- Stock screening is a critical component of any successful investing strategy.

- Investing.com recently hosted an educational webinar introducing its brand-new pre-set screeners designed to empower investors.

- Ready to start improving your portfolio? Test out this 3-step screener and watch how your investing game transforms.

- You can utilize the screener to pick out high-potential stocks too. Get started for free by accessing the new Investing.com screener here!

Navigating the stock market can be challenging for both new and experienced investors. With thousands of stocks to choose from and constant market fluctuations, it’s easy to feel overwhelmed.

However, in a recent webinar hosted by yours truly, I introduced a simple 3-step stock screening process that can help you outpace the market.

By following this system, you can streamline your decision-making process and make smarter investment choices.

You can watch the webinar, attached at the bottom of this article, to learn more about this simple 3-step stock screening process designed to help investors navigate the market with confidence and precision.

Here’s how you can use this 3-step screener to optimize your stock picks:

Step 1: Access Investing.com Pre-Set Screeners

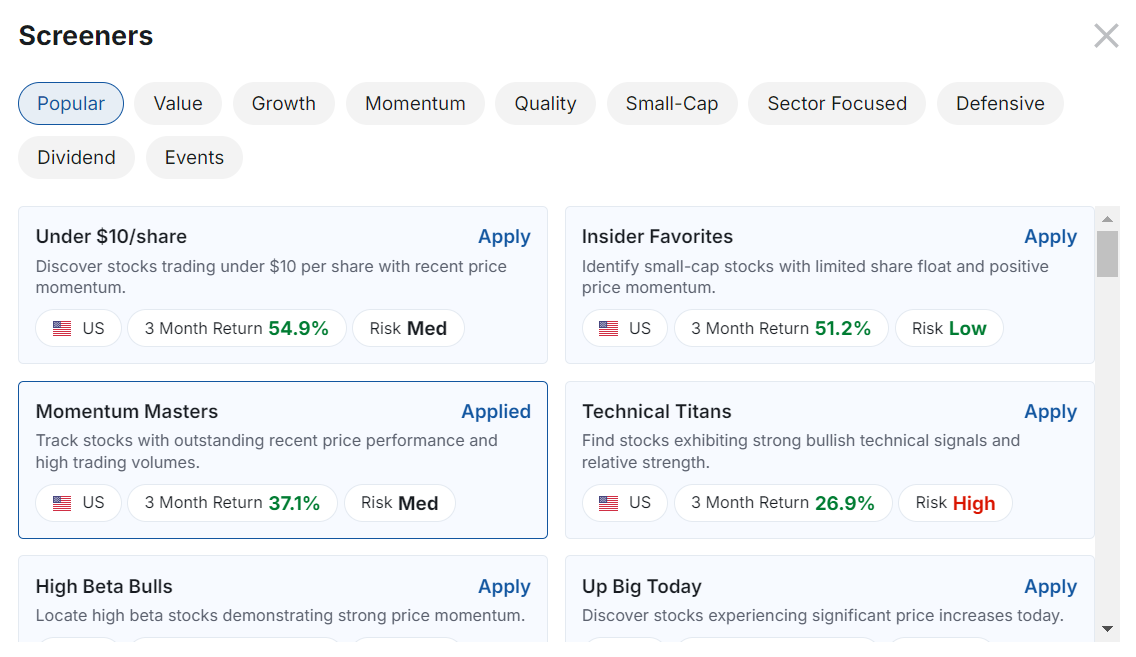

The first step is to leverage the powerful tools already available on Investing.com. The platform offers pre-set stock screeners that are designed to help you quickly filter out underperforming stocks and highlight potential winners.

Source: Investing.com

By using these pre-set screeners, you can eliminate much of the guesswork involved in stock selection and focus your attention on stocks that meet specific, high-performance criteria. This saves you time and gives you a strong starting point for your investment strategy.

Some of the most popular pre-set screeners include ‘Under $10/Share’, ‘Momentum Masters’, ‘Insider Favorites’, and ‘Technical Titans’ to name a few.

