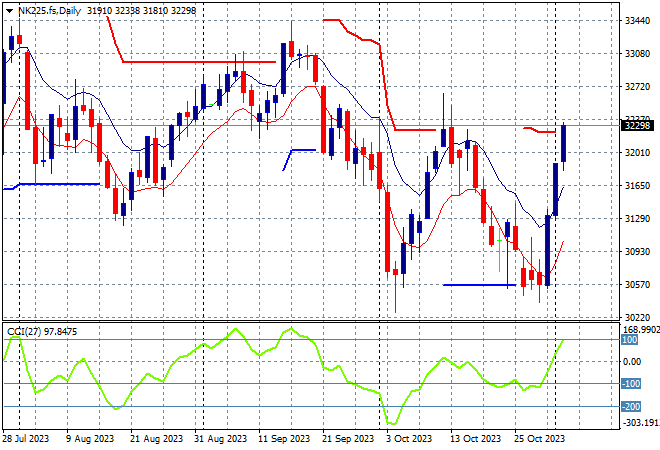

Japanese stock markets continued their run higher with the Nikkei 225 closing more than 1.1% higher at 31949 points.

Trailing ATR daily resistance was coming under threat in a very fast bounceback and while daily momentum retraced back from oversold settings as price action is following Chinese markets with a typical dead cat bounce pattern forming here. Futures are indicating another solid move higher again, reducing the chance of a return to the previous monthly low at 30000 points proper:

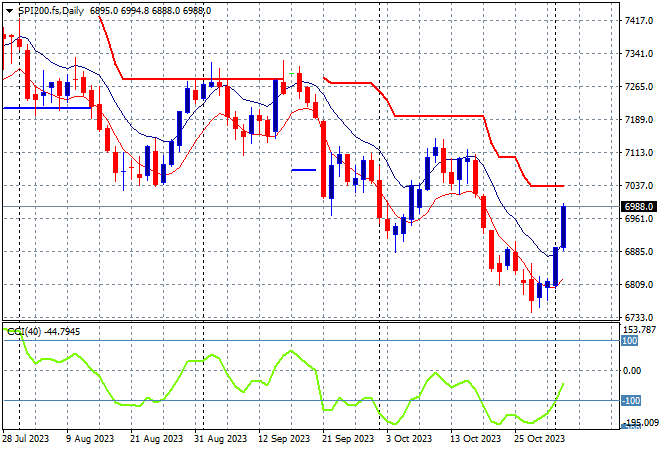

Australian stocks were one of the best performers with the ASX200 up nearly 1% at 6899 points, yet still well below former support at 7000 points.

With yet more relief across the risk complex, SPI futures are up nearly 1.2% so we should see the 6800 point support level firm on the open this morning with the 7000 point level still remaining as strong short and medium term resistance. The daily chart is not looking optimistic here with medium term price action continuing to move sideways at best, down the hill at worst:

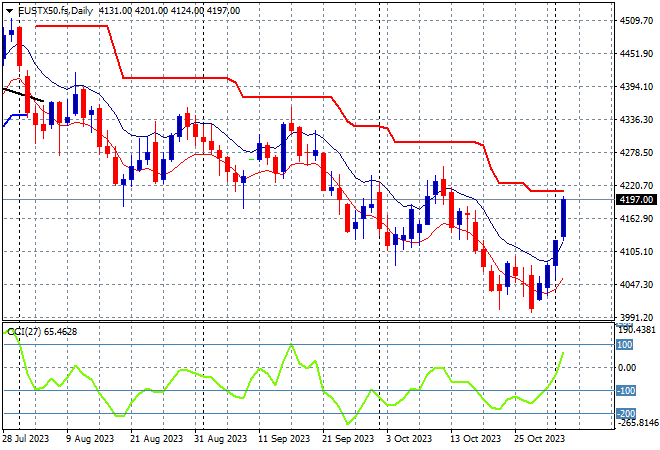

European markets continued their own bounceback with a big move across the continent, with the Eurostoxx 50 Index gaining nearly 2% to finish at 4169 points.

