The ASX fell today on the back of the Bank of Japan’s decision to “modify the conduction of yield curve control in order to improve market functioning and encouraging a smoother formation of the entire yield curve, while maintaining accommodative financial conditions".

Essentially the BoJ has altered its closely watched yield curve control program. It is allowing Japan’s 10-year bond yields to rise to 0.5%, up from the previous upper limit of 0.25%.

The target for the yield remains unchanged at around zero per cent.

Japan's move saw the blue-chip Nikkei 225 Stock Average plunge as much as 2.6%, while the broader Topix fell 1.6% in the afternoon session, erasing earlier gains. The yen was the winner. It strengthened around 2.8% against the dollar.

The S&P/ASX200 dropped 109.60 points or 1.54% to 7,024.30 and setting a new 20-day low. Over the last five days, the index has lost 2.48% and 3.67% over the last 52 weeks.

Bottom-performing stocks in this index are Johns Lyng Group Ltd and Liontwon Resources Ltd, down 11.89% and 9.63% respectively.

Looking at the sectors, nothing was in the green. The biggest loser was Information technology down 4.38%, followed by Real estate down 3.79% and Coonsumer Discretionary down 3.53%.

What’s making news

What did the BoJ do?

The Japanese yen is aggressively stronger following the BOJ’s YCC announcement. Matt Simpson, Senior Market Analyst, City Index gives his take.

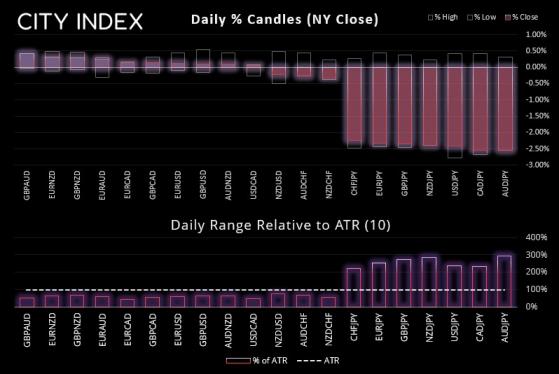

A sleepy session in Asia has been rudely awoken from is lull on the news that the BOJ will review their YCC (yield curve control), sending the Japanese yen sharply higher across the board.

The BOJ (Bank of Japan) have increased their upper limit of their yield target to 0.5% and will allow it to move freely between -0.5% to 0.5%. Markets were quick to react with the 10-year JGB rising to 4.3% - it’s highest level since 2015. The OIS curve is also rising aggressively as markets price in the end of the BOJ's ultra-loose policy.

No action was expected from today’s meeting – and the bank of Japan once again teach us that complacency is the devil. It’s almost as if they wait until nobody is watching before announcing any change of policy. And this is arguably the biggest surprise they have handed markets since moving to negative interest rates in January 2016.

Still, the winds of change are growing stronger with Japan’s financial regulator recently looking into risks for the bond market ‘if’ the BOJ were to remove their ultra-loose policy. And Japan’s PM now looking for flexibility with the inflation target with his review of the 10-year accord with the BOJ. So the move from the BOJ has not come without warning, it’s just few were paying attention ahead of the holiday period.

USD/JPY is currently down around -2.6% for the day, which is its worst session since the November US inflation report which came in much softer than expected. But you can look across any yen pair and they look very similar – strength to the yen to the detriment to the currency you trade it against. And whilst volatility is significantly high for an Asian session, take note that European and US markets are yet to react. From here is looks as though USD/JPY could be headed for 130 now that it has broken to a new cycle low.

RBA could have gone higher in December

Reserve Bank of Australia minutes show the central bank was considering a 0.5% cash rate hike.

“The arguments for a 50-basis point increase stemmed from the fact that inflation remained too high and the economy continued to operate with excess demand,” the minutes said.

“The arguments for a 25-basis point increase also recognised the need to bring demand and supply in the economy more into balance but acknowledged that there had already been a significant cumulative increase in interest rates and that the full effects of this adjustment would take time to occur.

“The arguments for no change in the cash rate placed further emphasis on the lagged effects of the large policy adjustment to date and the value in proceeding cautiously in an uncertain environment.”

Eventually, the 0.25% hike was implemented.

“A further increase in the cash rate was likely to be necessary to achieve a more sustainable balance of demand and supply but there had already been a material increase in the cash rate in a short period of time and there were lags in the operation of policy.

“Members also noted the importance of acting consistently and that shifting to either larger increases or pausing at this point with no clear impetus from the incoming data would create uncertainty about the board’s reaction function.”

Rates are expected to increase further in 2023.

“Members noted that the size and timing of future interest rate increases would continue to be determined by the incoming data and the board’s assessment of the outlook for inflation and the labour market.

“Recognising this uncertainty, members noted that a range of options for the cash rate could be considered again at upcoming meetings in 2023. The board did not rule out returning to larger increases if the situation warranted.

“Conversely, the board is prepared to keep the cash rate unchanged for a period while it assesses the state of the economy and the inflation outlook.”

The RBA board is determined to return inflation to target.

“Members emphasised that the board’s priority is to re-establish low inflation and return inflation to the 2 [per cent] to 3 per cent target range over time.

“High inflation damages the economy and makes life more difficult for people.

“The substantial cumulative increase in interest rates since May has been necessary to ensure that the current period of high inflation is only temporary.”

Five at five

Magmatic Resources powers through 6,000 metres of diamond drilling in four months at Myall

Magmatic Resources Ltd (ASX:MAG) has wrapped up diamond drilling at the 100%-owned Myall Project in Central West New South Wales designed to expand the Corvette Prospect to the south, north, west and at depth.

Read more

Arovella Therapeutics secures exclusive option to license cytokine technology to enhance iNKT cell platform

Arovella Therapeutics Ltd (ASX:ALA) has obtained an exclusive option to license a cytokine technology which could enhance iNKT cells, allowing them to persist longer and grow in larger numbers while also potentially supercharging the performance of the platform in solid tumours and blood cancers.

Read more

Kingfisher (LON:KGF) Mining completes 2022 drill program targeting REE at Mick Well

Kingfisher Mining Ltd (ASX:KFM) has completed its 2022 drill program targeting rare earth element (REE) mineralisation below high-grade outcropping at the Mick Well REE Project in the Gascoyne region of Western Australia.

Read more

Critical Resources pulls off strategic acquisition to increase Mavis Lake Lithium Project footprint by 324%

Critical Resources Ltd (ASX:CRR) has executed a binding purchase and sale agreement with TSX-V lister Power Metals Corp to acquire its Gullwing-Tot Lakes property in Ontario, Canada.

Read more

Blackstone (NYSE:BX) Minerals' completed Ta Khoa pilot program shows project is low-cost with low emissions

Blackstone Minerals Ltd (ASX:BSX, OTCQX:BLSTF) has completed a 12-month pilot program for its integrated Ta Khoa Refinery Project (TKR) in Vietnam with outcomes showing it will be one of the world's lowest cost and lowest emission projects.

Read more

On your six

Upholding the social contract: Alex Biggs

Lightning Minerals' Alex Biggs understands that expertise, speed and integrity are vital traits in the critical minerals industry; especially as Australia and the rest of the world race to decarbonise toward net neutrality.

Read more

The one to watch

NickelSearch takes the drill rig to Carlingup's priority targets

NickelSearch Ltd (ASX:NIS) managing director Nicole Duncan sits down with Proactive's Elisha Newell to discuss drilling activity at the Carlingup Nickel Project in WA.

Read more

Read more on Proactive Investors AU