What a twenty four hours for risk markets! With widening war looming in the Middle East, commodities are going crazy, the Yen soared nearly 500 pips on a tiny rate hike from the BOJ and the Federal Reserve indicating several rate cuts on the way, giving Wall Street the green light to go go go…The USD fell back against most of the majors, particularly Yen of course, with the Australian dollar helped back on its feet following yesterday’s local inflation print with a potential rate cut from the RBA sooner rather than later keeping it weak at the 65 cent level.

US Treasuries saw big moves across the curve with the 10 year down more than 10 points to just above the 4% level while oil prices reversed course sharply as Brent crude finished above the $81USD per barrel level after just recently hitting a new monthly low. Meanwhile gold prices rebounded more than $20 to extend its breakout above the $2400USD per ounce level.

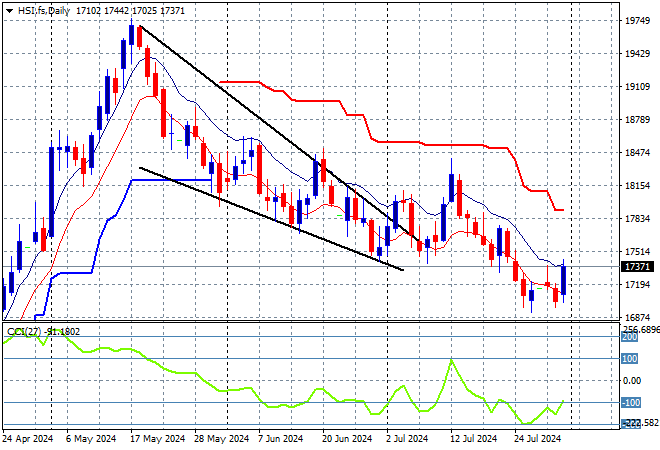

Looking at markets from yesterday’s session in Asia, where mainland Chinese share markets are no longer struggling with the Shanghai Composite zooming more than 2% higher while the Hang Seng Index is up nearly the same amount, bouncing off the 17000 point barrier, to close at 17338 points.

The Hang Seng Index daily chart was starting to look more optimistic with price action bunching up at the 16000 point level before breaking out in the previous session as it tried to make a run for the end of 2023 highs at 17000 points with the downtrend line broken. Price action looked like turning this falling wedge pattern into something more bullish but is still looking like a dead cat bounce instead:

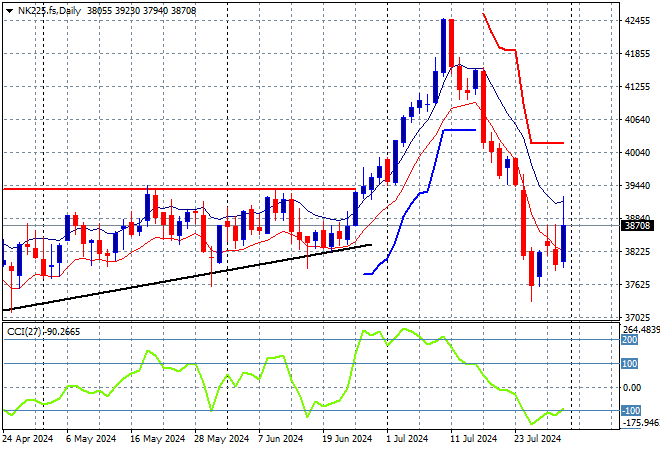

Meanwhile Japanese stock markets are liking the rate hike with the Nikkei 225 up more than 1.5% to close at 39101 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Short term support was broken on this retracement, with futures indicating a rebound possibly in line with Wall Street’s returns:

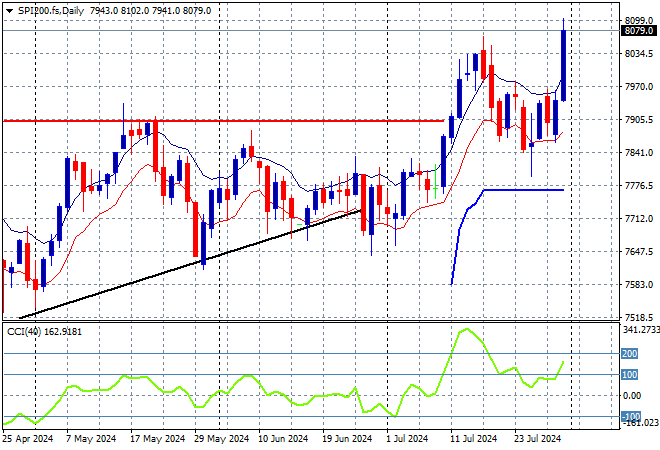

Australian stocks stumbled around the local inflation print amid working out what the RBA will do next but eventually led higher with the ASX200 closing 1.7% higher to 8092 points.

