Magnetite Mines Ltd (ASX:MGT) has launched a 1 for 5 renounceable rights issue to raise up to $4.1 million with funds to provide working capital to complete definitive feasibility study (DFS) funding negotiations with strategic partners.

The money will also go to the submission of a Mining Lease proposal for the Razorback Iron Ore Project in South Australia.

MGT is committed to developing the Razorback Project with a strategy of attracting sought-after strategic and offtake partners.

The raise will be partially underwritten to $2 million by lead manager and underwriter Mahe Capital with eligible shareholders to participate at $0.20 per share – a 13% discount to the last closing price of $0.23 per share and 20% to the 15-day VWAP on ASX of $0.25 per share.

With every 1 new share subscribed, shareholders receive 1 free attaching option, which will have an exercise price of $0.30 and a term of three years.

This latest raise follows the $1.17 million raised in July, with directors and management subscribing for $242,000 to the previous offer.

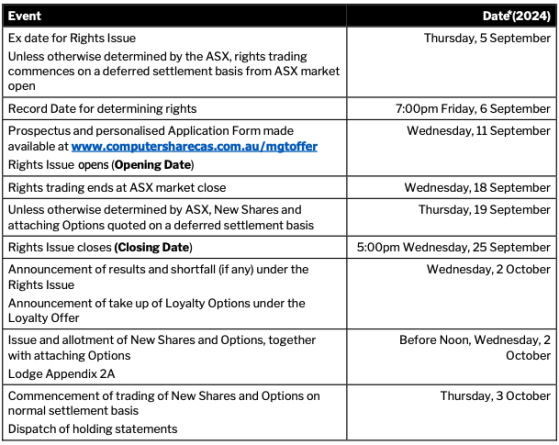

The rights issue will open on Wednesday, September 11, 2024, and close at 5.00 pm on Wednesday, September 25, 2024.

Funds to be used for two clear priorities

Magnetite has two clear priorities:

“In July 2024, the company achieved a major milestone by signing a Heads of Agreement with JFE Shoji to negotiate a binding transaction that will provide funding support for the completion of a definitive feasibility study for the Razorback Iron Ore Project. JFE Shoji is part of the JFE Group, which also incorporates JFE Steel, Japan’s second-largest steelmaker,” MGT chair Jim McKerlie said.

“The board believes that a stronger balance sheet will enable Magnetite Mines to continue to build on this progress, secure the strategic partnerships crucial for the development of Razorback and to progress the essential regulatory approvals required to build the project.”

The company believes it is positioned for success, with a premium iron ore resource and the ability to attract high-calibre partners seeking long-term involvement in the project. It is also garnering strong support for its role across the highest levels of Federal and state governments.

Ultimately, the funding will go towards Magnetite’s ambition to become a major iron ore player and key enabler of Australia’s proposed new green iron opportunity. It intends to become a long-life, high-value iron ore operator, producing premium-grade magnetite concentrates at scale, for decades into the future.

“Magnetite Mines has made significant achievements over the past 12 months and we are committed to ensuring greater recognition of the long-term shareholder value this has created,” McKerlie said.

“The company has an ongoing aggressive cost management program and maintains a small headcount of experienced people that are essential for attracting and working with the major organisations we are partnering with. This team has expertise and experience in areas where there are skill shortages and high demand.”

Key achievements over the past six months:

- Securing strategic partnerships, including signing agreements with JFE Shoji Australia Pty Ltd and ZEN Energy;

- Progressing regulatory approvals, with the Mining Lease Proposal nearing submission;

- Achieving a technical breakthrough in saline water processing; and

- Engaging extensively with government bodies to support the emerging green iron industry.

Strong support fuels MGT

Magnetite is thankful for the support it has received in bringing it to the position it currently sits in.

“In what has been a year characterised by challenging equity markets, the board is very thankful of all our loyal shareholders who have provided ongoing support for the company, particularly those who supported the company by participating in our July capital raising," McKerlie said.

"This new rights issue provides all shareholders the opportunity to participate at an attractively discounted price, and in doing so, finalise the funding round across the two capital raising activities we have pursued in 2024.

“Magnetite Mines has made significant achievements over the past 12 months and we are committed to ensuring greater recognition of the long-term shareholder value this has created.”

Indicative timetable

Read more on Proactive Investors AU