The ASX has begun to truly recover from last year’s loses, crossing into the green to mark up 1.27% growth over the last twelve months as the index grew 1.47% over the last five days.

Only the Nikkei225 was able to keep up, gaining 1.12% this week as the other indices fell, none more than the S&P 500 with a 2.12% loss.

Commodities mostly followed the market up, aluminium (+7.53%), zinc (+6.41%) and tin (+6.38%) gaining the most as platinum (-3.41%), palladium (-2.37%) and silver (-0.21%) languished.

West Texas Crude is also up 2.96% for the week, although WTI is still down 6.49% for the year overall.

More on the market movements this week from Wealth Within’s Dale Gillham.

Is it time to look outside the ASX to invest?

Wealth Within chief analyst Dale Gillham explores the pros and cons of investing in the ASX vs US markets, with some market insight to follow.

Access to the world stock markets has become even easier via trading apps, which is causing many to start questioning where they should invest their money.

While I am a big believer in keeping your trading simple (which is why I always say invest in the ASX), I often hear investors and traders wanting to trade on the US stock market.

When asked why, it’s because it offers more choice, is a more liquid market and they can gain access to the biggest companies in the world, like Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT) among others.

While on the surface these may sound like great reasons to invest in the US stock market, what many fail to recognise is that it adds a greater level of complexity and risk, as you need to also manage the currency exchange issues.

So, is having more choice better or worse when investing in the stock market?

As many have experienced, more choice leads to more confusion together with a raft of psychological challenges not the least of which is paralysis, regret and potentially unrealistic expectations.

As far as being able to buy the most well-known companies, such as Apple, being a fan of the company or product is one thing but making money from an investment is another.

In reality, Australia’s top 100 stocks are very liquid and indeed liquid enough that any retail investor will never have any issues.

The ASX also has some of the world’s best companies like BHP (ASX:BHP), Rio and CSL, as well as our banks, which are some of the most highly rated in the world. All of these companies and others in the top 100 perform as well as any US brand.

I have said it before and I will say it again, the perception that you will get better returns or lower your risk by investing in the US is a myth that will cost you a lot of money.

What are the best and worst performing sectors this week?

The best performing sectors include Healthcare up over 4% followed by Communication Services and Consumer Staples, which are both up over 2%.

The worst performing sectors include Utilities down over 1% followed by Materials and Energy, which are both just in the green.

The best performing stocks include Resmed up over 7% followed by Fisher and Paykel up over 6% and Ampol up over 5%.

The worst performing stocks include Alumina down over 5% followed by Origin Energy down over 4% and the A2 Milk Company down over 2%.

What's next for the Australian stock market?

In stark contrast to 2022, where the All Ordinaries Index ended January down over 6%, the market has so far traded up almost 6% in 2023.

While the doomsayers are continuing their rhetoric, especially around the US market, I still expect the Australian stock market to trade higher.

I also believe it will outperform the US market like it did last year. This is another reason why I think the Australian stock market is the best stock market for Australians to invest in.

While the US market does outperform the Australian stock market at times, the long term historical data proves that the Australian stock market generates better returns over the long run.

While it may not set the world on fire for returns this year, it certainly is on the cards that sectors that have lagged in the past will play catch up.

As such, I believe the All Ordinaries Index will trade higher over the next few weeks into February or March and up to around 7,800 points and beyond.

Not for the first time, the Bank of Japan spites the hype

City Index senior market analyst Matt Simpson argues the Bank of Japan (BOJ) has done it again, ignoring the census expectations of their own meetings and the market’s hype to surprise everyone yet again.

I’ve said it before, and I’ll say it again. The BOJ never go with the consensus expectations of their own meetings. If there are high expectations to act they tend to nothing, then surprise markets with a sudden change of policy when no expectations exist.

At its January 2023 meeting, the BOJ:

- held interest rates at -0.1%;

- maintained a target for 10-year JGB at ‘around’ 0% (with +/- 0.5% band);

- voted unanimously to hold policy; and

- played cards (unconfirmed)

Outlook for economic activity:

- Japan’s economy is likely to recover towards the middle of the projection period;

- high commodity prices and slowdowns with overseas economies to keep downwards pressure on the economy;

- CPI (all items less fresh food) likely to remain relatively high over the near-term;

- inflation expected to decrease around the middle of FY 2023; and

- projected growth rates for 2022 and 2023 are somewhat lower than previously forecast.

Despite the hype – and to possibly spite the hype – the bank left its YCC target band unchanged, let alone tweak it or scrap it.

It held interest rates at -0.1% which, to its credit, was expected, yet did not switch to an inflation target range as I had suspected.

The biggest change I can see is they expanded the range of ‘eligible parties for the climate change funding scheme’, so overall a nothing burger ahead of the press conference.

