With the FOMC meeting absorbed without much fanfare overnight, equity volatility was limited in today’s session here in Asia with closed Chinese markets helping smooth out the wobbles on Wall Street overnight. The lack of change in the Federal Reserve direction on interest rates still saw a reversal in USD with all the majors lifting overnight with the Australian dollar still climbing above the 65 cent level.

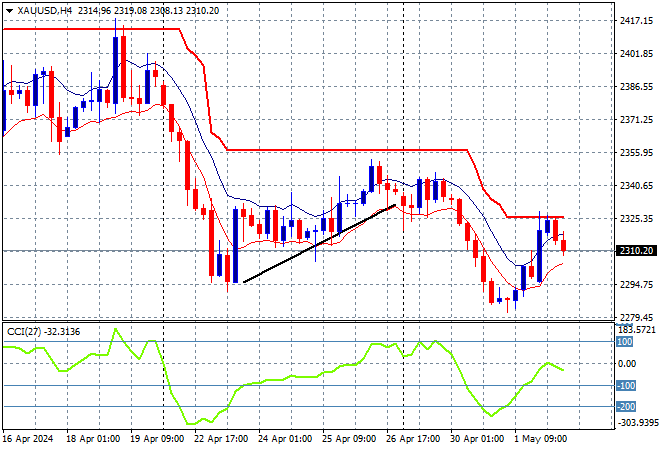

Oil prices are trying to stabilise after falling sharply overnight with Brent crude just above the $84USD per barrel level while gold is continuing its struggle, remaining just above the $2300USD per ounce level this afternoon:

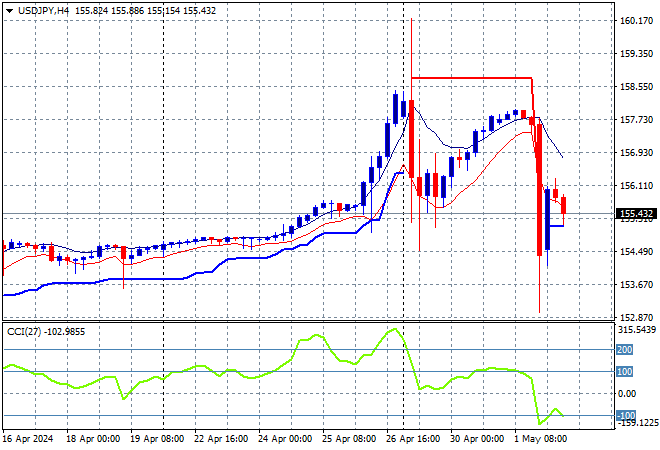

Mainland and offshore Chinese share markets were closed while Japanese stock markets slipped back again with the Nikkei 225 down 0.1% while the USDJPY pair is trying hard to normalise with lower volatility to stay just above the 155 level:

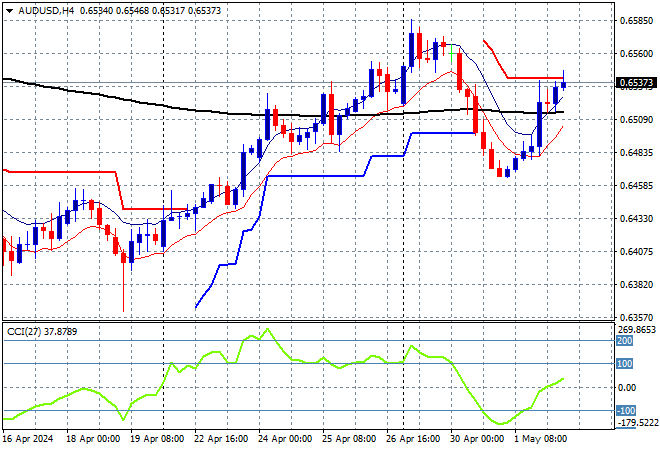

Australian stocks were the best performers but it’s all relative with the ASX200 closing just 0.2% higher at 7587 points while the Australian dollar wants to lift higher above the 65 cent level in afternoon trade:

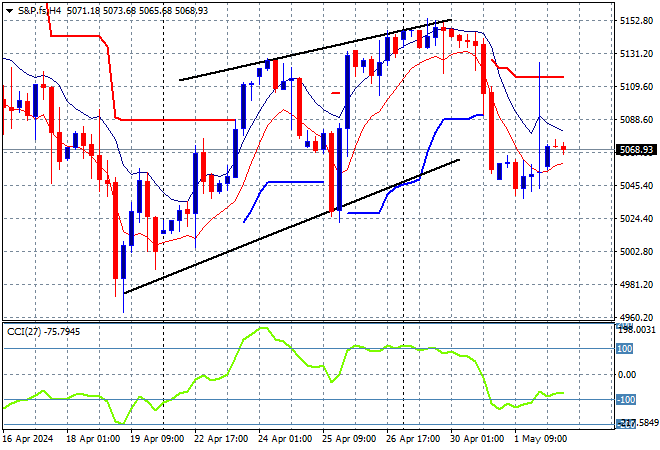

S&P and Eurostoxx futures are barely holding on as we head into the London session with the S&P500 four hourly chart showing price action at the lower end of its recent range, with the 5000 point level potentially coming under threat next:

The economic calendar is relatively quiet following the FOMC meeting with the latest US factory orders the only major item.