Step 2: Analyze Screener Results

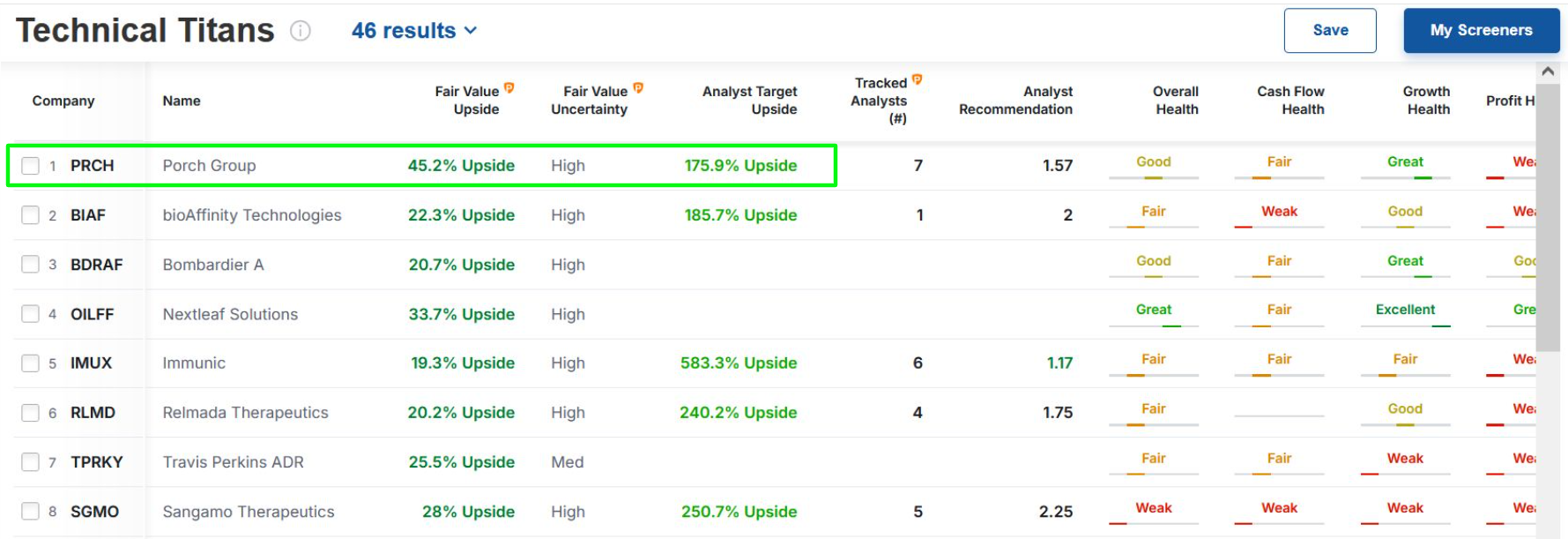

Once you've generated a list of potential stocks using Investing.com’s screeners, the next step is to analyze the screener results. At this stage, it’s essential to dive deeper into the data and evaluate the metrics that matter most to your investing strategy.

Source: Investing.com

Some important factors to consider include:

- Earnings Growth: Is the company consistently growing its revenue and profits?

- Valuation: Is the stock overvalued or undervalued compared to its peers?

- Financial Health: Does the company have a strong balance sheet with manageable debt levels?

By analyzing these results in detail, you can begin to separate the truly promising stocks from those that may not meet your expectations. This level of analysis ensures that you’re not just relying on raw data but making informed, strategic decisions.