Perhaps the bigger surprise is that there were no dissenters, so all were on board with keeping policy unchanged at this meeting.

It may even pour cold water on the expectation that Kuroda has any intention of wrapping up some of his policies before his successor takes the helm in April.

So that leaves either an unscheduled policy change like we saw earlier this month, or Kuroda intends to go out with a bang at his last meeting on March 10.

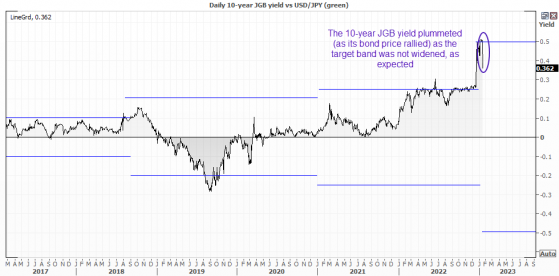

Yen and Nikkei rallies, JGB yield rolls over

We’re still waiting for the press conference, so perhaps they have a trick up their sleeve. But right now, we’re seeing a broad weakening of the Japanese yen as those pre-emptive bets of a hawkish meeting run for cover.

This also saw the 10-year JGBP yield plummet as its underlying price soared due to the dovish meeting. On that metric the meeting has been a success, as the BOJ would like to see lower yields.

So, it is now over to the press conference which is expected to be at 17:30 AEDT – but if nothing new is added, we suspect the yen will continue to weaken (USD/JPY bullish) and the Nikkei rally.

Nikkei 225 weekly chart:

As noted in our recent livestream, the Nikkei has been trying to carve out a triple bottom around the 200-week EMA. Since then, we have seen a strong rally from its base and now on track for a bullish engulfing week.

Given its reluctance to break below 25,500, I suspect it is now headed for gap resistance around 27,400 irrespective of fundamentals. It could then be a case of drilling down to lower timeframes for bulls to find suitable entries to fit their criteria.

AUD/JPY daily chart:

The Aussie yen looks interesting around current levels, particularly if we get a daily close around or above 92.00. Today’s bullish candle is trying to close above the 200-day EMA, 90.89 – 91.43 resistance zone and trend resistance.

Of course, today’s press conference could send this sharply lower with a hawkish bazooka, but if that does not arrive then the path of least resistance may be higher.

Netflix (NASDAQ:NFLX) subscription numbers rally

Market analyst for eToro, Josh Gilbert, ponders Netflix’s future as subscriber numbers recover from last year’s losses.

Netflix subscriber numbers have bounced back from the 200,000 loss at the start of 2022, adding 7.6 million new subscribers in the fourth quarter.

Content is key in the current streaming showdown, and Netflix delivered a strong quarter of movies and shows that retained customers and attracted new ones.

Investors will hope the streaming giant can continue delivering a steady stream of new releases throughout 2023 instead of one-hit wonders now and then.

But let's remember, there’s still a lot of work for Netflix to do. 2022 was its slowest year of subscriber growth since 2011 despite the strong end to the year.

Earnings and revenue both missed the street's expectations. Revenue came in at US$7.85 billion against expectations of US$7.86 billion, and earnings were light at US$0.12 vs the US$0.42 expected.

Its long-term objectives have remained the same, sustain double-digit revenue growth, failed in 2022, expand operating margin, and continue to grow positive free cash flow.

Some volatility to shares could be caused by the announcement that Netflix Co-Founder Reed Hastings will be down from his role as co-CEO, after being at the helm for more than 20 years.

Although this is unlikely to bring any dramatic changes, a change in C-suite management may bring some uncertainty for shareholders.

Small cap wins for the week

CuFe surges 43.7%

CuFe Ltd (ASX:CUF) shares have lifted 43.7% this week, on news the company would resume operations at the JWD Iron Ore Mine and had already secured several offtake positions.

Read more

Aruma Resources soars 38.5% higher

Aruma Resources Ltd (ASX:AAJ) shares were up 38.5% over the week, on news the company had appointed a new managing director to advance its portfolio of lithium and gold assets.

Read more

Corazon Mining leaps 31.5%

Corazon Mining Ltd (ASX:CZN) securities gained 31.5% over the last five days, buoyed by news of more high-grade lithium rock chips in sampling at the Miriam Nickel Sulphide Project in Western Australia.

Read more

Kingston Resources jumps 26.2%

Kingston Resources Ltd (ASX:KSN) gained 26.2% over the week after achieving record gold production at its Mineral Hill Mine in New South Wales over the last months of 2022.

Read more

Parabellum Resources climbs 25.6%

Parabellum Resources Ltd (ASX:PBL) shares have increased by 25.6% following news the company had begun discussions with three drilling contractors to begin a maiden drilling program on PBL’s copper-gold projects in New South Wales.

Read more

Read more on Proactive Investors AU