SPI futures are up 0.2% or so with the floodgates likely open now that rate cuts are on hand and also given the rebound on Wall Street overnight. Momentum is now back in overbought territory with this new record high getting risk spirits agitated:

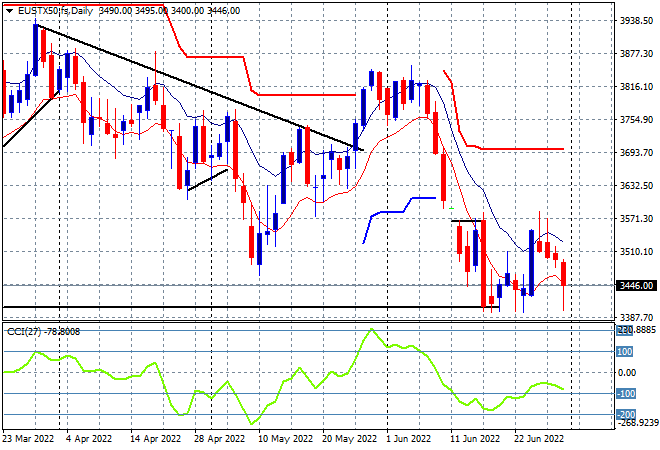

European markets are again trying to get traction with a better session overnight with solid moves across the continent, led by German stocks as the Eurostoxx 50 Index closed more than 0.6% higher to 4872 points.

The daily chart shows price action off trend after breaching the early December 4600 point highs with daily momentum retracing well into an oversold phase. This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance still looming at the 5000 point barrier. Former ATR support at the 4900 point level remains the anchor point but as I said I was wary of this one off move:

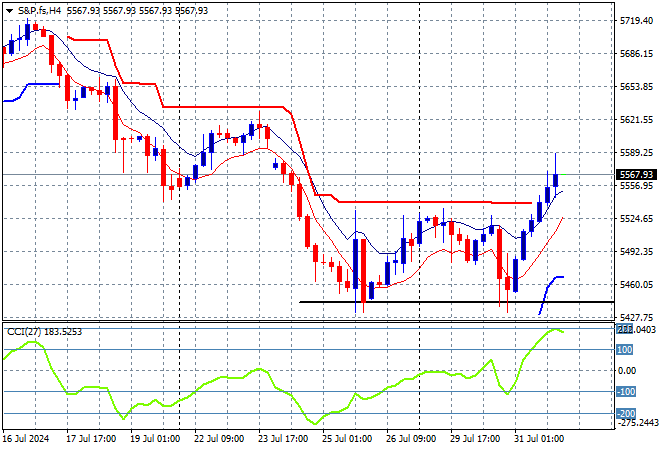

Wall Street was bullish across the board this time, both before and after the FOMC meeting with the NASDAQ soaring more than 2.6% higher while the S&P500 put on more than 1.4% to close at 5522 points.

The four hourly chart showed resistance overhead that had been tested last Friday before an early week slump that has now been tested and broken through, helped alongside a previously soaring NASDAQ. Momentum was somewhat oversold and has rebounded through to well overbought settings as price bounces off weekly support levels:

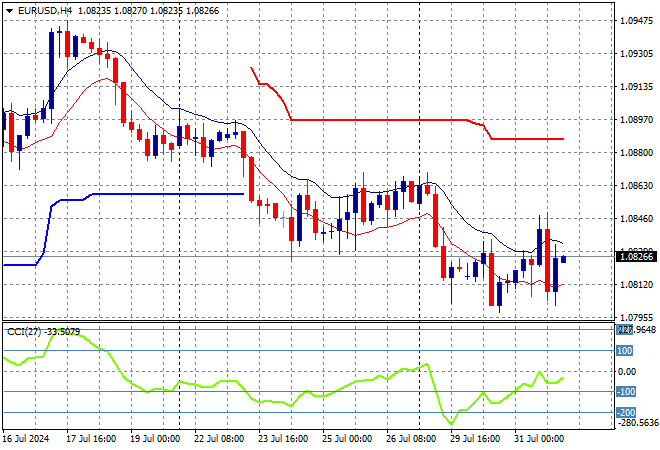

Currency markets were starting to moderate in volatility but the first leg of central bank meetings and important economic data points has seen the USD fall back overnight against almost everything, but especially Yen in the wake of the FOMC non-decision. Euro pushed back above the 1.08 level but still looks weak following the German inflation figures.

The union currency had previously bottomed out at the 1.07 level before gapping higher earlier in the week with more momentum building to the upside with the 1.0750 mid level as support but there is too much pressure here from King Dollar. There still could be a further retracement as ATR support has been taken out:

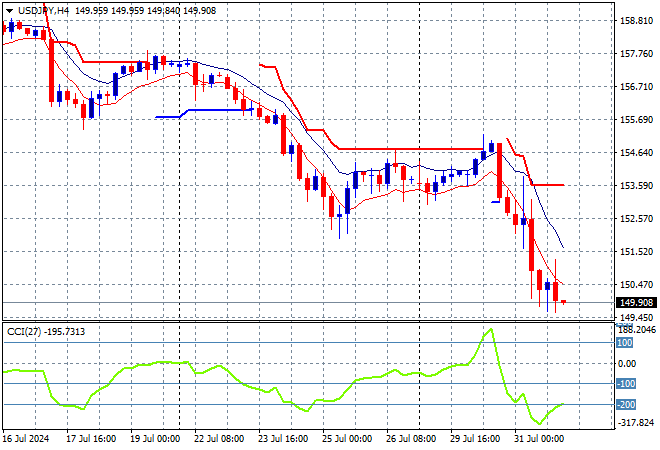

The USDJPY is having a wild ride – all the way down – with a near 500 pip move lower on the back of the BOJ rate cut as it collaped below the 150 level overnight following the FOMC meeting as well.