The daily chart shows an overall decline with weekly support at 4100 points no longer defended, as weekly resistance firms at the 4300 point resistance level. There were signs the previous little bounce was running out of steam as daily momentum remained neutral at best, with a rebound out of oversold settings now encroaching on trailing ATR resistance above:

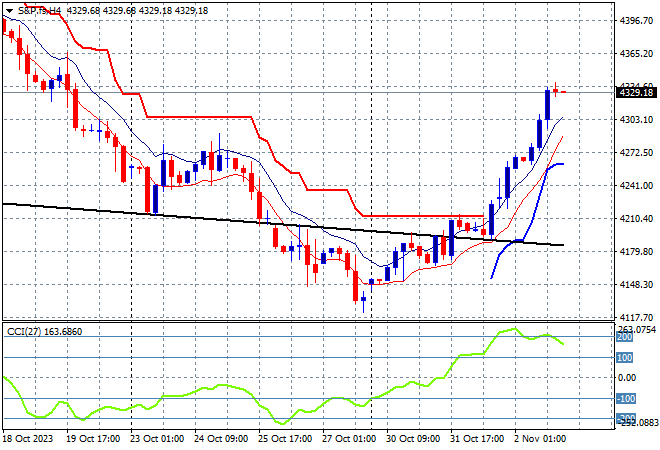

Wall Street is the market calling the shots with more positive momentum lifts across all three bourses as the NASDAQ gained 1.8% while the S&P500 lifted 1.9% to finish at 4317 points.

Short term momentum is now well overextended after this sharp short covering mid week rally as price action bounced strongly off the recent low at the 4100 point level. There is the potential for an end of week retracement here down to the 4300 point level:

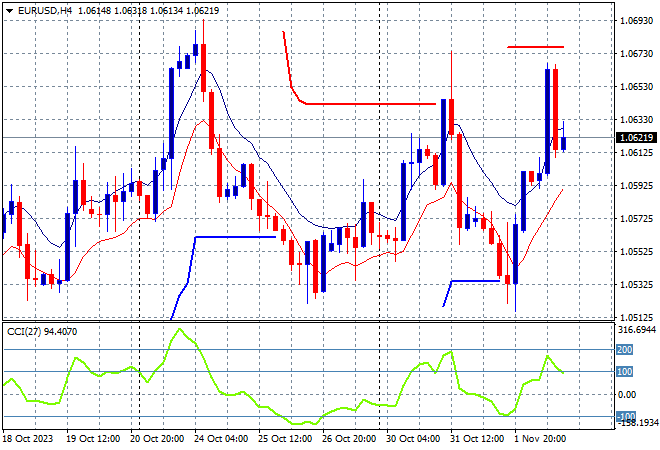

Currency markets remain highly volatile with more turbulence overnight following the recent Fed meeting and last night’s BOE meeting with another hold on interest rates. The USD is still getting pushed lower against most of the major currency pairs with Euro lifting again through the 1.06 handle.

Support at the recent weekly lows around the 1.05 level was tested before the Fed meeting with only a small bounce thereafter with price action again falling short of last week’s high so a further pullback is likely:

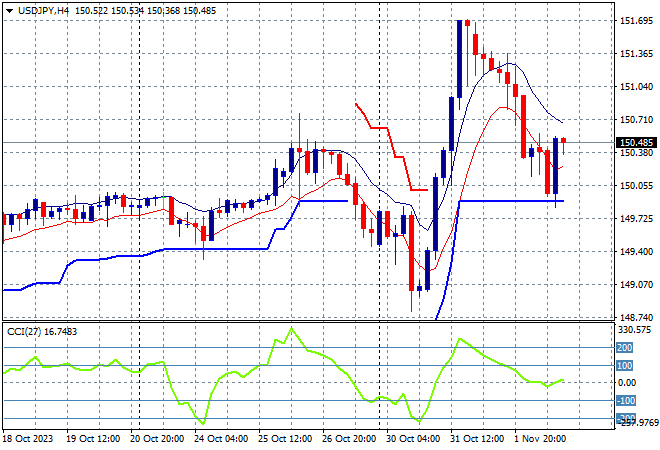

The USDJPY pair was able to hold somewhat steady after its minor selloff from racing up way too fast in the previous session and is no longer looking over-stretched here.

