A relatively positive start to the new trading year across Asian share markets although local stocks are struggling. European shares are looking to rebound following weekend elections while Wall Street will be reacting to the all important ISM manufacturing print tonight. The USD remains relatively firm against most of the majors after a staid session on Friday night with Euro possibly bouncing back. The Australian dollar remains somewhat elevated however, holding after the weekend gap to be just below the 67 cent handle.

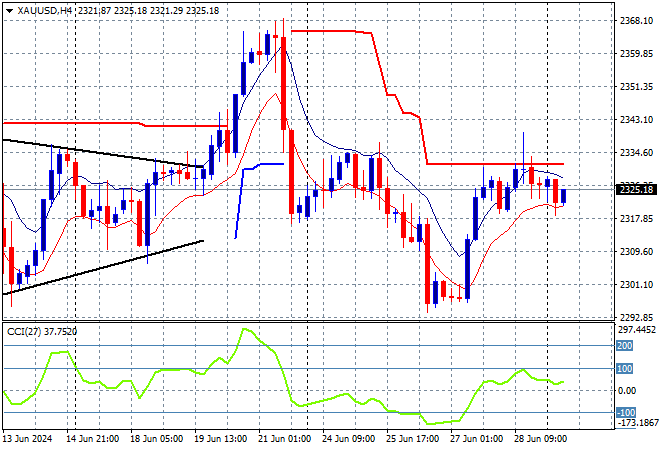

Oil prices are still holding on but building some intrasession volatility with Brent crude pushing slightly higher above the $85USD per barrel level while gold continues to struggle to be just above the $2320USD per ounce level:

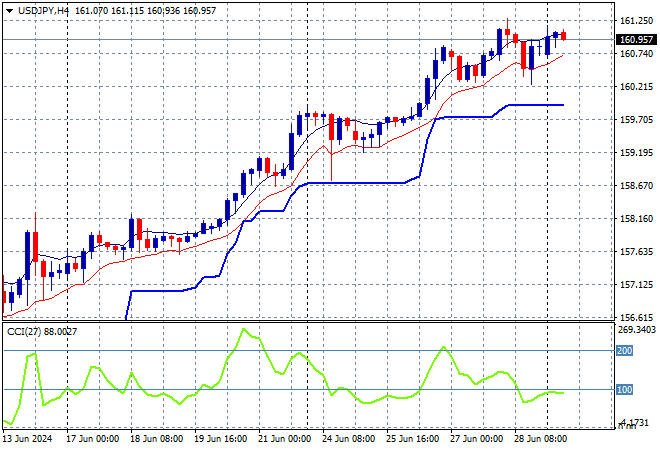

Mainland Chinese share markets are making a strong comeback with the Shanghai Composite up nearly 1% but still below the 3000 point barrier while the Hang Seng Index is closed for holiday. points. Meanwhile Japanese stock markets are barely moving with the Nikkei 225 closing just 0.1% higher to 39631 points as the USDJPY pair consolidates above the 160 level and looks to push above the 161 level next:

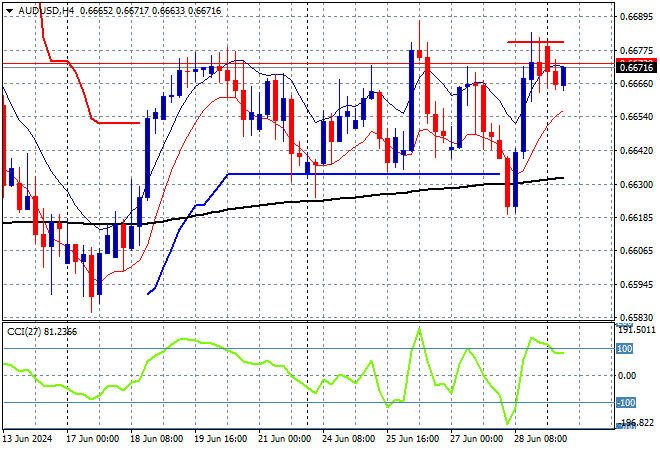

Australian stocks were again the worst performers with the ASX200 losing more than 0.2% to 7750 points while the Australian dollar is holding at its recent highs just below the 67 cent handle:

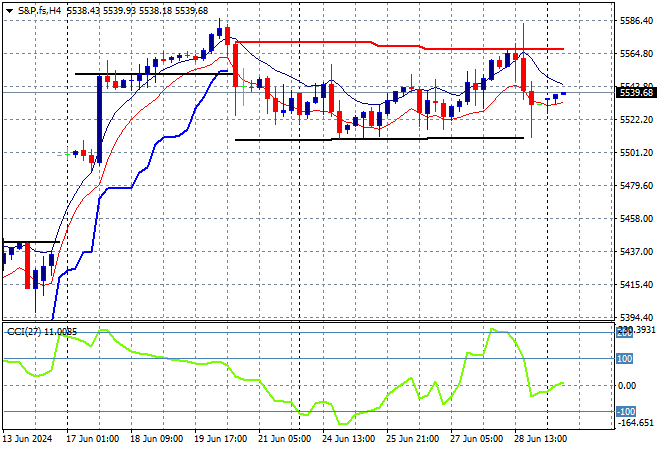

S&P are lifting slightly while Eurostoxx futures are rebounding strongly as we head into the London session with the S&P500 four hourly chart showing price action still holding above the 5500 point level which continues to act as support:

The economic calendar starts the trading week in busy fashion with German inflation and then the latest US ISM manufacturing survey.