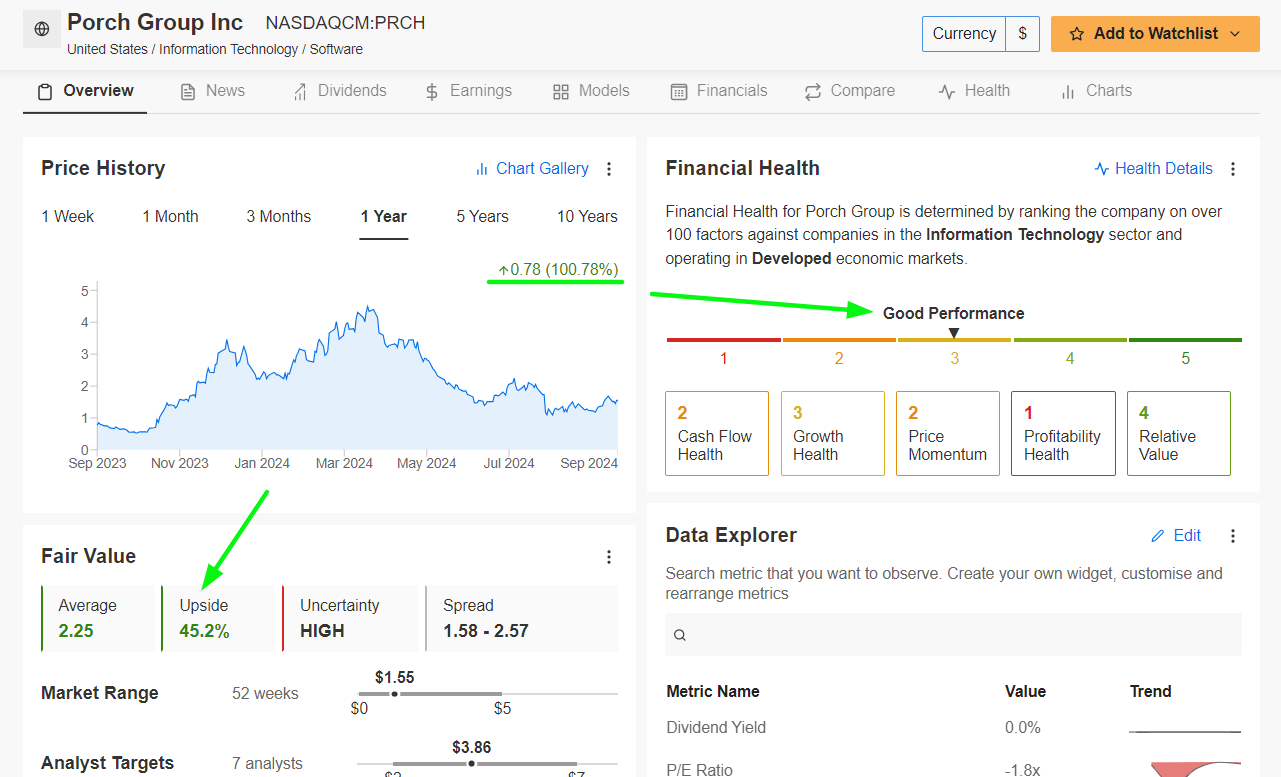

Step 3: Deep Dive Into Individual Stocks

Once you have a shortlist of stocks that meet your screening criteria, it’s time for a deep dive into individual stocks. This step involves taking a closer look at the companies behind the stocks you’re considering.

Some aspects to investigate include:

- Company Fundamentals: Review the company’s management team, business model, competitive advantages, and industry trends.

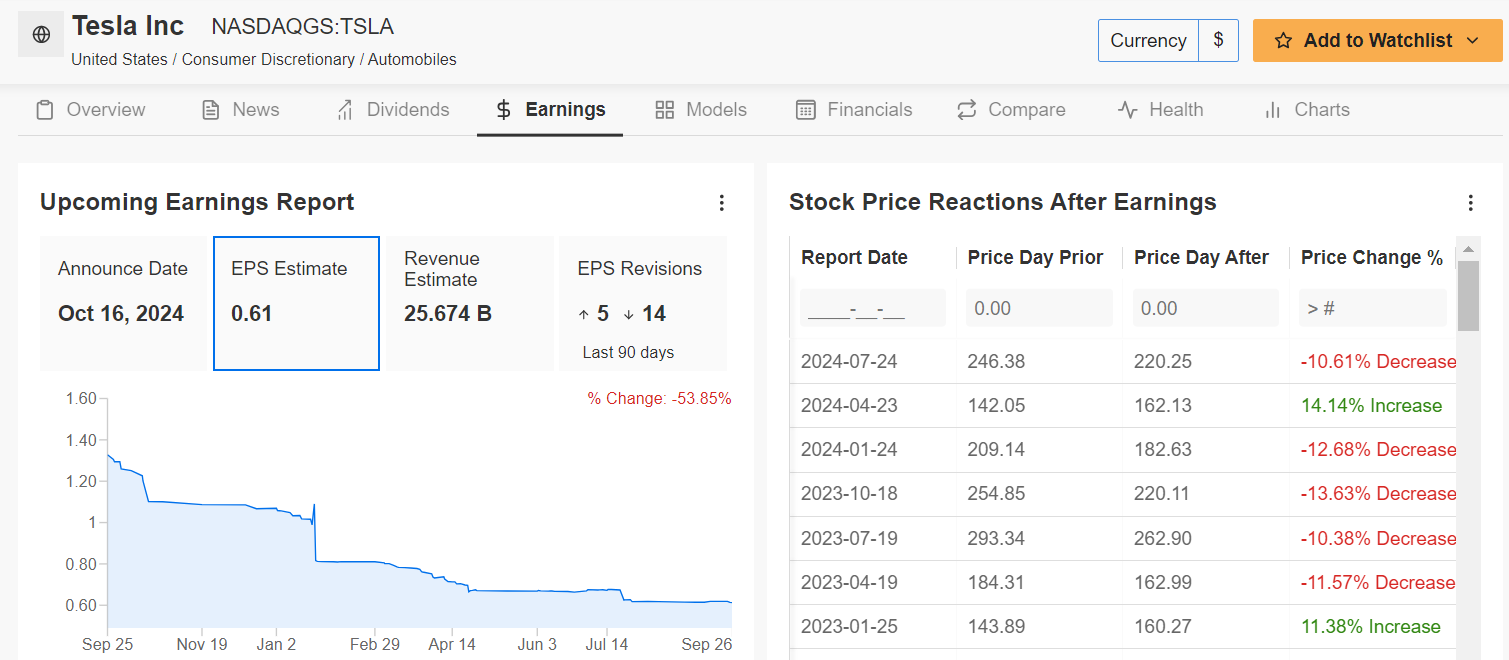

- News and Sentiment: Keep an eye on the latest news, earnings reports, and market sentiment around the company. Are there upcoming catalysts that could drive the stock higher or present risks?

- Technical Indicators: Look at stock charts and key technical indicators such as Moving Averages or the Relative Strength Index (RSI) to determine potential entry and exit points.

Source: InvestingPro

This deep-dive approach helps you move beyond just numbers and consider the broader context in which the company operates, giving you a fuller picture of its long-term potential.

Putting It All Together

By combining these three steps, you create a robust process for stock selection that balances efficiency with in-depth research.

Step 1 allows you to quickly narrow down a list of stocks using pre-set screeners, Step 2 ensures that you understand the financial health and performance of these stocks, and Step 3 gives you the ability to perform a detailed analysis of the company’s prospects.

For example, you might use the Investing.com pre-set screener to find undervalued stocks in the technology sector.

Source: Investing.com

After analyzing the financials and growth potential of several companies, you might then perform a deep dive into one or two promising candidates to understand their business models, management quality, and industry positioning.

Source: InvestingPro

This comprehensive approach helps you make more confident, informed investment decisions.

Conclusion: Gaining a Competitive Edge

In a market where most investors struggle to outperform, having a solid stock screening process is essential. Investing.com’s 3-step screener provides a powerful framework for identifying high-quality stocks, analyzing their potential, and diving deep into the specifics of individual companies.

Whether you’re a seasoned investor or just starting out, using this systematic approach can help you stay ahead of the game and maximize your portfolio’s returns.

Ready to start beating the market? Try out Investing.com’s pre-set screeners and take the first step toward smarter investing today!

By registering for free on Investing.com, you can unlock the full potential of this tool and take your stock market investing to the next level.

Start using the Investing.com stock screener today and discover the power of smart stock selection!

*To ensure the best possible user experience with the new screener, make sure to log in to Investing.com on all your devices.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust (NASDAQ:QQQ) ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.