Street Calls of the Week

Green across the board as Asian stock markets take the strong Friday night lead from Wall Street to start a new trading week afresh, despite the 4th of July holiday likely to disrupt the late week momentum. Currency markets are still feeling the weight of a stronger USD with a late surge this afternoon as Euro retraces below the 1.09 level while the Aussie dollar is struggling to maintain a hold above the 66 cent level as traders weigh up tomorrow’s RBA meeting.

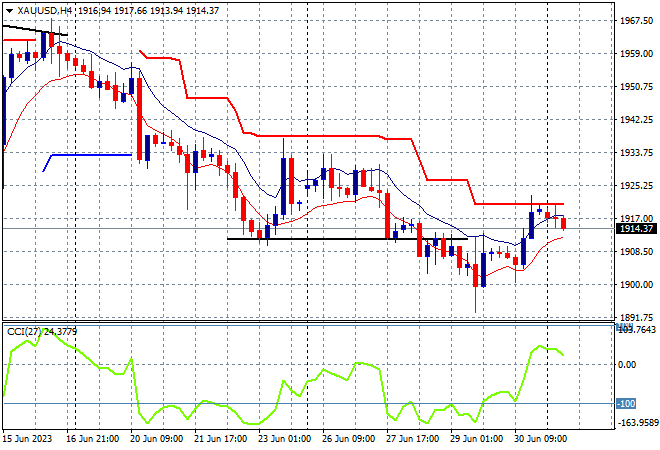

Oil prices are inching higher on potential supply problems with Brent crude just above the $75USD per barrel level while gold is looking depressed again, still struggling despite the Friday night surge seeing it bounce off a series of low sessions to remain just above the $1900USD per ounce level:

Mainland Chinese share markets are seeing a solid start with the Shanghai Composite currently up more than 1.2% to 3242 points while the Hang Seng Index is going even further, up more than 1.8% at 19267 points.

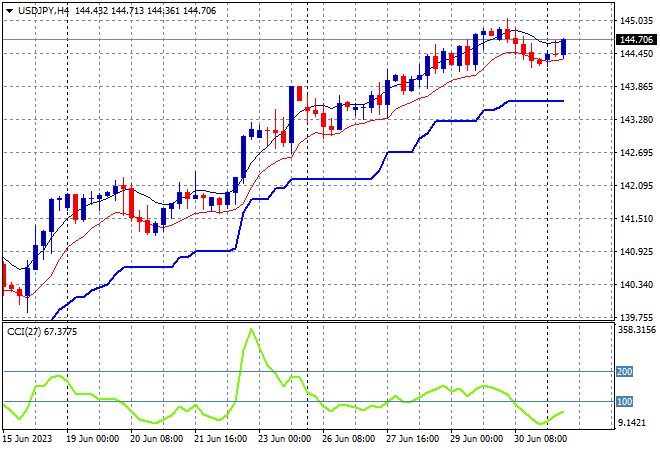

Japanese stock markets are not missing out in the fun with the Nikkei 225 closing 1.7% higher at 33753 points with the USDJPY pair having retreating slightly on Friday but now finding more strength to push above the 144 level:

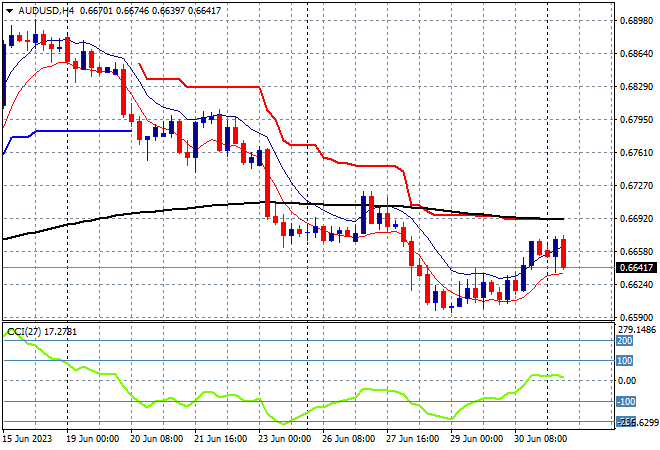

Australian stocks are the laggards with the ASX200 closing just 0.6% higher at 7246 points. The Australian dollar is pulling back after gapping higher as traders await the RBA, now below the mid 66 level, with short term momentum barely registering positive readings:

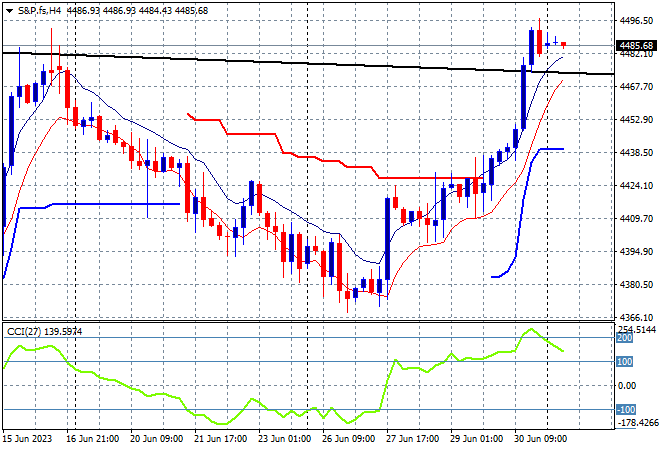

Eurostoxx and S&P futures are drifting slightly higher as we head into the London open with the S&P500 four hourly chart holding well above previous ATR resistance at the 4400 point level, trying to hold on to that new weekly high amid holiday concerns:

The economic calendar starts the week quietly given the forthcoming July 4th US holiday with some final PMI prints, but look out for the latest US ISM manufacturing survey.