The ASX paired back early gains of 0.9% just before midday to settle up 0.29% for the day, adding 22.60 points to 7,849.40 and crossing back across its 50-day moving average.

The bourse endured an unusually high level of attention today, after ASIC revealed it had sued the market operator for making "misleading statements" about the status of its Clearing House Electronic Subregister System (CHESS) replacement project.

Read: ASIC sues ASX for misleading statements about CHESS replacement project

There was strength in nine of 11 sectors with particularly strong performances by Tech (+1.78%) and Health Care (+1.89%) and an honourable mention for Real Estate (+1.38%).

Energy was flat but Mining stocks suffered, falling 1.80%. Yesterday, the Australian Financial Review reported hedge funds in Asia are increasingly buying short positions on ASX mining stocks, betting current weak commodity pricing will be enough to weaken the industry.

Pilbara Minerals, Liontown Resources (ASX:LTR), Syrah Resources, Chalice Mining, Strike Energy and Lynas Rare Earths were among the top 10 most shorted stocks by percentage on the ASX, according to data compiled by Shortman, a website that tracks ASX short trades.

Today, BHP (ASX:BHP) is down 2.67%, Fortescue (ASX:FMG) 4.74% and Rio Tinto (ASX:RIO) 2.37%. Ironically, Strike Energy jumped 5.88% today and Lynas is up 0.98% although Liontown Resources (ASX:LTR)’ stock slipped 1.23%.

Tech’s performance more than made up for the damage. WiseTech Global gained 2.64%, Xero 0.88% and NextDC 1.99%.

In Health Care, the standouts were CSL, up 2.41%, Resmed with a 1.42% gain and Pro Medicus, up 7.65%, which was also the top-performing stock on the ASX today alongside Orora Ltd, up 7.05%.

Overall, the ASX has gained 1.94% over the last five trading days, but still sits 3.67% off its recent highs.

Close watch on US CPI data

“There’s evidently scope for upside in equities from downside surprises in inflation data, with Wall Street rallying after lower-than-expected PPI data,” said Capital.com senior market analyst Kyle Rodda, commenting on the latest economic data out of the US.

“Core producer prices were revealed to have risen 2.4% in July, tumbling from 3% and below the 2.7% forecast.

“The data triggered a plunge in short-end yields – despite a relatively modest move in rate expectations, which is to be expected given the deep-cutting cycle currently discounted, which includes 100 basis points of cuts by the end of 2024.

“The Nasdaq outperformed as US tech stocks retraced their recent drawdown, allaying, although not extinguishing, fears of a top in equities for the cycle.

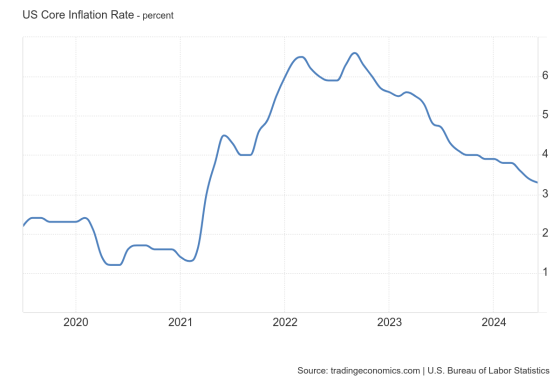

“The markets will look to the US CPI survey for confirmation that the underlying inflation pulse in the economy is diminishing and that last night’s rally is justified.

“Economists forecast that core CPI moderated to 3.2%, which, if it materialises, will mark a fresh three-and-a-half-year low.”

(Source: Trading Economics)

The Five at Five

Noxopharm soars as CRO-67 reduces pancreatic tumours and barrier cells in complex studies

Noxopharm Ltd (ASX:NOX, OTC:NOXOF), an innovative biotech company, has soared on new data regarding its CRO-67 preclinical drug for pancreatic cancer that shows significantly reduced pancreatic tumours and barrier cells in a complex model.

Read more

Evion Group charts course to Madagascan mining permits and EU funding under Critical Raw Materials Act

Evion Group NL (ASX:EVG, OTC:EVIGF) has laid out a regulatory pathway to secure mining permits for its Maniry Graphite Project in Madagascar and European Union (EU) funding to develop the project under the Critical Raw Materials Act.

Read more

Lightning Minerals eyes more lithium ground in Brazil with option agreement for Esperança

Lightning Minerals Ltd (ASX:L1M) has inked a binding exclusive call option agreement for the acquisition of the Esperança Project, which is just 5 kilometres south of the company’s recently acquired projects in the prolific lithium district of Minas Gerais, Brazil.

Read more

AuKing Mining has short-term funding agreement extended

In a strong show of support for AuKing Mining Ltd (ASX:AKN) and its critical minerals strategy, chair Peter Tighe has extended a $750,000 short-term funding agreement with the company.

Read more

Evolution Mining more than doubles final dividend amid robust gold and copper demand

Robust demand for gold and copper has resulted in a record $422 million in annual profit for Evolution Mining Ltd (ASX:EVN), promoting the company to more than double its final dividend and provide an optimistic outlook for the year ahead.

Read more

On your six

Westpac Consumer Sentiment Index rises 2.8% in August

The Westpac–Melbourne Institute Consumer Sentiment Index increased by 2.8% in August, rising to 85 from 82.7 in July. This marks an improvement in consumer sentiment for the month.

Read more

One to watch

Sprintex targets 400% growth with clean energy and high-speed motor technologies

Sprintex Ltd (ASX:SIX) managing director Jay Upton joins Proactive’s Tylah Tully to discuss its series of upcoming investor and broker briefings, highlighting its strategic progress and market outlook.

Watch more

Read more on Proactive Investors AU