- High valuations raise questions, but history suggests bear markets remain the exception, not the rule.

- With momentum and policy support in play, 2025 could defy bearish assumptions.

- Diversification and risk management are key to navigating an expensive yet resilient market.

Investors often approach the market like a game of roulette—placing bets on red or black while ignoring the green zeros that tilt the odds. Many rely on a binary mindset: if the market soared last year, surely it must crash this year. If S&P 500 gained 20%, some assume a 10% loss is inevitable.

But this logic is as flawed as it is widespread. To make sound decisions, we need to set aside assumptions and analyze the market with data and reason. Let’s dive into the numbers to assess where we stand and what might lie ahead.

Could Current Market Valuations Lead to a Decline in 2025?

There’s no sugarcoating it—the U.S. stock market is expensive. By nearly any measure, valuations are near historic highs, multiples are stretched, and future returns are expected to be modest. This presents undeniable risks that every portfolio should account for.

However, high valuations alone don’t guarantee a market crash in 2025. Here’s why:

- Bear Markets Are Rare Events

Statistically, bear markets occur once every four years. With 2022 marking the last bear market, history suggests 2025 could still deliver solid returns.

- Momentum Matters

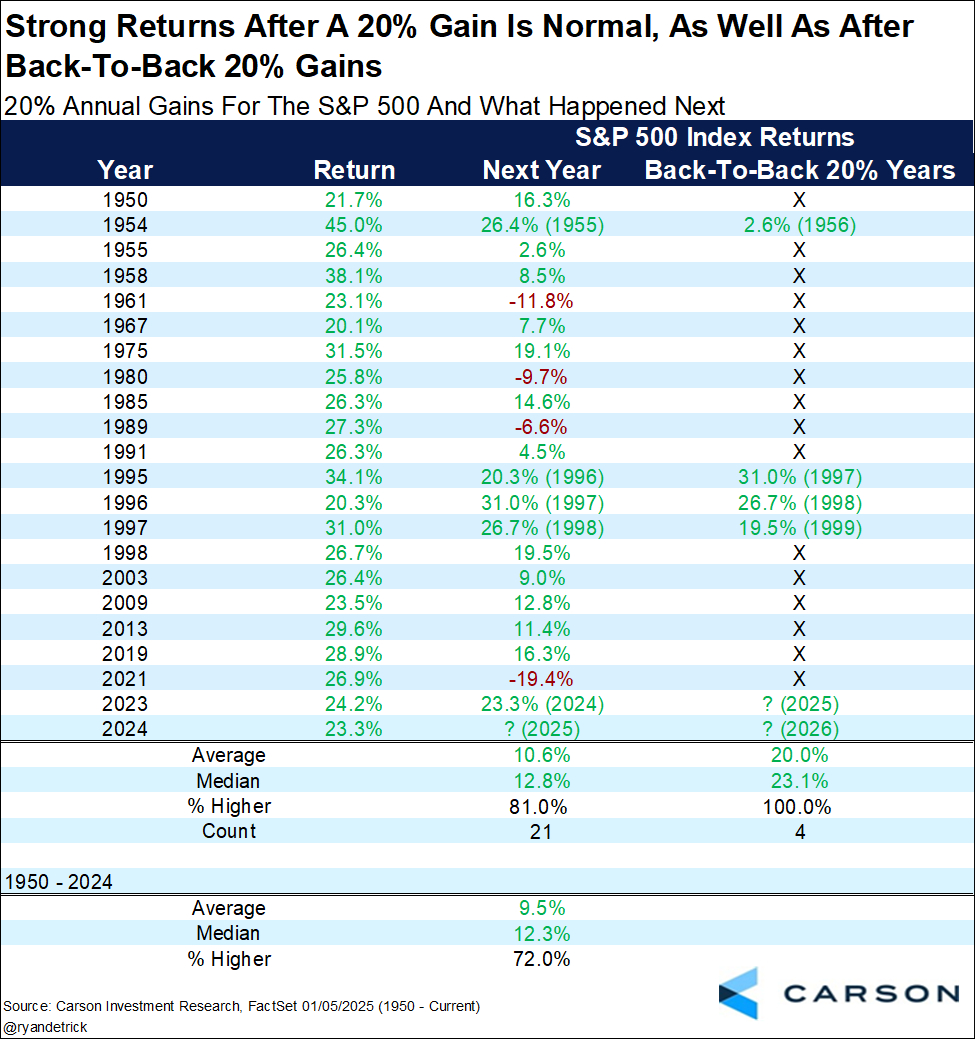

Both 2023 and 2024 delivered gains exceeding 20%. In similar cases, the third year following such strong performances has been positive 100% of the time, as shown in the table below.

- Policy and Economic Tailwinds

The U.S. government, under new leadership, is likely to prioritize economic growth and stock market performance. Meanwhile, central banks, especially the Federal Reserve, still have tools to manage economic turbulence, including high interest rates that provide room for easing if needed.

Risk Management Remains Crucial

Even with these optimistic factors, we can’t ignore the risks posed by an expensive market. As the saying goes, “You can’t predict, but you can prepare.” And preparation starts with recognizing the challenges.

For international investors, the historically strong US dollar compounds the risk. To mitigate exposure, consider these strategies:

- Diversify Into Bonds

Both U.S. and European bond yields are attractive right now, offering a compelling alternative to equities.

- Explore Less-Correlated Assets

Look beyond U.S. markets and tech-heavy portfolios. Consider regions or sectors with historically lower correlations to these drivers.

- Adopt Fractional or Periodic Investment Strategies

Dollar-cost averaging or periodic accumulation plans can help navigate volatile markets more effectively.

Bottom Line

Managing the current market phase requires finesse. We’re neither at a euphoric peak nor a market low, where trading decisions tend to be clearer. This middle ground makes it crucial to stay adaptable.

The goal is twofold: capture potential market upside if 2025 proves to be another strong year while minimizing the impact of any significant corrections.

Remember, pullbacks of up to 10% are normal and statistically likely to occur at least once a year. These dips don’t signal doom but should be part of any prudent risk management plan.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.