Asian share markets are selling off across the board as risk sentiment inverts despite the strong economic data out of the US overnight. Tonight’s ISM services print might extend the concerns that the Fed may indeed delay rate cuts with the USD still falling but not yet making a major dent against the major currencies, with the Australian dollar still depressed around the 65 handle.

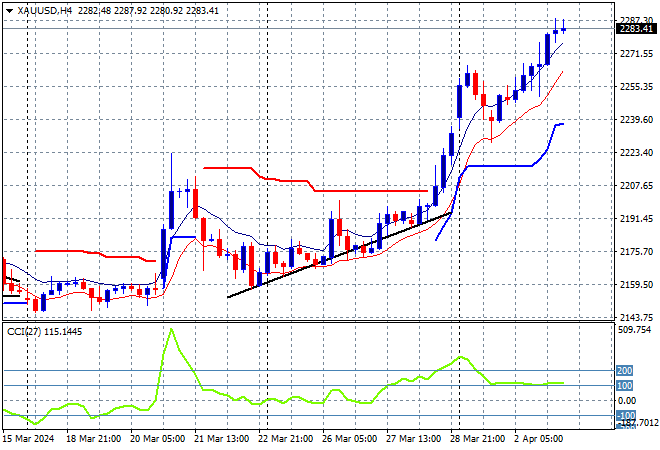

Oil prices are holding on to their post weekend gains with Brent crude still well above previous weekly resistance, about to exceed the $89USD per barrel level while gold continues to regain strength as it tries to hit the $2300USD per ounce level:

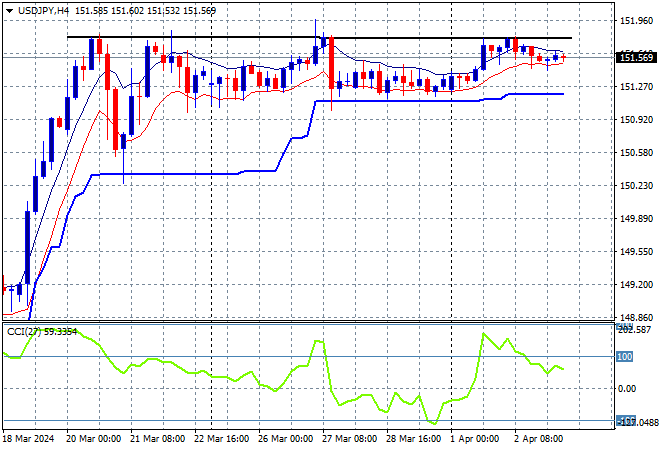

Mainland and offshore Chinese share markets are going in the same direction – down – with the Shanghai Composite holding above the 3000 point level but falling about 0.3% while the Hang Seng has lost more than 1.2%, currently at 16726 points. Japanese stock markets are also off, with the Nikkei 225 closing nearly 1% lower at 39451 points while the USDJPY pair is fairly steady at just above the 151 mid level, nearly matching the previous weekly highs:

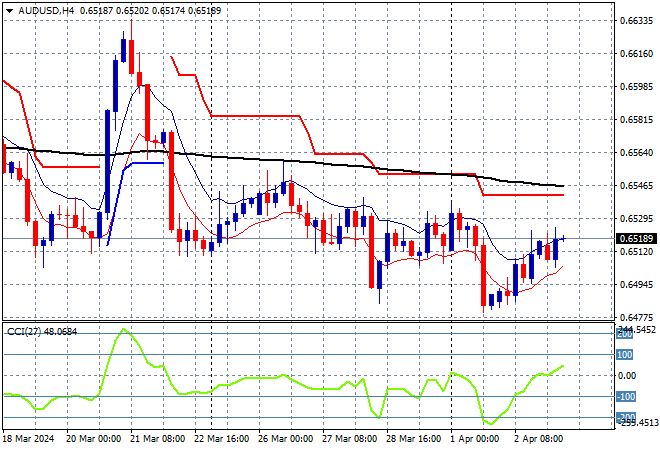

Australian stocks had the worst performance with the ASX200 closing over 1.3% lower to 7782 points while the Australian dollar is just holding on above the 65 cent level after last week’s volatility:

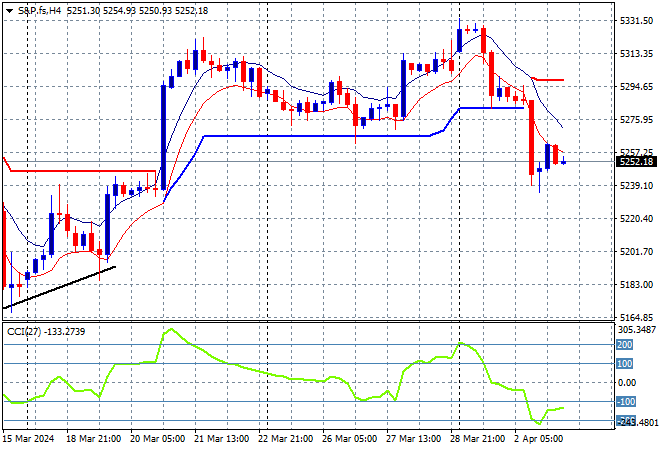

S&P and Eurostoxx futures are trying to get back on track after a poor session overnight as we head into the London session with the S&P500 four hourly chart showing price action stuck above the 5200 point level:

The economic calendar tonight includes Euro-wide core inflation and the US March ISM services PMI prints.