The drilling success continues for Latin Resources Ltd (ASX:LRS, OTC:LRSRF) at Colina deposit within the Salinas Lithium Project in Brazil, where high-grade infill results have confirmed the top-tier quality of the project.

Latin has received multiple high-grade assay results from the ongoing resource drilling program in the central zone of Colina deposit, affirming the continuity of thickness, consistency and quality of mineralisation.

Results included one of the largest intersections ever encountered at the Salinas Project with 32.92 metres at 1.62% lithium oxide from 325.19 metres, including 27.81 metres at 1.80% from 325.19 metres (in SADD246).

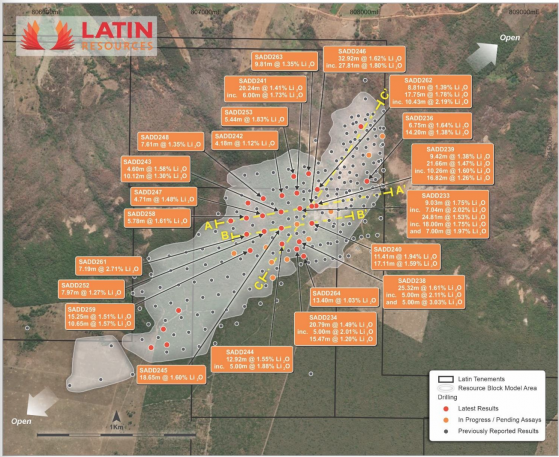

Plan view of the resource drilling program at the Colina Deposit, indicating new assays and section locations.

True thickness analysis of all current pegmatite intersections has shown that 75% or 48.3 million tonnes of the December 2023 mineral resource estimate (MRE) is derived from pegmatites with a true thickness of greater than 5 metres, including 39% or 24.8 million tonnes of the December 2023 MRE derived from pegmatites greater than 15 metres true thickness.

Colina Pegmatite true-thickness – December MRE tonnage distribution.

The importance of these new assay results and their location further enhances the geological understanding of the Colina lithium mineralised system and provides significant confidence toward the upgrade into measured category for the upcoming MRE and converting into the reserves category as part of the DFS, which is due to be released in 3Q 2024.

“With the Colina deposit infill drilling almost complete we are gearing up to run our next mineral resource estimate. This update will be focused on increasing the JORC mineral classification of the existing 63.5 million tonnes resource to enable the declaration of mineral reserves as part of the DFS which is currently underway,” said Latin Resources vice president of operations - Americas Tony Greenaway.

“Results from our infill drilling closely match our existing data, confirming the robustness of our early interpretations for the Colina pegmatites. Once the infill drilling is completed, we will refocus some of our drilling fleet back onto our high-priority exploration target at Planalto, where our first drill hole intersected thick high-grade mineralisation.”

Drilling continues

There are currently 16 rigs on site undertaking the 2024 drilling program encompassing resource definition, metallurgical and geotechnical drilling.

These programs will continue throughout the 2024 drilling season, aimed at increasing tonnage and upgrading the confidence level in the current Colina mineral resource estimate model and to further identify and validate new priority drill targets at Colina, Planalto, Salinas South and Fog’s Block deposits.

At Colina, the resource definition drilling program, which started in December 2023, is set to be completed on time at the end of this month.

The program is primarily aimed at infill and extensional drilling, with the goal of improving the confidence of the JORC resource categories and extending the spodumene mineralisation at the existing Colina MRE down dip. It will also deliver an upgraded confidence level in the current Colina resource estimate.

As it stands, the Colina deposit contains a MRE of 63.5 million tonnes at 1.3% lithium oxide, based on 198 drill holes for 64,769 metres of drilling.

Read more on Proactive Investors AU