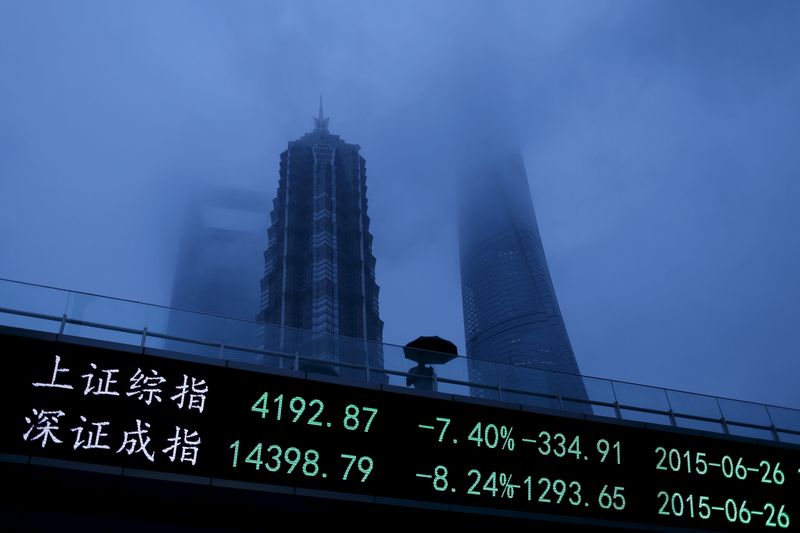

* Asian stock markets : https://tmsnrt.rs/2zpUAr4

* Pound hits 20-mth low as British PM risks party challenge

* Wall St ends mixed on conflicting Sino-US trade news

* China might cut tariffs on US autos, more detail awaited

* Oil prices bounce after big draw in stockpiles

By Wayne Cole

SYDNEY, Dec 12 (Reuters) - Asian markets faced a fraught session on Wednesday as conflicting reports deepened confusion over Sino-U.S. trade, while sterling was battered by talk of an imminent party coup against British Prime Minister Theresa May.

Investors also had a wary eye on events in Strasbourg, where a lone gunman shot dead at least four people and wounded 11 others near a Christmas market. European Parliament, which is sitting in Strasbourg this week, was put into lockdown.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS firmed 0.09 percent in sporadic early trading.

Nikkei futures NKc1 hinted at a modest opening bounce after two days of losses, while E-Mini futures for the S&P 500 ECc1 edged up 0.07 percent.

Sterling slid on reports Conservative lawmakers could vote on a no confidence motion in May's leadership as soon as Wednesday night. political ructions come a day after her decision to delay a vote in parliament on her Brexit deal for fear of a rout angered many in her Conservative Party.

The news sent the pound reeling to a 2-month trough of $1.2484 GBP=D3 , a loss of 1.9 percent in just two sessions.

The euro climbed to 90.62 pence EURGBP= , even as it eased on the dollar to $1.1318 EUR= . The dollar was being viewed as the best of a bad bunch and rose to 97.466 on a basket of currencies .DXY .

"The market is concerned that May could be replaced by a Brexit-supporter, increasing the chance of a no-deal scenario," said Rodrigo Catril, a senior FX strategist at NAB.

"Bottom line: there is great uncertainty about whether Theresa May can survive as PM and what the prospects are for a general election, new referendum or a hard Brexit."

"CHOP-FEST"

Sentiment had got a brief lift on Tuesday from reports China was considering cutting import tariffs on American-made cars to 15 percent from the current 40 percent. there were also reports the U.S. would release evidence this week detailing Chinese hacking and economic espionage.

"Even if this (auto) step is taken it just removes what was a retaliatory measure to begin with," noted ANZ economist David Plank. "Moreover, markets are still be nervous about the evolving Huawei situation."

"Whatever the case, market price action is somewhat of a chop-fest, right now, as it swings around on each new headline."

The U.S. State Department expressed concern on Tuesday about reports a Canadian citizen has been detained in China following the arrest of Huawei Technologies' HWT.UL chief financial officer in Canada. were also jolted when President Donald Trump threatened to shut down the government over funding for a wall he has promised to build on the southern border with Mexico. cross currents left Wall Street mixed, with the Dow .DJI down 0.22 percent and the S&P 500 .SPX 0.04 percent, while the Nasdaq .IXIC added 0.16 percent. .N

Investors were looking ahead to the U.S consumer price report later on Wednesday where an expected slowdown in headline inflation would only reinforce speculation of fewer rate hikes from the Federal Reserve. on a more restrained Fed helped gold steady near a five-month peak of $1,243.11 XAU= an ounce.

Oil bounced a little after industry data showed a surprisingly large draw on stockpiles. O/R

Brent futures LCOc1 added 54 cents to $60.51 a barrel, while U.S. crude CLc1 rose 97 cents to $51.97.

<^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ Asia stock markets

https://tmsnrt.rs/2zpUAr4 Asia-Pacific valuations

https://tmsnrt.rs/2Dr2BQA

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^> (Editing by Shri Navaratnam)