Four hourly momentum has retraced from extreme overbought settings so watch for a potential consolidation before another jump above the high moving average band:

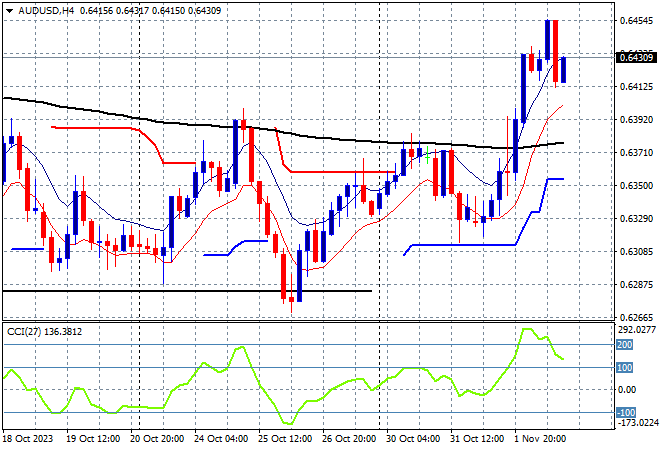

The Australian dollar is still doing better than expected with calculations around the RBA’s move next week remaining in focus after the Fed hold with a return to the 64 cent level that finally surpassed last week’s high.

The Pacific Peso remains under medium and long term pressure with price action now starting to firm better on the short term charts with a potential Kardashian big bottom forming here as traders await next week’s RBA meeting:

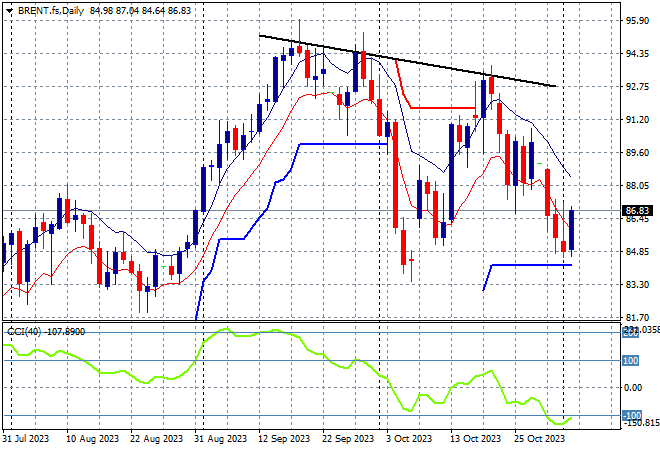

Oil markets remain volatile in the wake of growing conflict in the Middle East with a small bounce off the recent lows, with Brent crude lifting back above the $86USD per barrel level.

After almost reaching $100 in mid September, price was looking to return to the August levels around the $85 area where a point of control had been established before the recent breakout. Daily momentum is still at negative settings with a retest of support at the August level likely again:

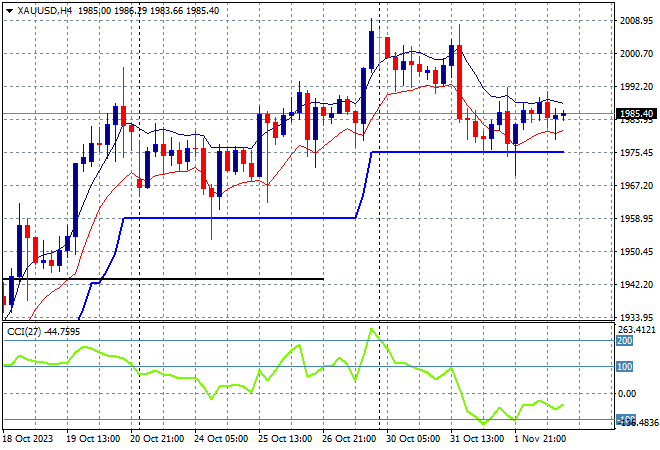

Despite the reversal in USD, gold remains the best undollar by holding on to its strong position after finally breaking through the $2000USD per ounce level, but it remains in a holding pattern around the $1980 area for now.

The daily chart showed quite a steep uptrend since the previous weekend gap higher as momentum remained very positive in the short term, trying to get back up to the $2000 level. This new breakout puts in a new monthly high with daily momentum again looking overbought and ripe for a pullback back to retest the $1900 level, but the bugs are fully in charge here for another attempt at the all time record high. Watch ATR support on the four hourly chart though: