Caspin Resources Ltd (ASX:CPN) has mobilised geochemical and geophysical crews for the surveying of the new nickel, copper and gold targets at its Mount Squires Project in Western Australia.

On completion of the surveys, the company will begin its reverse circulation (RC) program in June to test its several prospects situated within the project.

Promisingly, Caspin has received the WA government’s EIS co-funding of $220,000 awarded for the drill testing of its Handpump IP anomaly.

Looking ahead, the company has a large exploration program of geochemistry, geophysics and drilling planned which will continue through the coming months.

Exploration program

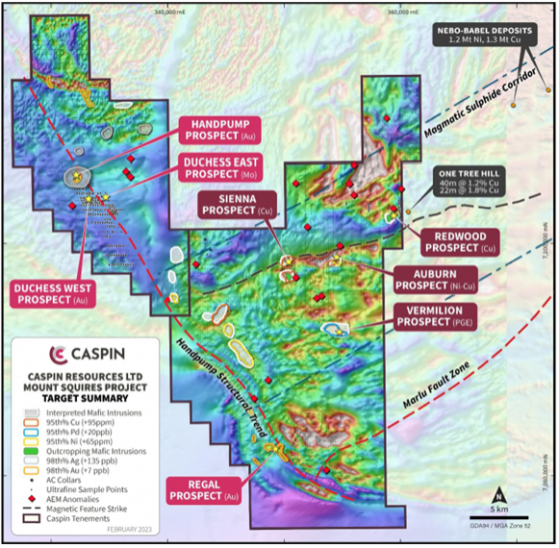

Caspin has identified numerous new nickel, copper and gold targets during the 2022 exploration program, primarily through the application of Ultrafine Fraction (UFF) soil geochemistry.

Many more anomalies require infill sampling of the broad 400m x 200m initial spacing to define a more discrete target before drill testing.

Prospects such as the Vermillion Prospect (PGE-Au-Ag anomalism) are a priority for the current geochemical sampling program. This program has now commenced and is expected to take four to six weeks to complete.

More advanced prospects such as Sienna and Auburn have already been infilled but are still large and extensive anomalies with strikes of greater than 500 metres.

Caspin is applying ground-based moving loop electromagnetic surveys (MLEM) across these prospects to potentially identify conductors that could represent massive sulphide accumulations.

Any conductors identified would present discrete targets for subsequent drill testing.

Summary of precious and base metal targets at the Mount Squires Project.

EIS Co-funding for Handpump IP target

Caspin has been awarded an exploration incentive scheme (EIS) co-funded drilling grant of up to $220,000 to test the Handpump IP anomaly.

The company acknowledges the ongoing support of the WA Government to the EIS.

RC Drilling is currently scheduled for June and will comprise approximately 2,000 metres across all targets.

The induced polarisation (IP) anomaly is located immediately to the south of the Handpump Prospect, which has returned many significant gold intersections and is coincident with a magnetic feature.

Unique opportunity for molybdenum

Deeper testing of the Duchess West, Duchess East and Handpump Gold Prospects will be conducted within the same drill program.

The drill program includes testing of highly significant molybdenum mineralisation intersected in aircore drilling at Duchess East.

The molybdenum market has seen increased demand and accompanying supply issues, forcing the price to jump over 100% in early 2023.

Consequently, this target presents Caspin with what it describes as a unique opportunity.

Read more on Proactive Investors AU