Asian stock markets are trying to calm down after the mid week rout following the Fitch US ratings downgrade but there’s still a bit of selling to be had as local stocks dived on a poor retail sales print. The USD remains firm going into tomorrow’s NFP and tonight’s BOE meeting while the Australian dollar is now dicing with the 65 cent level.

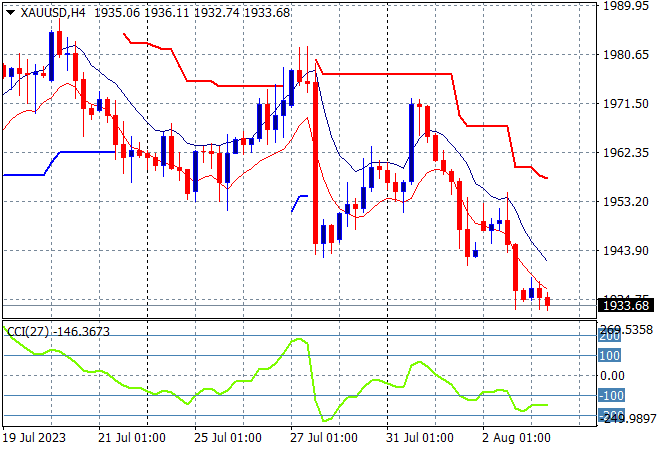

Oil prices are holding on to their recent gains despite a small setback overnight as Brent crude hovers above the $82USD per barrel level while gold is failing to clawback its recent losses, still diving down as it hits the $1930USD per ounce level and looking very weak here:

Mainland Chinese share markets are having the only really positive sessions with the Shanghai Composite about to close 0.6% higher at 3280 points while in Hong Kong the Hang Seng Index is bouncing back, up 0.4% to 19600 points even.

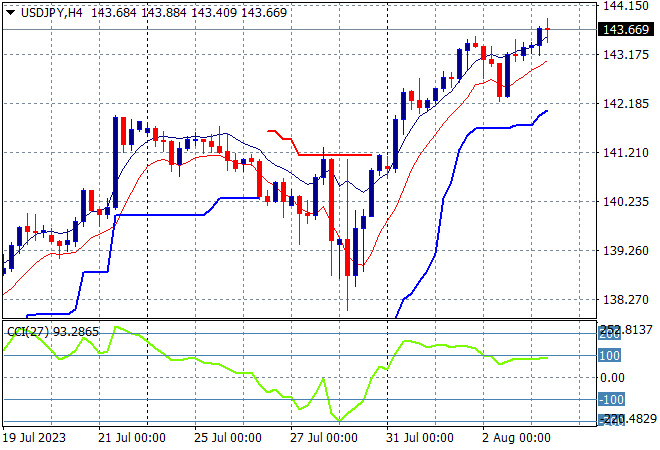

Japanese stock markets remain spooked with the Nikkei 225 closing nearly 1.6% lower at 32159 points while the USDJPY pair has pushed forward again to advance above its previous weekly high above the 143 handle:

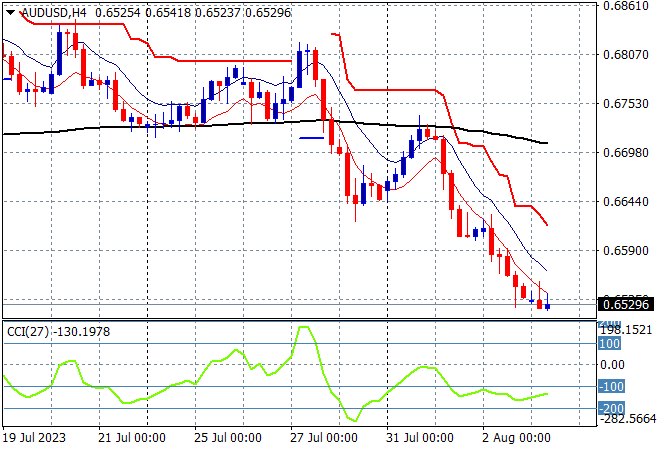

Australian stocks sold off as well with the ASX200 closing 0.6% lower at 7311 points. The Australian dollar remained in full retreat mode to clear well below the Friday night lows to just above the 65 cent level, confirming the current downtrend:

Eurostoxx and S&P futures are somewhat flat although the S&P500 four hourly chart does show a potential push through the key 4500 point level is looming. The inability to get back above the 4600 point level before the NFP print on Friday could see a sharp rollover:

The economic calendar continues with the Bank of England interest rate meeting and US initial jobless claims.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI