Highfield Resources Ltd (ASX:HFR) has awarded a contract for the construction of civil works at the Muga-Vipasca Potash Project in Spain.

The contract for construction of the Civil Works and Urbanization for the Muga Project has been awarded to Acciona Construcción, S.A. following a “robust” tendering process.

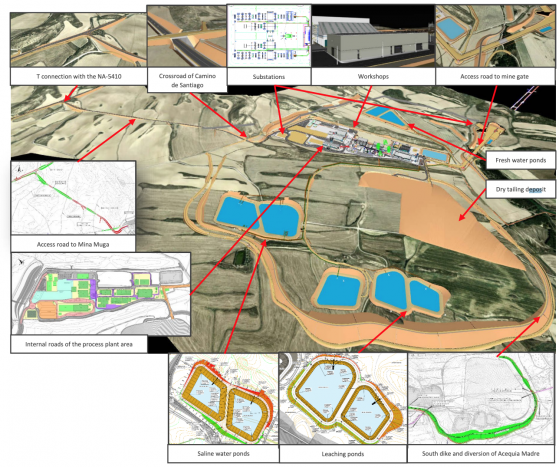

Under the contract, Acciona — a well-known Spanish international construction company — will provide infrastructure including facilities and equipment for transportation, energy, water supply, waste treatment and disposal. The group has significant experience in civil works including the construction of tunnels, bridges, ports and hydraulic works as well as airports.

Now having signed with Acciona, and once funding is completed and a final investment decision is made, Muga is ready to start building.

"Well prepared to start construction"

Highfield CEO Ignacio Salazar said: “We are pleased to be signing the last key contract for the construction of Muga. The civil works are the main component of the contract, and we are pleased to partner with Acciona with whom we have a long-standing relationship.

“With this contract, we are well prepared to start construction and build Muga to deliver a new and robust source of a critical fertiliser located strategically in the middle of the European market.

“Furthermore, the signing of this contract coincides with continued significant progress made in the negotiations with strategic investors to complete the remaining Muga funding.

“With the permitting in Spain sorted, the project fully prepared to start construction and the debt financing in place, Highfield is fully focused on finalising the strategic process and getting Muga in construction.”

The contract value is a lump sum contract with a value of €56.9 million which is in line with the estimated cost included in last year’s updated Muga Feasibility and accounts for one-third of Highfield’s construction budget.

Around 40% of the €449 million Muga capex estimate relates to construction work, including construction of the mine, the civil works and the processing plant. The remaining 60% of Muga’s capex covers equipment, land purchases, licences, staff, and indirect costs, all of which are well prepared.

Illustration of contracted process plant urbanisation works.

Financing progressing

Highfield says “good progress” is being made on the financing including discussions with several strategic investors which have signed non-binding term sheets, and are advancing due diligence, and negotiations.

The company is actively negotiating with a combination of potential investors from a range of sources — including offtake customers, equity investors, strategic business partners and royalty providers — to complete the remaining funding of Muga.

Based on progress so far, Highfield plans to conclude these negotiations during the current quarter.

Read more on Proactive Investors AU