Asian stocks are starting the new trading week well into the green zone as the strong finish on Wall Street from Friday night is aligning most risk markets, with the USD stabilising. Meanwhile the Australian dollar has slipped a little after the weekend gap to be just above the 66 cent level.

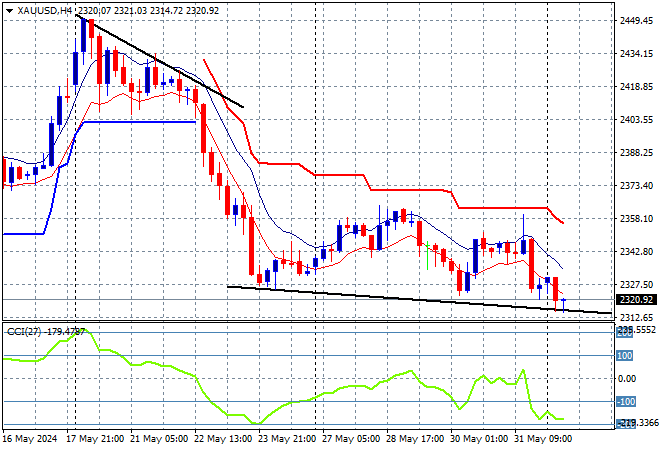

Oil prices are slipping again as Brent crude opens at the $81USD per barrel level while gold is failing to steady itself as it gaps down to the $2320USD per ounce level this afternoon:

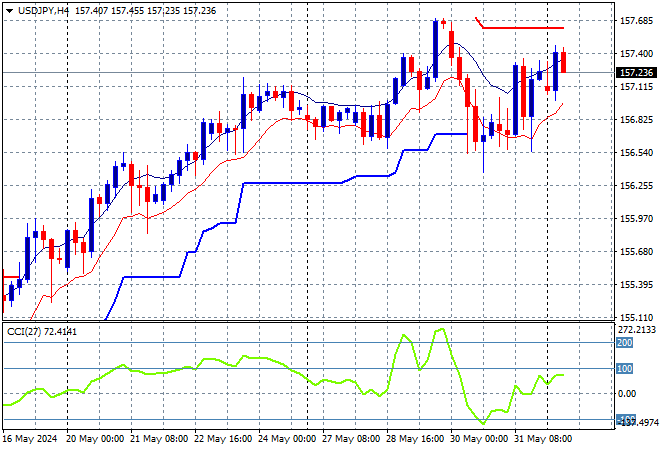

Mainland Chinese share markets were unable to make any positive gains with the Shanghai Composite down 0.3% while the Hang Seng Index is having a much better start, closing 2% higher at 18441 points. Meanwhile Japanese stock markets are continuing their rebound with the Nikkei 225 up more than 1.1% to 38923 points as the USDJPY pair gaps slightly higher above the 157 level:

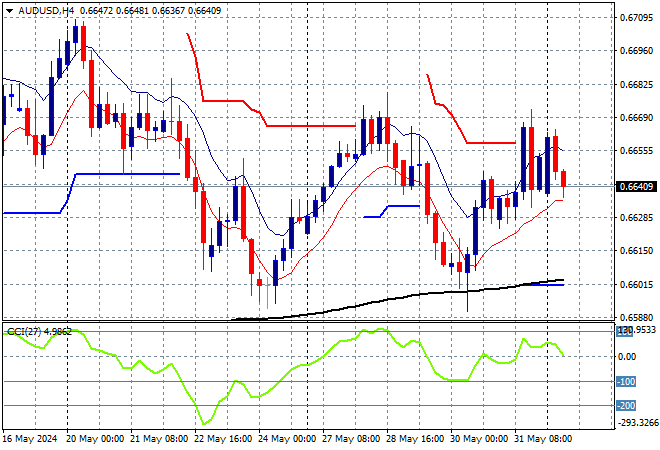

Australian stocks had a solid session to start the week with the ASX200 up nearly 0.7% to 7761 points while the Australian dollar has held on just below the mid 66 cent level with momentum from Friday’s session starting to drop off:

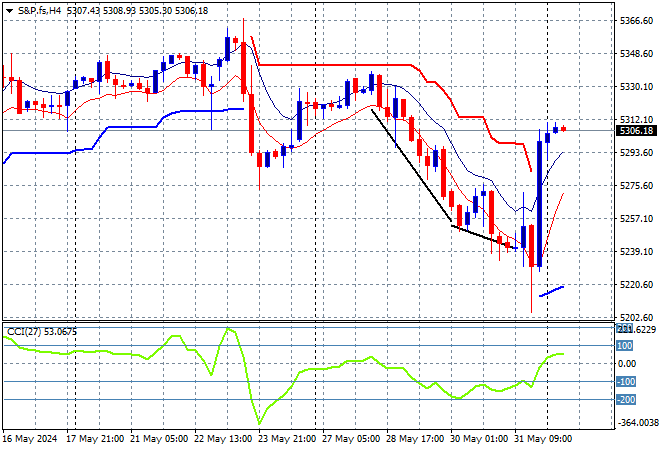

S&P and Eurostoxx futures are both up as we head into the London session with the latter trying to play catchup. The S&P500 four hourly chart shows price action having broken above the 5300 point level on Friday night and wanting to extend further tonight but momentum is only just positive here in the short term:

The economic calendar starts the trading week with the very closely watched US ISM manufacturing PMI print.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.