Asian share markets are behaving in mixed fashion after a poor lead from Wall Street overnight as the new trading year gets underway for most markets, with the Nikkei 225 still closed. The Australian dollar is trying to hold back a resurgent USD to remain above the 67 cent level.

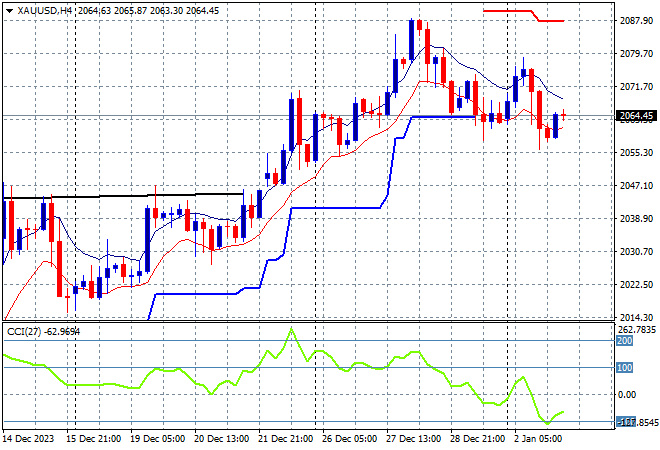

Oil prices are failing to push higher on Red Sea tensions as Brent crude sits just below the $76USD per barrel level while gold is in another pause phase, remaining just above the $2060USD per ounce level:

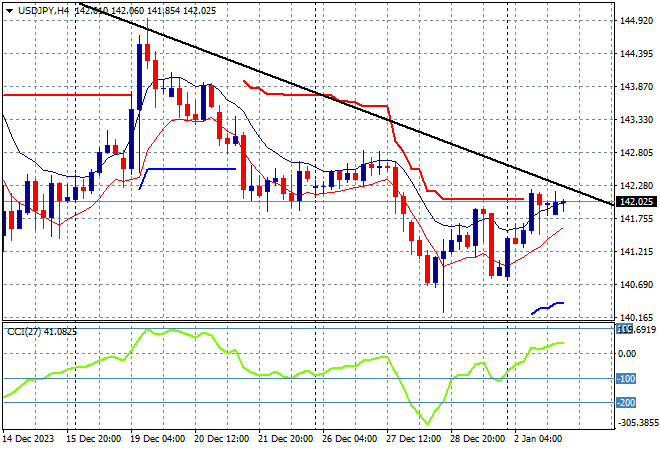

Mainland Chinese share markets are trying to bounceback but the Shanghai Composite remains well below the 3000 point barrier, currently at 2968 points while in Hong Kong the Hang Seng Index is down over 1%, currently at 16599 points. Japanese stock markets remain closed while the USDJPY pair remains stubbornly above the 142 level:

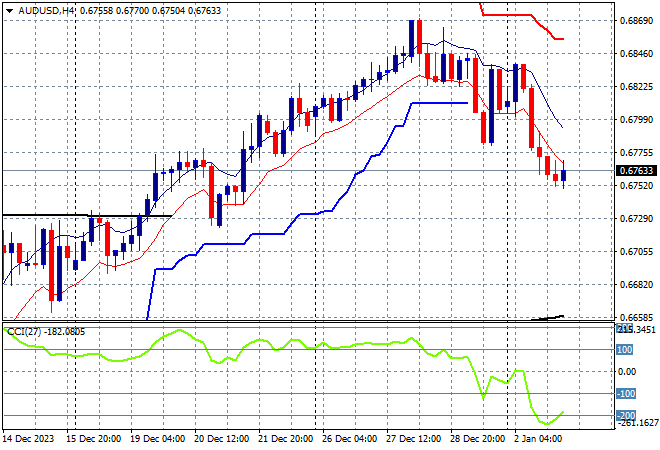

Australian stocks were the biggest losers in the region with the ASX200 closing nearly 1.4% lower to almost retrace below the 7500 point level, closing at 7523 points while the Australian dollar decelerated its overnight flop to remain above the 67 cent mid level but it is slowing down going into the London session:

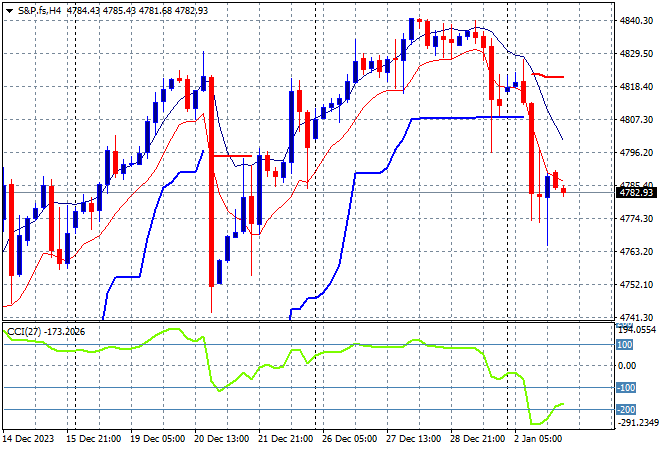

S&P and Eurostoxx futures are hovering at their start of year lows going into the London open with European stocks likely to start a lot lower as they play catchup to the Wall Street selloff. The S&P500 four hourly chart shows a breakdown below the 4800 point level with short term momentum extremely oversold:

The economic calendar will focus mainly on German unemployment tonight plus the latest FOMC minutes and ISM manufacturing print.