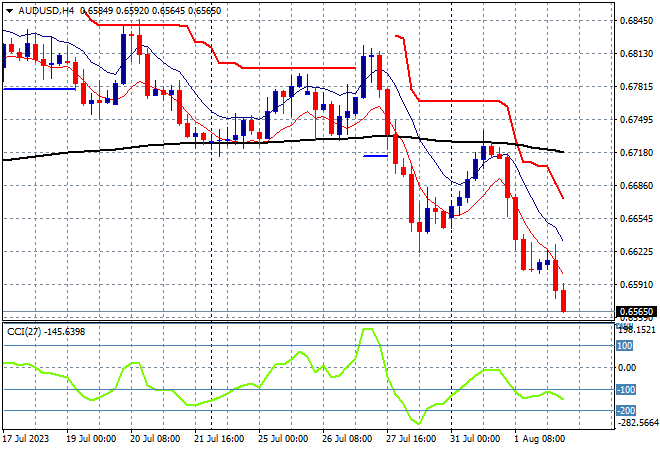

Asian stock markets are the first to react to the post close shock of the Fitch US downgrade with a broad selloff across the region and a run to safe havens. S&P futures are down considerably with European stocks not far behind with this catalyst a wakeup call before the all important US jobs print on Friday. The Australian dollar was pushed back the hardest, now down to the mid 65 cent level after yesterday’s RBA pause and other undollars remain under the pump of a strong King Dollar.

Oil prices are holding on to their recent gains as Brent crude remains above the $85USD per barrel level while gold is failing to clawback its recent losses, still floating around the $1950USD per ounce level and looking very weak here:

Mainland Chinese share markets are having down sessions with the Shanghai Composite about to close 1% lower at 3256 points while in Hong Kong the Hang Seng Index has pulled back even further, down 2% or more to again reject the 20000 point barrier.

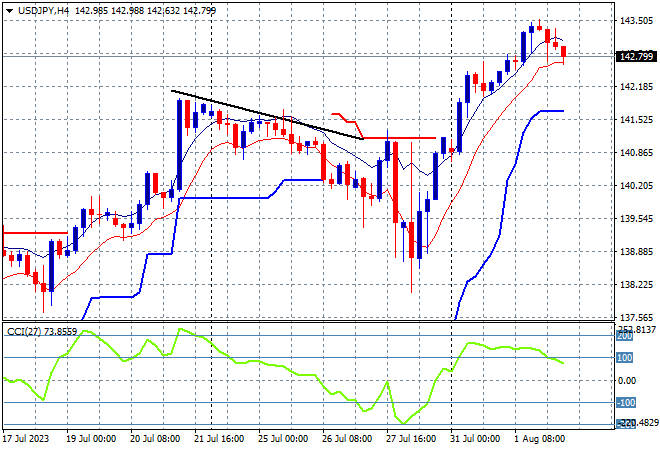

Japanese stock markets were spooked with the Nikkei 225 closing nearly 2.3% lower at 32707 points while the USDJPY pair has had only a minor retracement to remain well above its previous weekly high above the 142 handle in what is still a big turnaround from last week’s low:

Australian stocks sold off sharply as well with the ASX200 closing 1.3% lower at 7354 points. The Australian dollar remained in full retreat mode to clear below the Friday night lows to the mid 65 cent level, confirming the current downtrend:

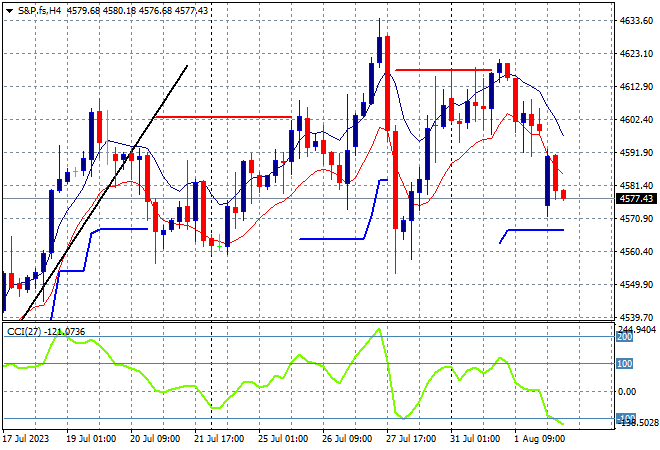

Eurostoxx and S&P futures are down about 0.8% as traders play catchup to the Fitch downgrade with the S&P500 four hourly chart showing a pullback down to last week’s session lows. The inability to get back above the 4600 point level before the NFP print on Friday could see a sharp rollover:

The economic calendar continues with a private ADP (NASDAQ:ADP) jobs report from the US.