This volatility speaks volumes as it once pushed aside the 158 level as longer term resistance, but then was unable to breach the 162 level as it looks like the BOJ intervention finally worked on the ever weakening Yen. This could go even further but momentum has subsided somewhat on the downside with a potential short term bottom forming here:

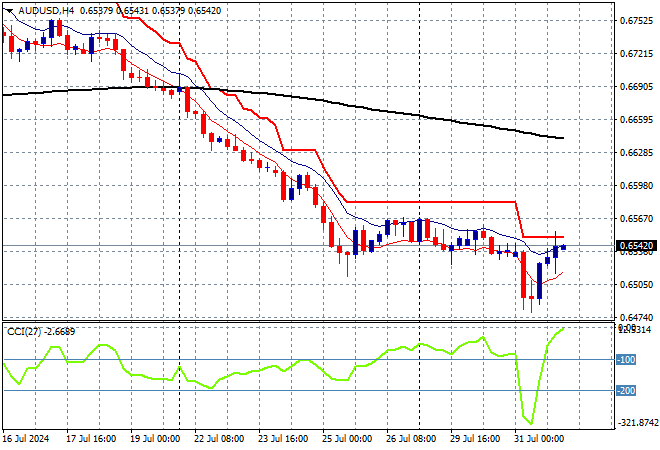

The Australian dollar struggled after yesterday’s CPI print and broke below the 65 cent level but was rescued by the FOMC non decision overnight and returned to its start of week point instead, but still in a precarious state.

During June the Pacific Peso hadn’t been able to take advantage of any USD weakness with momentum barely in the positive zone but that has changed in recent weeks with price action finally getting out of the mid 66 cent level that acted as a point of control. This still looks very weak with medium term support still broken as we await the RBA’s next step:

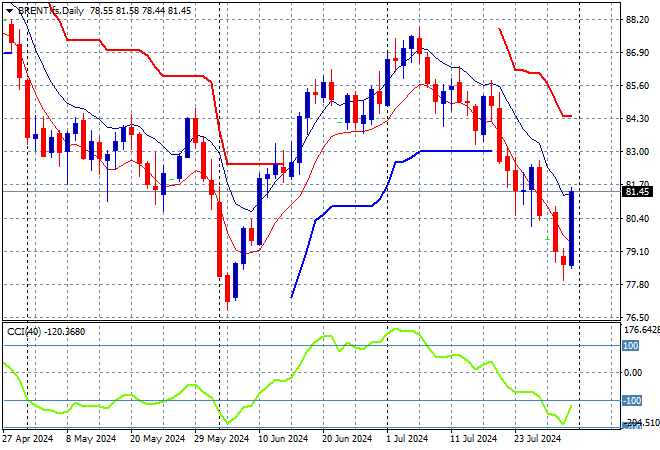

Oil markets love a good old fashioned war in the Middle East with Brent crude moving higher in a big reversal overnight, closing above the $81USD per barrel level.

After breaking out above the $83 level last month, price action had stalled above the $90 level awaiting new breakouts as daily momentum waned and then retraced back to neutral settings. Daily ATR support had been broken with short term momentum still in oversold mode but watch for a potential follow through on this reversal as this swings into higher volatilty:

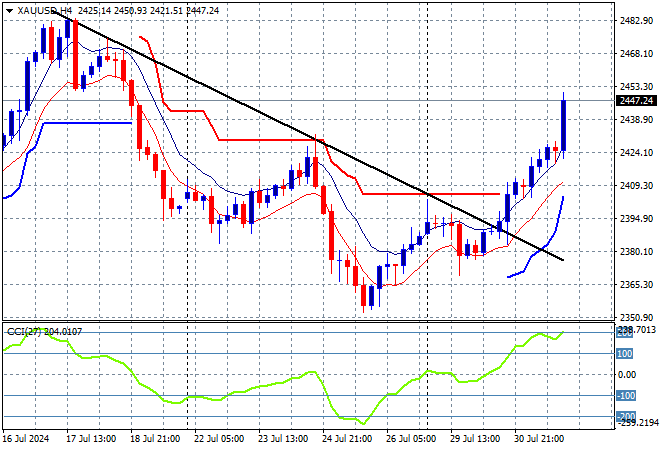

Gold is well back on trend after following through on its rebound overnight with a big surge above the $2400USD per ounce level.

While it was the biggest casualty of the reaction to the recent US jobs report, the shiny metal was able to clock up some gains before this reversal, almost hitting the $2500USD per ounce level. The longer term support at the $2300 level remains key but that broken downtrend line from mid July looks like a good opportunity with momentum now nicely overbought: