Asian share markets are fumbling in the final session of the trading week as a stronger USD dominates risk sentiment although a swathe of contradictory PMI readings from Japan, Australia and China kept currency and bond markets second guessing.

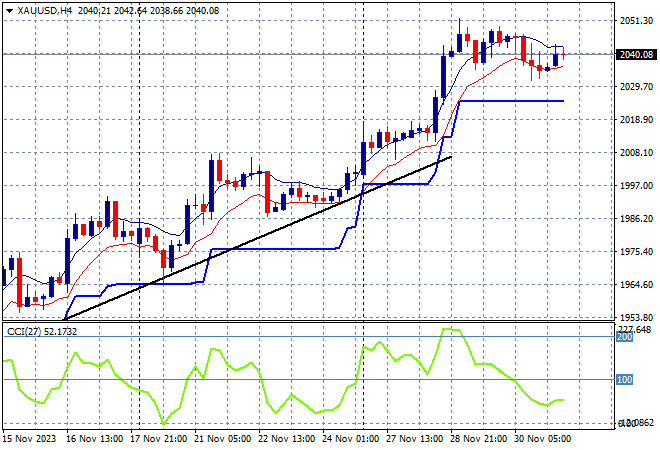

Oil prices are trying to stabilise following the OPEC meeting with Brent crude still hovering just below the $81USD per barrel level while gold is holding steady well above the $2000USD per ounce level still shoring up short term support:

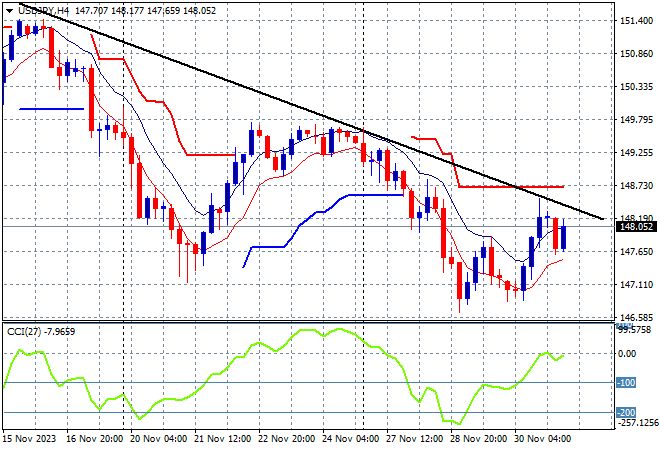

Mainland Chinese share markets are back in the red near the close with the Shanghai Composite down 0.5% to 3014 points while in Hong Kong the Hang Seng Index is also off smartly, down nearly 0.7% to continue its losing streak, currently at 16906 points. Japanese stock markets are treading water with the Nikkei 225 steady at 33466 points while the USDJPY pair is trying to stave off its rollover to get back above the 148 level:

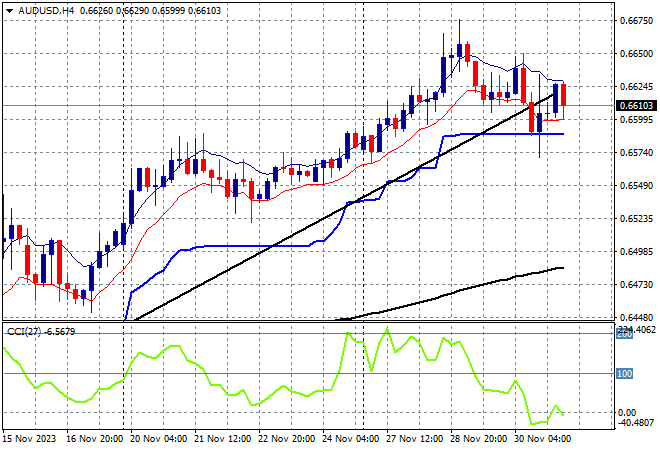

Australian stocks were unable to put in a final positive session with the ASX200 closing 0.2% lower to remain above the 7000 point support level at 7072 points while the Australian dollar has taken further heat out of its recent run up but is still holding just above the 66 cent level with a minor consolidation:

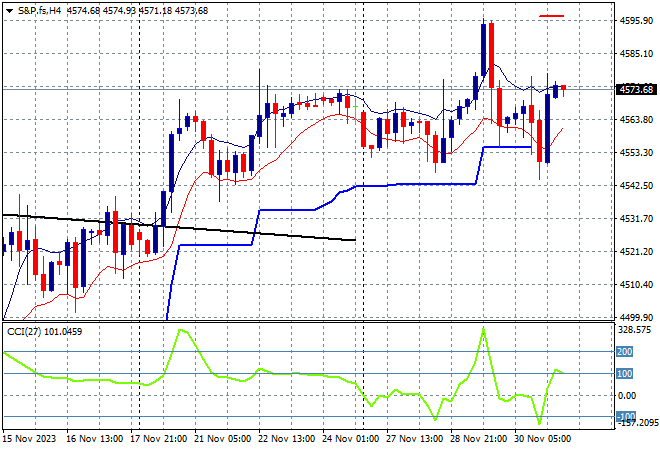

S&P and Eurostoxx futures are steady going into the London open as the S&P500 four hourly chart shows support continuing to firm at the 4500 point level where price action is likely to test in tonight’s session, following a series of large steps following the recent rebound above the 4300 point level:

The economic calendar finishes the trading week with quite a few ECB and Fed speeches followed by the latest ISM manufacturing survey in the US.