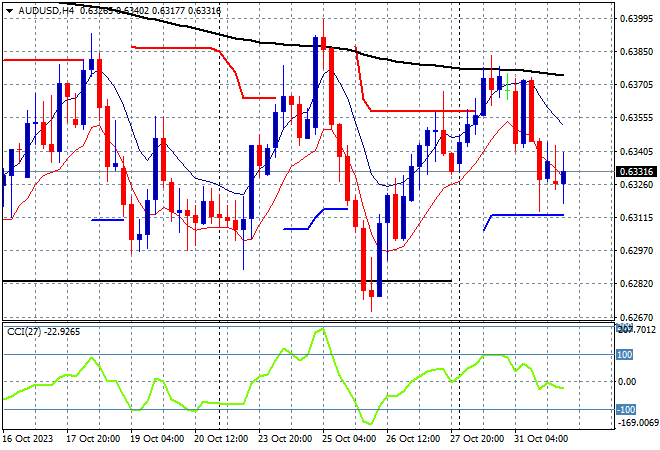

A sea of green across Asian share markets this time as risk markets stabilised overnight while the USD surged against most of the major currency pairs amid stronger US wage data. Tonight’s manufacturing PMI may increase this surge with the Australian dollar again dicing with the 63 cent level and near its monthly low.

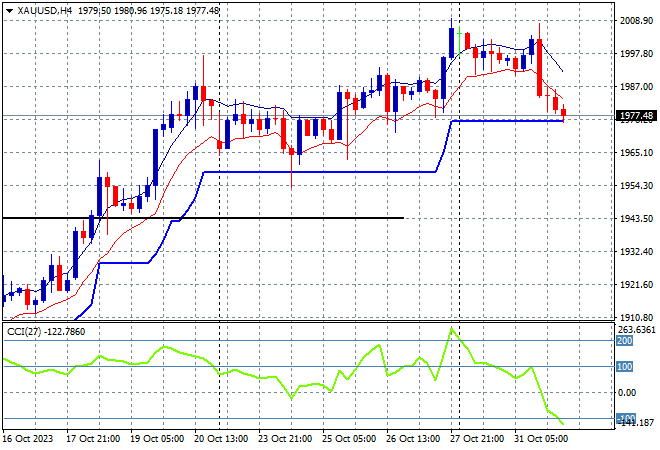

Oil prices have pulled back further from their recent reversal, with Brent crude consolidating around the $85USD per barrel level while gold is taking the foot off the throttle, edging just below the $1980USD per ounce level:

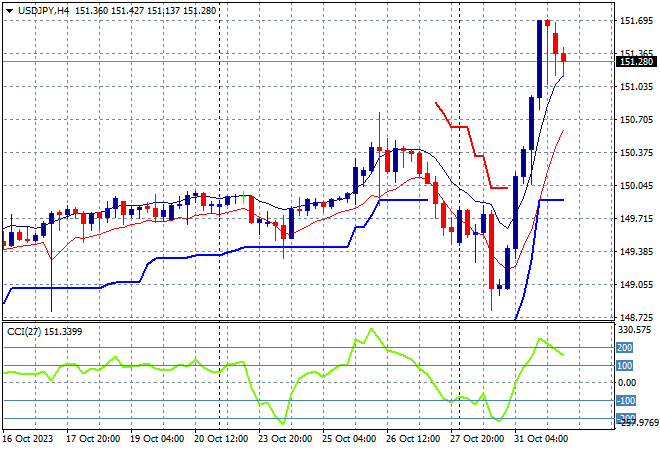

Mainland Chinese share markets lifted higher initially but the Shanghai Composite is treading water, up only 0.1% at 3023 points while in Hong Kong the Hang Seng Index is dead flat at 17119 points. Japanese stock markets had the best run with the Nikkei 225 about to close at least 2% higher due to the weaker Yen at 31480 points. Trading in the USDJPY pair is seeing a small pullback from the mighty surge overnight, but still above the 151 level:

Australian stocks were finally able to put in a solid session with the ASX200 up more than 0.6% at 6824 points, still well below former support at 7000 points while the Australian dollar has oscillated around its overnight low, threatening the 63 cent level:

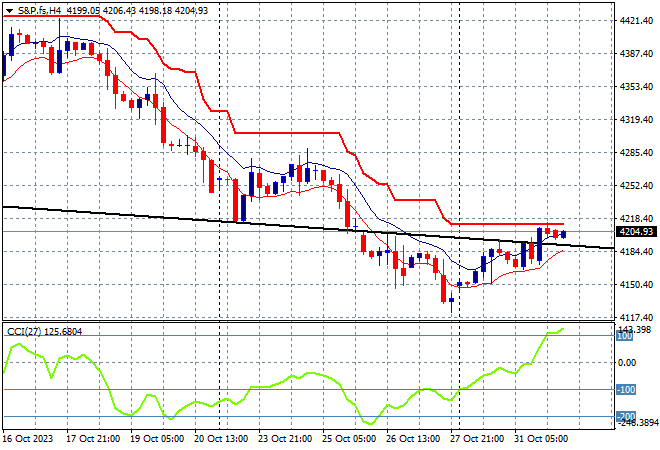

S&P and Eurostoxx futures are steady going into the London open as the S&P500 four hourly chart shows support trying to shore up at the 4200 point level as short term momentum gets slightly overbought:

The economic calendar continues with the main focus on the latest US manufacturing PMI print.