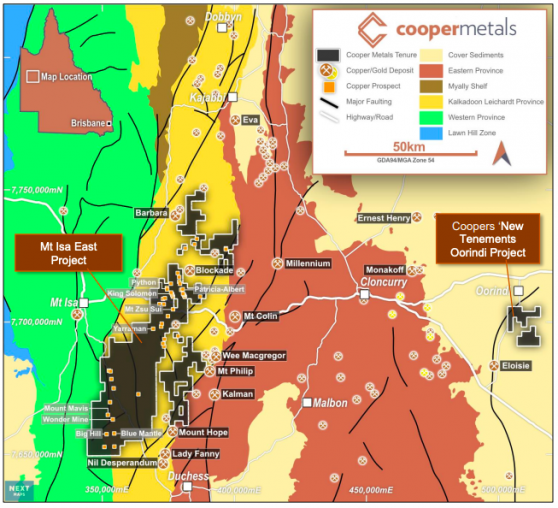

Cooper Metals Ltd (ASX:CPM) is expanding its foothold in the highly prospective Eastern Province of the Mt Isa Inlier in northwest Queensland with the signing of a binding term sheet (BTS) for the 100% acquisition of tenement EPM19686 near Cloncurry.

The Eastern Province hosts the significant Eloise copper-gold mine owned by AIC Mines Ltd, just 13 kilometres to the southeast, which has produced more than 13.5 million tonnes of ore grading 2.8% copper and 0.8 g/t gold.

Notably, the area is also where AIM’s Jericho copper-gold deposit was recently discovered, underscoring the Eastern Province's substantial mineral exploration opportunities.

Being adjacent to Cooper’s exploration licence application EPM28905, the new tenement, referred to as the Oorindi Copper-Gold Project, will add to the company’s land holding in the area to around 100 square kilometres.

Limited exploration

No on-ground exploration has been completed on EPM19686 in the last 10 years due to a lack of funding by its previous owners.

Melbourne-based mining giant BHP (ASX:BHP) conducted some drilling in the 1990s, mainly targeting magnetic highs at the Kevin Downs magnetic trend for IOCG-style mineralisation, including in the EPM28905 application area.

Cooper sees strong potential to uncover iron-sulphide copper-graphite (ISCG) style mineralisation in EPM28905 and EPM19686.

The company plans to use geophysics, such as electromagnetic surveys, to target prospective Proterozoic rocks in the area, and drill-test the highest-ranked anomalies.

Cooper's Mt Isa East project, including new acquisition tenement over regional geology and main prospects.

“Thrilled to add this area”

“Cooper has signed a binding term sheet for the acquisition of a tenement just a stone’s throw from the significant Eloise copper-gold mine,” Cooper Metals managing director Ian Warland said.

“The tenement has had no on-ground exploration for the last decade.

“Cooper believes the area has significant potential for copper-gold mineralisation and is thrilled to add this area to our impressive ground-holding in the Mt Isa Inlier.

“Plans are underway to commence exploration in the area once the transaction is finalised.

“Cooper continues to push ahead with exploration in our Mt Isa East Project, with reverse circulation drilling due to commence shortly on five prospects.”

Acquisition conditions

Under the agreement with Spinifex Rural Management Pty Ltd, the vendor of EPM19686, Cooper will issue 600,000 fully paid ordinary shares in the company, valued at $0.125 per share, as well as 300,000 free attaching unlisted options to Spinifex.

These options, exercisable at $0.25 each, will expire three years from the date of issue.

The success of the BTS depends upon:

- Cooper completing due diligence on the tenement;

- Shareholders’ approval at a general meeting to be held on October 12, 2023; and

- The company obtaining all other necessary approvals, including regulatory and board, to complete the proposals set out in the BTS.

Read more on Proactive Investors AU