Sunstone Metals Ltd (ASX:STM) has raised $2 million via an oversubscribed share placement at 1.1 cents ($0.011) per share to new and existing institutional, professional and sophisticated investors as part of a capital raising exercise for up to $6.3 million.

In a show of confidence, and subject to shareholder approval, the board of directors intend to put $150,000 of their own money in.

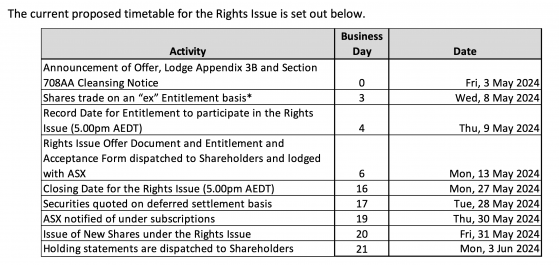

The company will also undertake a non-renounceable pro-rata rights issue to raise up to $4.3 million (before costs) from existing shareholders.

The placement and rights Issue are being undertaken at the same offer price of 1.1 cents, which represents a discount of:

- 21.4% to the last closing of 1.4 cents ($0.014) on April 30, 2024; and

- 19.9% to the 10-day volume weighted average price of 1.37 cents ($0.0137) as at April 30, 2024.

- The offer is not underwritten.

Investment in exploration

Proceeds from the offer will be allocated to resume drilling operations at the Limon gold-silver epithermal discovery within the company's Bramaderos concession in Ecuador.

Additional funds will support continued exploration activities at the El Palmar and Verde Chico sites, aiming to enhance the demonstrated value of these discoveries.

The remaining funds will cover corporate and administrative expenses in Australia and Ecuador.

"Huge potential upside"

“The outstanding drilling and trenching results have already established that Limon is an exceptional discovery with huge potential upside, Sunstone managing director Patrick Duffy said.

“To have this amount of known gold and silver mineralisation from surface, which remains open, and with numerous new areas of mineralisation outlined through trenching, puts us in a very strong position in the lead-up to a maiden resource.

“We have an exceptional opportunity to create shareholder value here as we drill it out and demonstrate the size of what we have found.”

Placement and rights issue details

The company has announced the issuance of approximately 183.8 million new fully paid ordinary shares through a placement and rights issue. Of these, 13.6 million new shares are allocated to the board of directors, pending shareholder approval, while 168.2 million are available under ASX Listing Rule 7.1. These shares will rank equally with existing shares.

Morgans Corporate Limited and Canaccord Genuity (TSX:CF, LSE:CF) served as joint lead managers for the placement.

The rights issue will allow eligible shareholders to purchase one new share for every nine shares they hold at an offer price of 1.1 cents per new share, the same as the placement price. This could potentially raise up to A$4.3 million, before issue costs, with around 389 million new shares issued.

Eligible shareholders, identified as those with a registered address in Australia or New Zealand, may also access a shortfall facility to subscribe for additional shares.

Read more on Proactive Investors AU