A bath of blood on Asian share markets today as risk markets couldn’t absorb the various sources of volatility this week going into tonight’s US non-farm payroll print. The biggest moves have been in Japan with their equity markets off 5% almost immediately as the rate hike by the BOJ of the last 24 hours with the latest Fed meeting overnight following the BOJ rate hike and the huge moves in Yen. The Australian dollar managed a small blip higher but doesn’t look too good either with recent inflation figures pointing to possibility of rate cuts sooner than expected as it barely maintains above the 65 cent level.

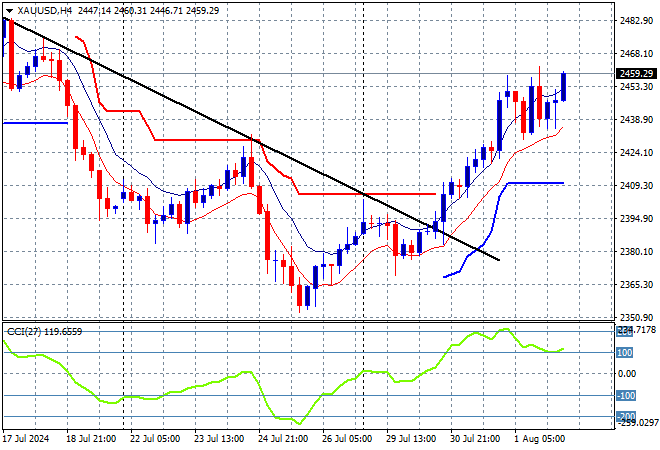

Oil prices are steady but still volatile on the growing Middle East conflicts with Brent crude hovering around the $80USD per barrel level while gold has continued its bounceback above the $2400USD per ounce level:

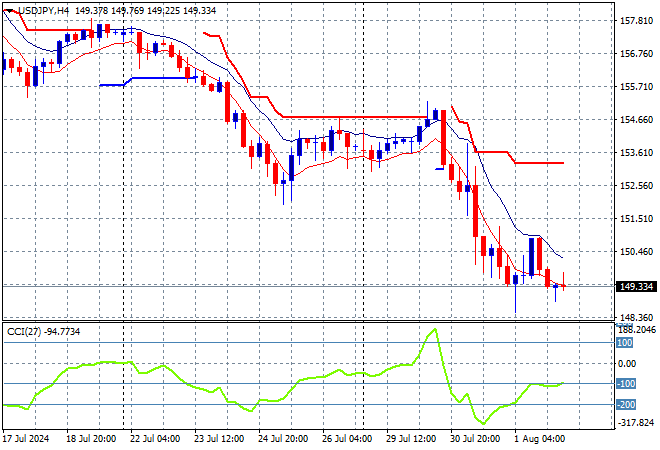

Mainland Chinese share markets are doing the best, relatively speaking with the Shanghai Composite only off by 0.4% or so to remain under 3000 points while the Hang Seng Index is down 2% at at 16950 points. Meanwhile Japanese stock markets are doing the worst with some massive moves lower with the Nikkei 225 down nearly 5% to close at 36360 points as the USDJPY pair can’t go anywhere but is trying to anchor here at the 149 handle:

Australian stocks didn’t escape the carnage with the ASX200 about to close more than 2% lower to 7930 points while the Australian dollar rebounded slightly from its overnight slip but is still on the floor at the 65 cent level:

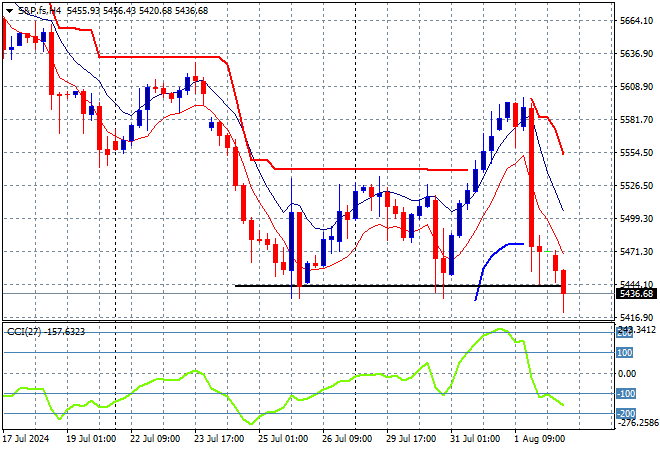

S&P and Eurostoxx futures are down and looking weak going into the London session with the S&P500 four hourly chart showing how the bottom at the 5400 point level no longer looks quite firm as it fails to clear resistance around the 5600 point level:

The economic calendar will focus squarely on the US non farm payrolls aka unemployment print tonight.