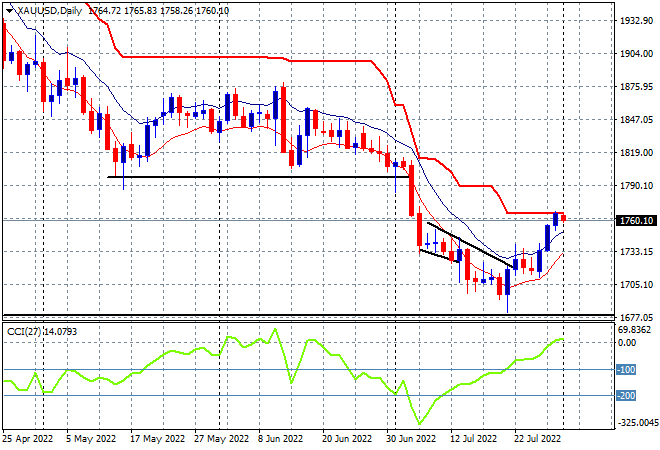

Asian stocks are having a solid start to the trading week with Chinese stocks still the laggards but avoiding the steep falls from Friday’s session. The mixed earnings from Wall Street is not overshadowing risk sentiment as all risk markets keep lifting as the USD strength wanes slightly. Yen remains strong while the Australian dollar is failing to push through the 70 level. Meanwhile oil prices are slowly going nowhere with {[8833|Brent}} crude hovering at the $103USD per barrel level, while gold has also paused from its Friday night high to maintain the $1760USD per ounce level to hold on to a new monthly high:

Mainland Chinese share markets are just holding on to some gains going into the close with the Shanghai Composite up slightly to 3258 points while the Hang Seng Index is slipping after getting into full reverse mode on Friday, down just 0.1% to 20126 points. Japanese stock markets are pushing higher despite the much higher Yen, with the Nikkei 225 up 0.5% to 27951 points as the USDJPY pair drops below the 133 level again as Yen buyers step in amid the renewed USD weakness for a new monthly low:

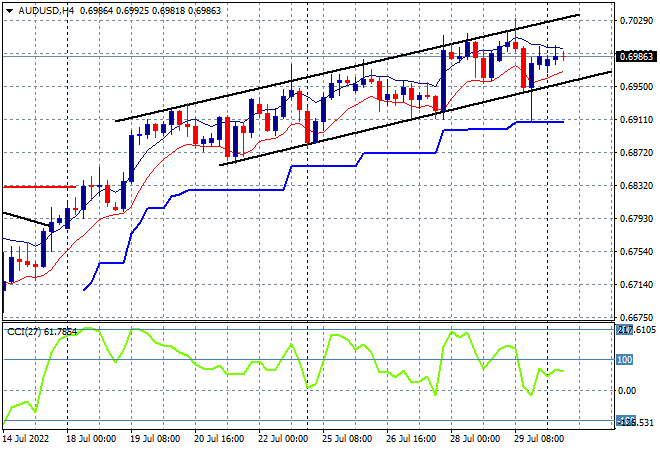

Australian stocks had a great start to the trading week with the ASX200 closing some 0.6% higher to almost push through the 7000 point level, closing at 6989 points. The Australian dollar has again failed to punch through the 70 handle as it remains stuck following the Fed’s rate rise, now anticipating tomorrow’s RBA meeting:

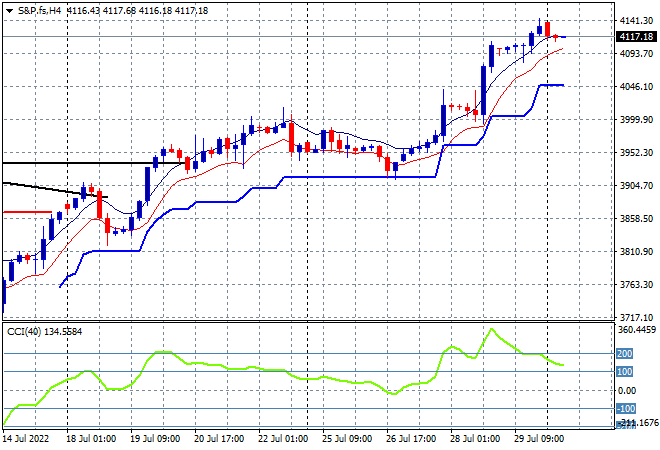

Eurostoxx and US futures are holding on to their end of week gains with the S&P500 four hourly futures chart showing price action wanting to continue its breakthrough above the 4100 point level to continue this relief rally:

The economic calendar starts the week with German retail sales and the latest ISM manufacturing print from the US for July.