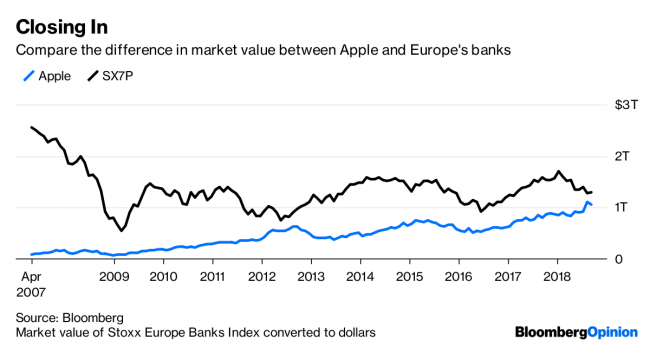

(Bloomberg Opinion) -- Bloomberg Opinion marks the 10th anniversary of Lehman’s bankruptcy with a collection of columns from around the world. Read more.To see how Europe’s banking system has failed to bounce back from the collapse of Lehman Brothers Holdings Inc., one metric will suffice. The market value of a single U.S. company — Apple Inc (NASDAQ:AAPL). — is getting close to that of Europe’s 48 biggest banks combined.

On almost any measure, Europe’s lenders have been the loser from the financial crisis. They are less profitable and less valuable than they were in 2008. They’ve lost market share to Wall Street rivals, whose share prices have recovered handsomely. The market capitalization of the Standard & Poor’s Financial Sector Index has climbed to $3.4 trillion today.

What explains this divergence? Europe’s political leaders wasted the crisis: They cauterized the wound, but missed the chance to clean up, consolidate and overhaul a fragmented financial system. The region’s banking chiefs dragged their feet, resisting calls for more regulation and not bolstering their balance sheets quickly enough.

By contrast, the U.S. was decisive, providing a $700 billion bailout that recapitalized the biggest lenders and let them offload their worst loans in to the Troubled Asset Relief Program. There was no such initiative in Europe, and banks there have proved less willing than U.S. peers to offload assets at a heavy discount.

The sovereign debt crisis that by 2012 had engulfed Europe underscored the previous failures and slowed the industry’s recovery. Even now, policymakers haven’t fixed the so-called “doom loop” — where a troubled bank’s big holding of government bonds can threaten a nation’s creditworthiness, and vice versa.

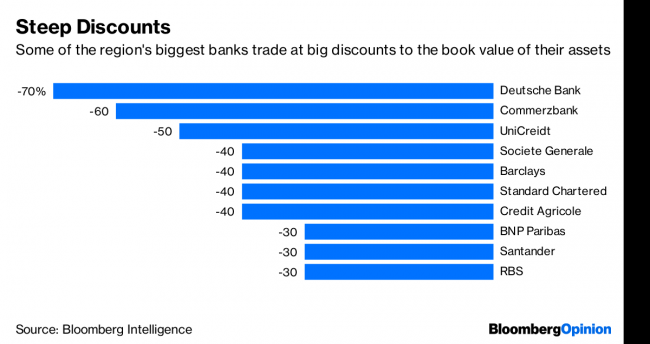

So the financial scars could take a decade more to heal — if they ever do. Bank shares haven’t returned to their pre-crisis level, with the likes of Deutsche Bank AG (DE:DBKGn) and Barclays (LON:BARC) Plc trading at a steep discount to the book value of their assets. This is not the sign of a healthy financial system.

Clients have taken their business to Wall Street. Europe has tumbled down the banking league tables. Barclays, the top underwriter of international bonds in 2008, now ranks fifth, according to Bloomberg data. Deutsche Bank, second in 2008, doesn’t even make the top five.

Europe remains unprofitable. Too many firms are chasing too few customers. The Lehman crisis never triggered the Bank of America/Merrill Lynch-sized mergers that we saw in the U.S. — another sign of the political shackles on meaningful European consolidation. We’re still waiting for the combination of Deutsche Bank and Commerzbank AG (DE:CBKG) or UniCredit SpA and Societe Generale (PA:SOGN) SA. In the meantime, Deutsche has dropped out of the Euro Stoxx 50 Index for the first time since its inception — a humiliation for Germany.

Amid the gloom, there are some brighter spots, of course. Not every firm is as dismal as Deutsche Bank, and some countries, like Spain, did attempt to tackle their broken lenders with merger programs. But Italy remains an open sore. Banks there are still struggling with bad loans, and consolidation is glacially slow.

As lenders prepare to wean themselves off the European Central Bank’s emergency programs, the cost of funding will rise, which may dent revenue for some, according to Jonathan Tyce, Bloomberg Intelligence’s senior banks analyst. “You can guarantee, if there are any wobbles, it will be the southern European banks that suffer most,” he says.

Europe urgently needs to speed the healing process to keep up its slow economic recovery. That won’t be easy. The EU still lacks a truly unified capital market or a proper banking union. Germany still hates the idea of bailing out the profligate south. Confronting Italy’s banks might simply strengthen that country’s Brussels-baiting populists.

If the crisis exposed one thing, it’s that the relationship between the banking system and national governments is a central failing of the European project. Until that’s fixed, Europe’s bankers will remain stuck in the recovery ward.