Asian share markets are generally buoyant across the region as they follow Wall Street’s positive lead from overnight as local stocks try to play catchup after recently falling behind. With a few central bank speakers tonight alongside continued speculation about President Biden’s future, it will be a volatile session on bond and currency markets with the Australian dollar holding firm above the mid 66 cent level as the latest retail sales figures came in hotter than expected.

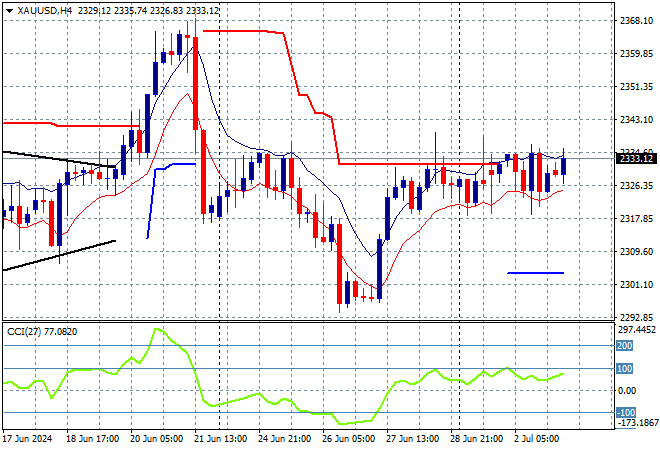

Oil prices are holding at their recent highs with Brent crude still above the $86USD per barrel level while gold wants to push higher but is struggling at the $2330USD per ounce level:

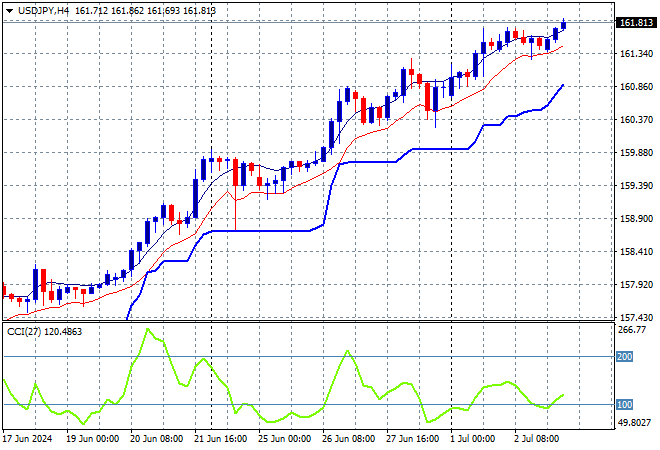

Mainland Chinese share markets are failing to make a strong with the Shanghai Composite unable to break above the 3000 point barrier, currently down 0.5% while the Hang Seng Index has pushed nearly 0.9% higher at 17925 points. Meanwhile Japanese stock markets are soaring higher with the Nikkei 225 up more than 1.3% to 40597 points as the USDJPY pair nearly breaks above the 162 level in what seems like a straight line:

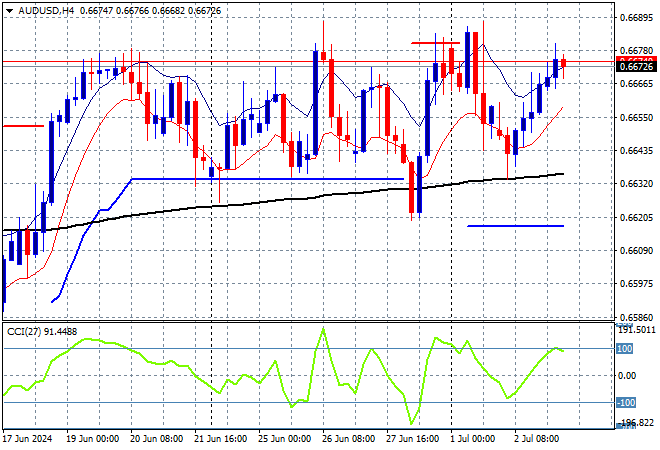

Australian stocks were again the worst performers with the ASX200 gaining just 0.2% to 7736 points while the Australian dollar is pushing back above the mid 66 cent level, wanting to breakout here but still needing that final push:

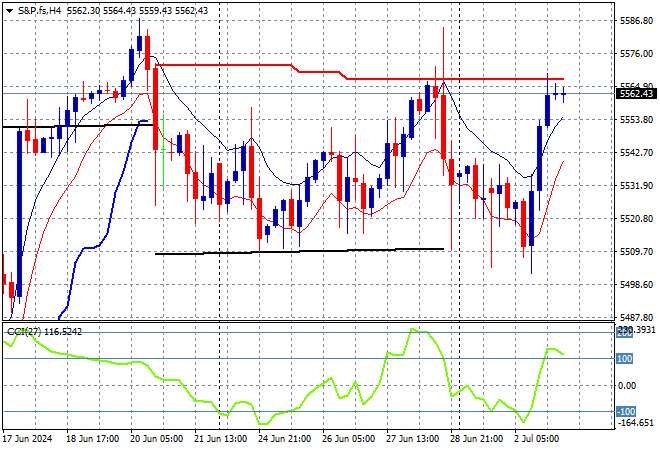

S&P and Eurostoxx futures are somewhat flat as we head into the London session with the S&P500 four hourly chart showing price action wanting to advance above the 5500 point level which continues to act as support:

The economic calendar includes US initial jobless claims and then the US services ISM survey.